Affordable Car Insurance with CD30 Conviction for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

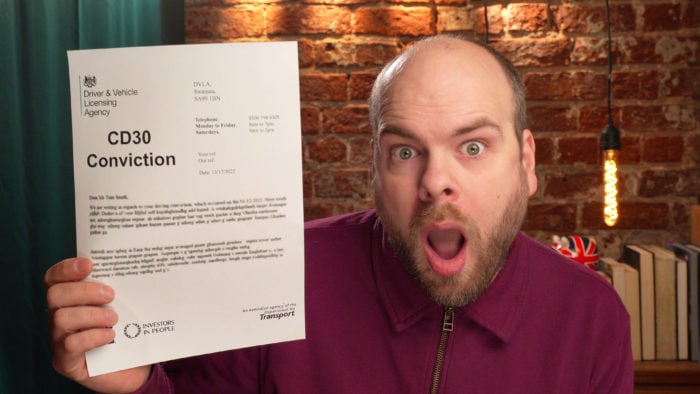

Are you searching for better car insurance deals after a CD30 conviction? This is a worry for many; in fact, over 9,300 people come to our site each month for guidance on this matter.

In this article, we’ll help you understand:

- What a CD30 conviction is.

- How it impacts your car insurance.

- Which insurance companies do not ask about criminal convictions.

- How to find affordable car insurance even with a CD30 conviction.

- Why you must tell your insurance company about your conviction.

We know that the fear of not being able to afford car insurance, or worse, not being able to get insurance at all, can be stressful. But fret not; we’re here to help you through this difficult time.

Our expertise is your benefit. Let’s work together to find a solution that fits.

What is a CD30 conviction?

A CD30 conviction is given to drivers who drive without due care and attention and/or without reasonable consideration for other road users.

In that regard, it’s a combination of a CD10 and CD20 conviction.

Is it a criminal record?

When a court convicts you of a driving conviction, the conviction will also create a criminal record.

Is it serious?

All driving convictions are serious and have consequences.

But CD10, CD20 and CD30 convictions are less serious than the other CD convictions; for example, a CD90 which is issued for causing death by driving.

How long does it stay on your licence?

A CD30 conviction remains on your driving licence record for four years from the date the offence was committed.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What is the penalty?

The repercussions of a CD30 conviction are summarised in the table below:

| Conviction code | Nature of offence | Penalty points | Fine amount |

| CD30 | Driving without due care and attention and/or without reasonable consideration for other road users | Between 3 and 9 penalty points depending on the details of the careless driving offence | Varying fine based on the details of the offence and a means test |

The repercussions are greater for other driving convictions, such as drunk driving.

Which insurance companies do not ask about criminal convictions?

It’s extremely unlikely that any car insurance company would avoid asking about previous criminal convictions. The car insurance company will want to know about your driving record to decide whether they are willing to offer you insurance, and if so, at what cost.

Source: https://www.forum.drinkdriving.org/threads/best-insurance-company-for-convicted-drivers.82586/

If you’re ever asked about convictions by an insurance provider, you must disclose all of them. Failing to disclose a driving conviction is likely to invalidate your insurance so you’ll be driving without insurance and at risk of further consequences.

How does it affect insurance?

Having a CD30 conviction will negatively affect your options for insurance. There may be fewer companies willing to offer you a (competitive) insurance policy. Specifically, your insurance premiums will likely be increased due to the CD30 conviction.

How much your insurance premiums are increased depends on how many penalty points you received as part of the CD30 conviction. The number of penalty points issued tells the insurance company how serious the driving offence was. Therefore, your insurance will increase by more if you receive a higher number of penalty points.

Remember, you can receive between three and nine penalty points for a CD30 conviction, depending on the details of the offence.

Consider searching for convicted driver insurance

If you’re searching for affordable car insurance after a CD30 conviction, you may want to search specifically for CD30 car insurance for convicted driver insurance. These are insurance policies provided by companies that are more open to insuring people with previous driving convictions.

You can compare convicted driver insurance to bad credit personal loans, whereby creditors provide loans to people with a below-average credit rating. In the case of car insurance, the insurer is providing insurance to drivers with a below-average driving record.

CD30 insurance may offer more competitive rates than standard policies still available to people with driving convictions. Yet, it’s important to complete your own diligent research on all options.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Are there any tips for securing affordable car insurance?

If you’re looking to secure more affordable insurance with a CD30 conviction, it is important to prove that you are less of a risk on the road to your insurer.

It is possible for convicted drivers to take rehabilitation courses, which may reduce insurance premiums in the future. However, these are often intended for those who have drunk driving and drugged driving convictions.

Other tips for reducing premiums with a CD30 car conviction include:

- Taking advanced driving courses.

- Adding a more experienced driver to the policy.

- Increasing the voluntary excess.

- Installing a ‘black box’, or other forms of vehicle telematics.

What is the most affordable car insurance I can get?

It’s not always possible to state what the most affordable insurance provider is for people with a CD30 conviction. The various CD30 insurance policies are subject to frequent change and may not be accurate at the time of reading.

Moreover, several factors can influence insurance policies when you have a driving conviction, such as age, vehicle, where you live in the UK, etc.

So, what can you do to find affordable car insurance with a CD30 conviction? You should consider:

- Searching specifically for CD30 car insurance or convicted driver car insurance

- Combine these searches with car insurance comparison websites

- Or use a car insurance broker who specialises in helping people get the best insurance deals with a driving conviction