Does an IVA Affect Renting a Property? What You Can Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if an IVA (Individual Voluntary Arrangement) would affect your chance of renting a property?

You’ve come to the right place. Each month, over 170,000 people visit our website looking for clear, helpful advice on debt solutions.

In this article, we’ll cover:

- The main facts about an IVA and its effect on renting a property.

- How an IVA might change your current rent agreement.

- How an IVA might impact your ability to rent a home in the future.

- Options for including rent arrears in your IVA.

From July to September 2023, the Gazette reported that there was a total of 13,965 Individual Voluntary Arrangements.1 This highlights just how many people are navigating similar financial challenges like yours.

Don’t worry, we understand what you’re going through, and we’re here to help you understand how an IVA can affect your chance of renting a property.

Will Entering into an IVA Affect My Current Rent Agreement?

In most cases, an IVA has no effect on a rent agreement that is already in place.

That being said, you should still check your contract to ensure there isn’t any clause which states that you cannot be insolvent while you reside at that address.

Please note that your landlord won’t be informed about your IVA (unless you include any rent arrears in your IVA) and your rented property won’t be considered a part of your IVA either.

It’s important to remember that your IVA won’t affect your living situation in most cases, either.

This is because when you devise a payment plan with your Insolvency Practitioner (IP), they will consider the payment you have to make towards your monthly rent. This will be considered a part of your essential living expenses.

Furthermore, if you’ve fallen behind on your rent payments and have rent arrears, you can put some money aside each month to pay back these arrears. These will be separate from your IVA payments.

IVA Breakdown

Understanding the basics of an Individual Voluntary Arrangement is essential for anyone navigating financial decisions.

Here’s a quick table that will help you better understand how an IVA works.

If you want to learn more about the pros and cons of IVA, be sure to read our specialized guide.

Is it Possible to Move to Another Rented Property While an IVA is in Place?

Moving to another rented property is possible when you have an IVA, but it can be more difficult as your options will be limited.

This is because an IVA is recorded in your credit file and, as a result, negatively impacts your credit rating.

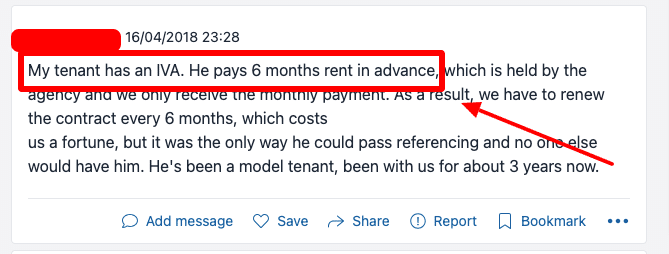

If your potential landlord performs a credit check on you before approving you for the rented property, then mentioning the IVA in your credit record may make them apprehensive about approving your application.

Credit checks can also be a problem when renewing letting agreements.

If credit checks are required for renewing your letting agreement, this may also raise concerns with your landlord. If you’re having trouble or worried about an IVA and tenant-landlord relationship when acquiring a rented space because of your poor credit rating, there are a couple of options you can explore:

Firstly, you’ll have a much easier time finding a space to rent if you rent it with another person.

Secondly, if you can’t find another person to rent a space with, you can opt to produce a guarantor for the rent agreement.

A guarantor is a person that will be responsible for your rent payments if you ever fail to make them; This could be a close friend or a family member of yours.

Having a guarantor for your rental agreement does wonders when it comes to alleviating the concerns of a landlord or letting agent regarding your ability to pay your rent and helps mitigate many of the IVA and rental contract implications.

It’s important to be honest and upfront with landlords and letting agents when you want to acquire a space to rent so that they can decide about IVA, arrears, and eviction risk.

Landlords and letting agents will be more willing to help you when assured that you’re being sincere about your finances.

Will an IVA affect My Ability to Rent a Home After it has Finished?

An IVA stays in your credit file for six years after the date it was registered.

Please note that it stays in your credit record for six years, even if it ended in five years (or even earlier than that). If your IVA takes longer than six years, then the mention of it is removed from your credit report once it ends.

As I said earlier, when you’re looking to rent a property, the landlord will likely perform a credit check on you.

The mention of an IVA in your credit report during a credit check, even if it has ended, will severely lower your chances of being approved for a space to rent.

I highly recommend that once your IVA ends, you spend at least six months (or up to 12) rebuilding your credit rating and exploring various renting options with a bad credit history.

I would highly advise you not to look for a rented space until the mention of your IVA has been removed from your credit report and you have taken steps towards credit score repair after your IVA.

This is because, in today’s day and age, almost every landlord you go to will perform a credit check on you. You’ll stand a much better chance of getting approved for a rented space if you’ve rebuilt your credit rating to a point where it’s decent.

Alternatives to IVAs when renting

There are alternatives to IVAs if you find yourself in a position where your debts become unmanageable. These include things like debt relief orders and even bankruptcy.

However, these will also show on your credit report, causing the same issues as an IVA. Again, speaking to a debt charity like the ones in the table above can signpost you in the most appropriate direction for your circumstances.