DWP Debt Management Contact Details

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve just got a surprise letter from a debt collector, and it says ‘DWP Debt Management’, you may feel a bit lost. But don’t worry, we’re here to help.

DWP Debt Management is a group from the Department for Work and Pensions. They take back money that was given out too much, like social security benefits. Each month, over 170,000 people visit this site for answers about debt, so you’re not alone.

In this easy-to-understand guide, we’ll look at:

- What DWP Debt Management is.

- The common types of DWP debts.

- How you can get in touch with DWP Debt Management by phone or email.

- What you can do if you can’t pay your DWP debt.

- If DWP can stop asking for the money back.

Nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. So, we know getting a letter about debt can be scary.

We’re here to help. Let’s learn about DWP Debt Management together.

Advice for people dealing with DWP debt management

The average unsecured debt amount has increased by 27% year-on-year (to £16,174)2. So, it’s common for people to struggle with debt.

If that’s your case, and you’re struggling with your finances, you should contact your lenders, creditors, bank, or the DWP to discuss your options.

The DWP and other organisations have specific policies regarding debt and support.3

You should use the DWP Debt Recovery contact information I’ve provided in this post.

Plus, you should speak to one of the UK debt charities. They provide free debt advice which could prove invaluable if you’re not coping with your debts.

I’ve listed some UK debt charities that provide guidance for managing DWP debts here:

What are the common DWP debts?

You could owe money to the DWP for different reasons. The most common DWP debts are:

- Tax credit overpayments

- Housing benefit overpayments

- Unpaid social fund loans

Most of the time, you’ll owe the Department for Work and Pensions because they overpaid you a social security benefit.

This happens when the department has incorrect information about you, such as the wrong details about your or your household’s annual income.

If the DWP thinks you earn less than you do, they’ll continue to pay you a means-tested benefit at a higher rate.

Once they realise that you’ve been earning more than they thought, they’ll ask for all of the overpayments back.

This is why it’s important to keep the DWP updated with your most recent information. They usually ask for a lump sum repayment, but you may be able to discuss payment plans with DWP Debt Management to prevent entering into financial instability.

Typical Debt Collection Process

Debt collectors will call or send letters to request payment. This is quite common, as it’s part of the initial stage of the debt collection process.

Here’s a table that explains each stage of the debt collector timeline. If you want to learn more or require further advice, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I pay DWP debts over the phone?

Telephone payments for DWP debts are accepted. In short, you can pay some DWP debts over the phone.

You’ll need to call the relevant department and provide the agent with your details to pay. Lines are made secure when making these payments.

» TAKE ACTION NOW: Fill out the short debt form

Can the DWP write off a debt?

Some DWP debts can be written off in specific circumstances. In short, conditions for DWP debt forgiveness will apply.

StepChange, the debt charity states that the DWP will pause repayments on a debt if you can’t afford to pay at least £10 per month within a payment plan.

The DWP will then reassess your financial situation a year later. If you still can’t afford to pay £10 per month, they will consider writing off your debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if I don’t pay my DWP debt?

The consequences of unpaid DWP debts could be far-reaching.

If you don’t pay a DWP debt you could face debt enforcement action, which may include the use of bailiffs or an Attachment of Earnings Order (AEO).

An AEO is where money is taken directly from your monthly salary or other social payments.

Can I make an official complaint over the phone?

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

The DWP accepts complaints made over the phone or in writing unless stated otherwise.

DWP Debt Recovery contact information

I’ve listed the dwp debt management number in the table below.

| Address: | Debt Management (C) Mail Handling Site A Wolverhampton WV98 2DF |

| Phone: | 0800 916 0647 |

| SMS: | 0800 916 0651 |

| Relay UK (if you cannot hear or speak on the phone) | 18001 then 0800 916 0647 Monday to Friday, 8am to 7.30pm |

DWP Debt Management contact details (quick recap!)

Here is the DWP Debt Recovery contact information once again.

| Phone: | 0800 916 0647 on weekdays between 8am and 7.30pm 0800 169 0140 between 8am and 5pm on weekdays (social fund loan) |

| Mail: | Debt Management C, Mail Handling Site A, Wolverhampton, WV98 2DF |

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

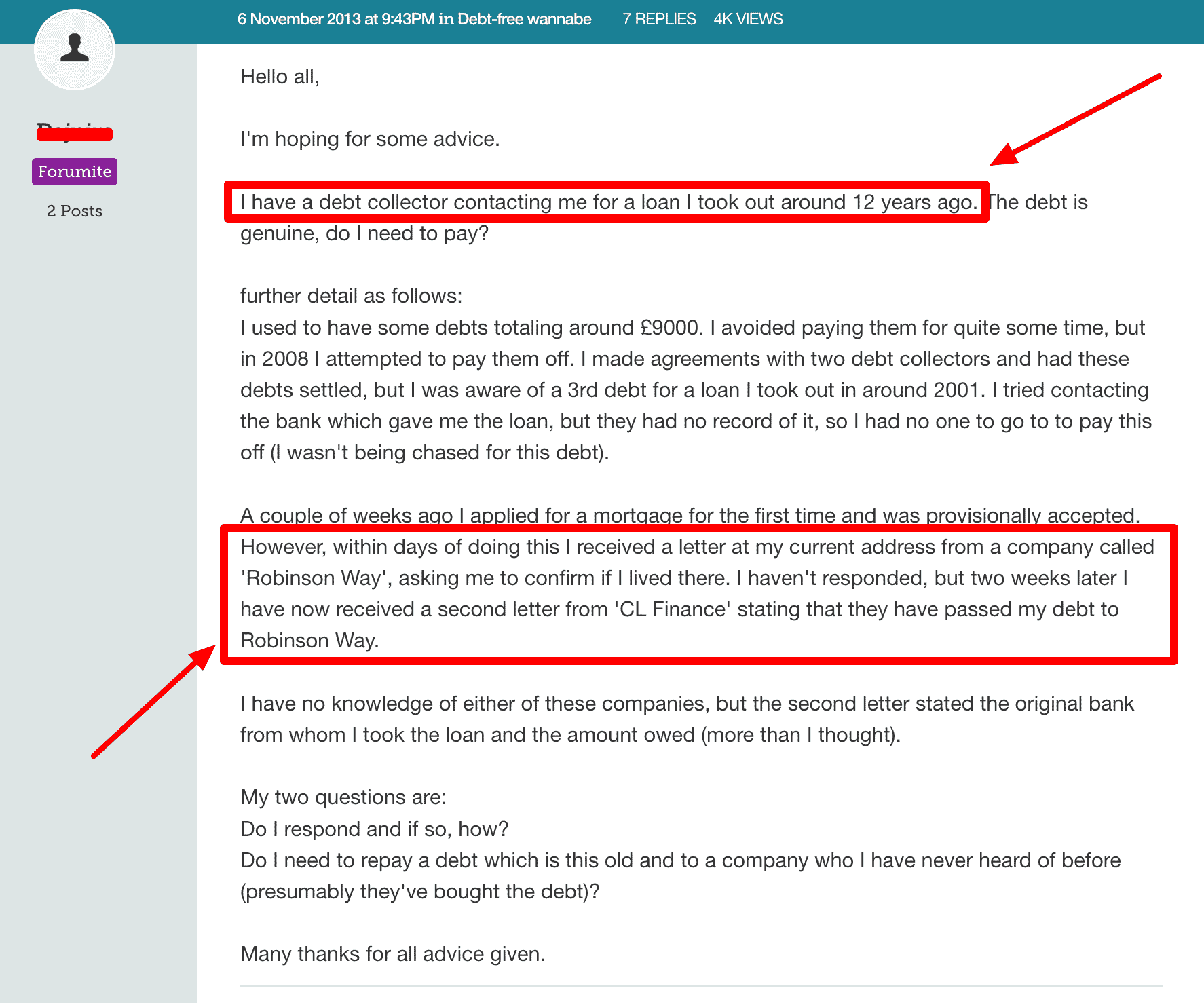

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.