Affordable Car Insurance with DR30 Conviction for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Looking for a better deal on car insurance after a DR30 conviction? You’re not alone. Over 9,300 people visit our website each month for guidance on this very topic.

In this article, we’ll give clear information and helpful advice about:

- What a DR30 conviction is and why it can affect car insurance.

- How to find an affordable insurer for DR30 conviction.

- How much DR30 conviction can increase your insurance.

- Affordable car to insure after a DR30 conviction for you.

- If a DR30 conviction is a criminal conviction.

We know it can be worrying to think about affording car insurance. It’s even more worrying to think about not being able to get insurance, but we’re here to help you through this tricky time.

We know what you’re going through because we offer guidance to many people in your situation every day. We’re committed to giving you the best advice possible to get your life back on track.

Let’s dive in.

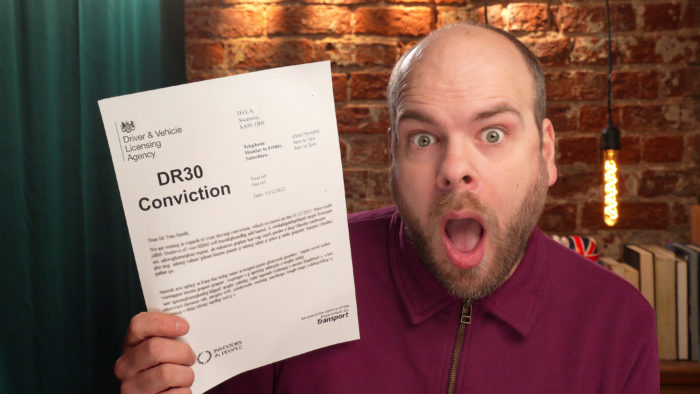

What is a DR30 Code?

The following conviction is presented for not allowing the police to use a breathalyser or blood test when they requested it. They did not deem your reason for not providing it sufficient to avoid the conviction.

| Driving Licence Conviction Code | The Motoring Offence | Penalty Point Range | How Long the Conviction Stays on Your Licence |

| DR30 | Driving or attempting to drive then failing to supply a specimen for analysis | From 3 to 11 | This is required to stay on your record for 11 years from the date of your conviction |

Is it a criminal conviction?

There are multiple potential outcomes, depending on the severity and number of convictions you have. This is alongside the number of points you have on your licence:

- A driving ban

- A fine

- A community order

- Up to 6 months in prison

So in short, Yes, it can in many cases be a criminal conviction.

Disclaimer

Of course, this general advice can not be catered to you directly. There are too many unknowns. While Money Nerd is always here to help, seeing professional advice before any important decision is the way to go for many.

What is the most affordable insurance?

Affordable insurance can be found by first choosing a car with a smaller sized engine. It is the same for everyone of course, but this is one factor that will help you in your choice of car. Search for 1ltr engines and continue your research from there.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Who is the most affordable insurer for you?

Comparison websites are how you get the answer to this question. It depends on a range of factors that they take into consideration. These include:

- How amount of convictions you have on file

- How many points you have on your limit

- The number of times you have made a claim in the past

- How long ago you last made a claim

- The number of years on you no claims bonus

- Where you live

- Demographic information

With the above questions answered, the insurers will be able to give you an answer, depending on how ‘risky’ they think you are.

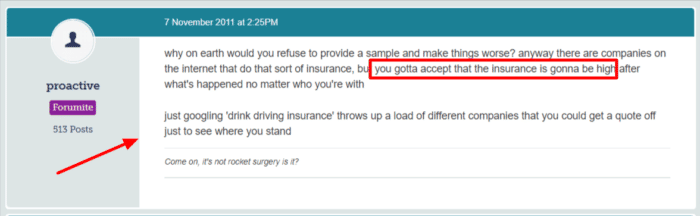

But as mentioned above, the insurance will inevitably be higher when you have a conviction such as the DR30. Look at the various solutions to help you:

- Find a smaller car that is more affordable to insure

- Compare a few results from competing for insurance comparison websites. Get to know what is available out there

- Input the number plate of the vehicle you are thinking of purchasing, with the other information you have listed above to get those quotes

Some might even choose to sell their newer car to pay for the smaller replacement to help further.

Insurance Companies

There is a range of websites that allow you to submit your details to multiple insurance companies that offer insurance for drunk drivers. Quotes come from companies such as:

- Insurance Revolution

- Pol-Plan

- Logical Choice

- One Sure

- Peart

- Business choice direct

And many more. If you take the time to look at and compare their offers, you will be closer to selecting the option that will hopefully save you some cash.

What car model is best to insure?

Utilising online car dealers is a great research tool. Smaller 1ltr cars are the best choice. A selection of these are models like these:

- Ford Puma

- Toyota AYGO

- Volkswagon Polo

- Ford Fiesta

- Kia Stonic

- Fiat 500

- Ford Focus

- Renault Clio

So, whilst there isn’t one car that will be the most affordable to insure, the above will all be in the lower price range.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How much will my insurance increase?

Being classified as a “High-risk offender” means that your insurance will increase by 2X when you apply. Depending on how long you have been out of the driving game, the loss of your no-claims discount might increase this further.

Considering a shared insurance arrangement with a friend or family member at this stage might be an option for you. The increase that they get for having you on there might be more affordable than what you would pay alone.

This is just another avenue to explore in your research. While it might allow for lower costs, it might also cause tensions when it comes to paying them the difference every month.

Will it show up on a DBS check?

Yes, it will show on the DBS for 11 years. The financial impact will in this case go on for multiple years.

General concerns around debt are common in this situation. Sorting out your finances might be on your mind in this stressful time too. Money Nerd is here to help you look at the available options in this difficult situation.

To Conclude

We can see that you have more control over this situation than you first thought. Getting a smaller car and taking the time to compare the insurance providers from there will be a good starting place. From here, you can learn more from the related articles below, and please do get the advice of a specialist before the final decision.