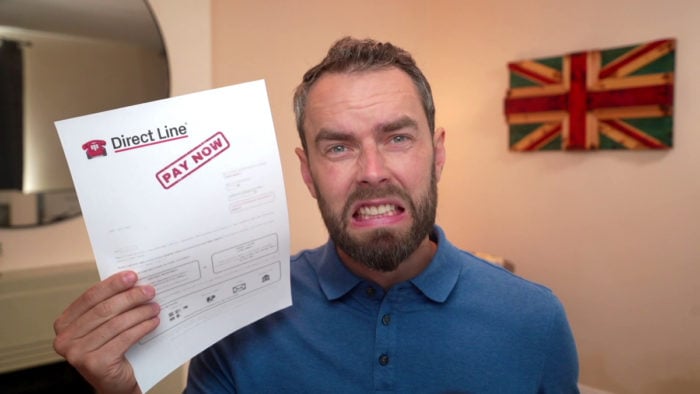

Direct Line Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re a Direct Line customer, and you’ve missed a payment, you’re in the right place. Every month, over 170,000 people visit our website for advice on issues just like this one.

In this article, we’ll cover:

- How Direct Line deals with missed payments

- Steps to take if you can’t afford a Direct Line payment

- The impact of a missed payment on your credit score

- What happens if Direct Line hands over your details to a debt collection agency

- Ways to manage and reduce your debt, legally.

We know you might be worried about the consequences of a missed payment or about not being able to pay your debt; some of us have been in your shoes.

Don’t worry; we’re here to help you understand how to handle a missed Direct Line payment.

What you should do if you miss a payment?

It’s an easy mistake to make. We all lead busy lives. Circumstances change, especially over the last couple of years.

You could miss a Direct Line payment for several reasons.

Whether it’s because of a computer glitch, you did not have enough money in an account, or you just forgot about it.

Whatever the reason for a failed or missed Direct Line payment, contact their support as soon as possible.

Otherwise, the consequences can be far-reaching!

» TAKE ACTION NOW: Fill out the short debt form

First, make sure your insurance payment didn’t go through, which can happen when you do it online!

Do this to confirm if the payment was made or not:

- Check your bank account – the information can be found in the ‘recent transactions’ section

- Contact Direct Line support and ask whether they received the payment or not

If you have the funds to make the payment, I advise you pay the outstanding if the first one fails. When you don’t, things could be more challenging to resolve.

How do they deal with it?

When there’s a Direct Line missed payment, the provider sends out reminders.

You should contact support as soon as they do if you can’t meet the payment.

If you ignore payment reminders, Direct Line will cancel your insurance policy. So you won’t be insured!

The secret is to stay in touch with Direct Line’s support team. They may be able to help you when you can’t make a payment.

If you don’t contact them, things get more problematic.

Having a cancellation on your insurance record might make obtaining future insurance more difficult or expensive since you have to declare it to all insurers.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The Consequences

The consequences of a failed or missed payment can be severe. Direct Line may:

- Charge you a late or failed payment fee

- Add extra administration costs to your account

- Cancel your insurance policy could be cancelled due to non-payment. You’ll no longer be insured to drive. Your car will not be insured either!

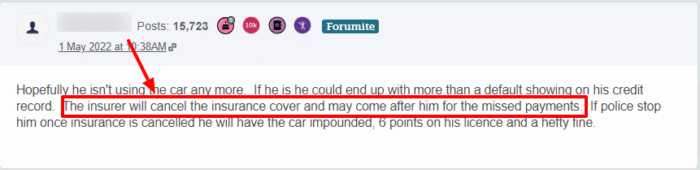

Missed and failed insurance payments can stay on your credit report for up to 6 years!

In short, it could affect your credit score and history, making it harder to get a loan, mortgage, or credit card.

Note that when your policy is cancelled, you must not drive. It’s against the law, and the fines can be high!

Will it affect your credit score?

No, it will not affect your credit score when you miss a Direct Line payment.

This is because the information does not appear on your credit history.

But if you fail to pay your insurance (default on payment), you could see the matter going to a debt collection agency!

In short, it’s better to make an insurance payment on time or as soon as possible after a missed installment.

Will they refer your details to an agency?

Yes, when you default on a payment to Direct Line, they refer the debt to a debt collection agency.

You may get a letter from Allied International Credit (AIC). They will chase you for the money when you default on a payment.

You’ll likely receive letters asking you to contact them to arrange payment. After this, you could receive letters saying a debt collector plans to visit you at home!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Debt Help and Support

I suggest getting debt advice if you’re struggling to pay a bill. Don’t ignore things or try to deal with things on your own.

Independent debt charities to contact include:

They provide free, impartial advice. It can help get you out of a debt trap when you fall into one!

What happens if you can’t afford it?

Contact Direct Line support straight away. They could offer to arrange a different payment date for you.

In addition, there are other ways to reduce the cost of your insurance premium.

This includes the Direct Line Mileage Moneyback scheme! Direct Line may also offer you a payment deferral.

My advice is to contact Direct Line if you know you will miss a payment or you can’t afford to pay on time. This way, they know what’s happening and could offer advice and help.

Could you pause insurance?

Yes, you may be able to ‘pause’ your insurance, but you must meet specific criteria. An example is when your car is written off, and you haven’t bought a replacement yet.

However, if you pay your premium in monthly installments, you have to continue doing so!