Does HMRC Debt Affect Credit Rating? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

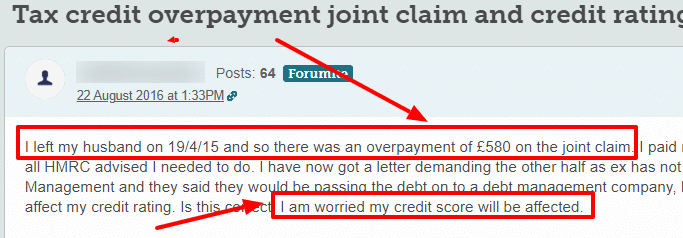

Are you worried about HMRC debts? Are you wondering if these debts can impact your credit score?

You’ve come to the right place for answers. Each month, over 170,000 people visit our website seeking advice on debt matters, just like this one.

In this article, we’ll explore:

- What HMRC debt is and how it works

- How you can manage and pay your HMRC debt

- If HMRC debt can affect your credit rating

- The possibility of writing off some of your debt

- How HMRC may take money from your pay

Some of our team members have experienced similar situations. We know it can be a tough time, but we’re here to guide you through it.

So, let’s dive in to find out more about HMRC debts and your credit score.

Will the Debt Harm My Credit Rating?

If you have had HMRC debt in the past, you might suddenly want to know if it harms your credit rating.

The good news is that HMRC debt won’t affect your credit file.

The reason for this is quite simple and given away in the name ‘credit rating’.

When you get into debt through a personal loan or credit card, you take out credit intending to pay it back. But when you owe money to HMRC, you haven’t taken out any credit.

HMRC debts are simply money owed to the UK Government, but the UK Government hasn’t given you any credit. And for that reason, the debts you owe to HMRC will not impact your credit score.

And thus, it will not reduce your chance of getting credit or negatively impact your financial health.

However, it is possible for HMRC to declare you bankrupt, which would of course reduce your chances of getting credit in the future.

» TAKE ACTION NOW: Fill out the short debt form

Remember, a debt from HMRC will not be registered on your credit file unless they apply for a CCJ or make you bankrupt.

Does Debt Collection Affect Credit Rating In The UK?

If you don’t repay your debt, HMRC may ask a debt collection agency to recover your debt.

The debt agency is then responsible for chasing the debtor for repayment. Such agencies are likely to send more aggressive reminders and threaten to seize your goods or take legal action.

If HMRC passes your case to a debt collection agency, this will not appear on your credit report.

It is also important to note that debt collection agencies are not bailiffs. They have limited powers under the UK debt collection laws.

For instance, they cannot force entry to your home or business premises, and they cannot seize goods.

Why You Should Pay

HMRC often uses external debt collection companies to recoup the money you owe them.

So, if you are not paying because you disagree with them or because you don’t want to hand it over, you won’t succeed.

They can even employ bailiffs to come and get the money (or seize and sell your valuables) if they prove you do owe them in court, which is almost always the case.

But this isn’t the only reason you should look to pay HMRC.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Can You Pay HMRC Debt?

If you can clear your HMRC debt, then it is best to do so.

Otherwise, you could face legal action (e.g. county court judgment) – or even worse, imprisonment (although this is very unlikely for most people).

But if you cannot pay what HMRC are asking you to pay, there are other options.

HMRC usually offer their Time to Pay Arrangement (TTP) so you can spread the cost of any HMRC debt over six months or a little more.

This helps you pay off the debt in affordable monthly instalments and avoid HMRC enforcement actions.

It should be noted that HMRC is usually reluctant to offer a TTP payment plan beyond one year. And there’s no ‘standard’ Time to Pay arrangement.

They will look at what you can afford to pay and then use that to work out how much time you need to pay.

If you feel you need more than a year to catch up on what you owe, you will need to put forward a compelling case.

The reason is simply that it is likely you will also owe them money next year. Besides, HMRC may not see long-term repayments as a viable solution to the current problem. In simple terms, it will drag on too long.

Can They Take From Your Pay?

Yes, HMRC has extra powers that creditors don’t have.

For example, they have the power to go directly to your employment income to recover what is owed. They can do this through a direct earnings attachment (DEA).

But this isn’t their first choice of action, so don’t worry. You will have a chance to contest their debt claims or make other payment arrangements.

For example, if you agree to a debt repayment plan, they won’t enforce the DEA.

How They Can Deduct from Your Pay

In addition to DEA, HMRC will take money from your pay by adjusting your tax code in the PAYE scheme.

In other words, they simply increase the amount of tax you pay before you receive your pay from your employer.

But they won’t do this to everyone equally.

If you earn less than £30,000 per year and have HMRC debts that amount to £3,000 or less, they can’t adjust your code. But if you earn more than this, HMRC may come down even harder on you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

HMRC Contact Details

| Post: | Pay As You Earn and Self Assessment HM Revenue and Customs, BX9 1AS, United Kingdom |

| Phone: | 0300 200 3300 +44 135 535 9022 outside UK |

| Relay UK: | Official HMRC app |

| Official app: | official HMRC app |

| Website: | https://www.gov.uk/government/organisations/hm-revenue-customs |