Equity Release with a Lasting Power of Attorney? Possible?

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

As a person considering equity release as a route to a comfortable retirement, you need to keep in mind that circumstances can change, sometimes very rapidly indeed. For instance, what happens if you develop an illness that leaves you incapacitated, and unable to make key financial decisions at the appropriate time? This is where Lasting Power of Attorney (LPA) comes in.

Putting an LPA arrangement in place to safeguard your financial interests and manage your equity release arrangement if you should become incapacitated, simply makes sense. This ensures that no matter what happens in the future, somebody will be looking out for your best interests, financially.

What Is Lasting Power of Attorney?

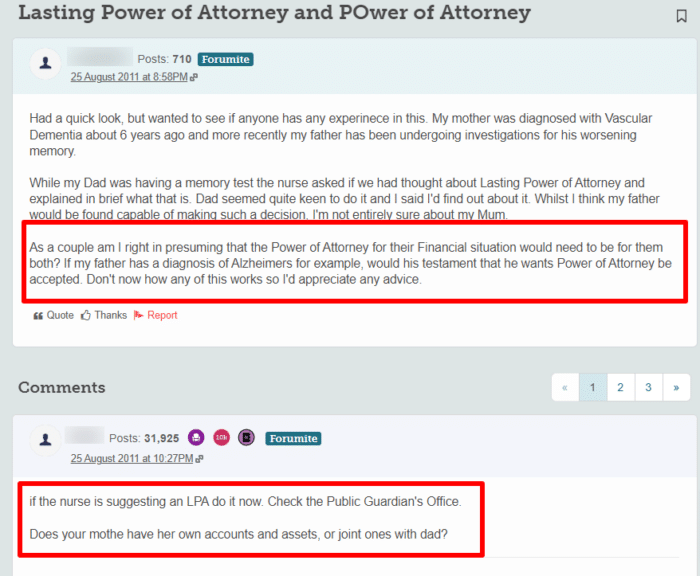

A Lasting Power of Attorney is a legal document that enables an individual, referred to as the donor, to appoint one or more persons, known as attorneys, to make decisions on their behalf should they become unable to do so due to mental incapacity or physical disability. The LPA is governed by the Mental Capacity Act 2005 in England and Wales.

-

Types of Lasting Power of Attorney

- Property and financial affairs LPA – This type empowers the attorney to make decisions related to the donor’s financial matters, such as managing bank accounts, paying bills, and selling property.

- Health and welfare LPA – This type allows the attorney to make decisions concerning the donor’s personal welfare, including medical treatment, daily routine, and healthcare provisions.

-

Registration process

- To be legally valid, an LPA must be registered with the Office of the Public Guardian. This involves submitting the completed LPA forms along with the necessary registration fee. The process may take several weeks to complete.

-

Eligibility criteria

- The donor must be at least 18 years old and must have the mental capacity to understand the implications of creating an LPA at the time of its execution. Attorneys must also be at least 18 years old and must be capable of undertaking the responsibilities involved.

-

Revocation and termination

- An LPA can be revoked by the donor as long as they possess the mental capacity to do so. It is automatically terminated if the donor or attorney becomes bankrupt, subject to certain exceptions, or if either party passes away.

-

Safeguards

- The LPA includes several measures to protect against abuse. For example, the donor can appoint more than one attorney and specify whether decisions must be made jointly or separately. A “certificate provider” must also confirm that the donor understands the LPA and is not under undue pressure to create it.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

Why Is an LPA Agreement Beneficial in Relation to Equity Release?

Establishing a Lasting Power of Attorney can offer a layer of security and peace of mind when engaging in financial arrangements such as equity release. Both equity release and LPA are intricate legal instruments that carry long-term implications, making their integration and coordination particularly beneficial. Below are some of the reasons why an LPA agreement is advantageous in relation to equity release.

- Continuity of financial management – Should the homeowner lose mental capacity during the term of an equity release plan, an LPA enables appointed attorneys to manage the property and financial affairs seamlessly. This ensures that any obligations or opportunities related to the equity release scheme can be appropriately handled.

- Facilitation of healthcare decisions – An LPA focused on health and welfare may be beneficial if the homeowner moves into long-term care. Decisions about healthcare, including the choice of care facility, can have financial implications that affect the equity release arrangement.

- Protection against financial abuse – The rigour involved in establishing an LPA helps safeguard against financial exploitation. This is crucial, especially when substantial assets like a property are involved in an equity release scheme.

- Flexibility in financial planning – As equity release impacts the value of the estate, having an LPA allows attorneys to make informed decisions about the donor’s broader financial portfolio. This can be beneficial for estate planning, as well as for making adjustments to the equity release plan if necessary.

- Reduced stress for family members – With an LPA in place, family members are relieved of the burden of having to apply for a deputyship through the Court of Protection, a process that can be time-consuming and emotionally taxing, to manage the financial affairs or healthcare decisions of the homeowner.

- Compliance with lender requirements – Some equity release providers may have clauses in their contracts that pertain to mental capacity. An LPA ensures that there is a legal framework for decision-making, which could be in compliance with the lender’s requirements.

- A streamlined process for dealing with changes – Life circumstances can change rapidly. An LPA provides the legal foundation for attorneys to efficiently address any changes in the homeowner’s situation that could affect the equity release agreement.

» TAKE ACTION NOW: Find out how much equity you could release

Is an Ordinary Power of Attorney Different?

An Ordinary Power of Attorney (OPA) is different from a Lasting Power of Attorney in several key respects. While both instruments empower someone to act on your behalf, the scope, duration, and conditions under which they operate differ significantly. As detailed, below.

- Duration and applicability – An Ordinary Power of Attorney is generally temporary and ceases to be effective if the donor loses mental capacity. In contrast, a Lasting Power of Attorney continues to be effective even after the donor loses mental capacity, provided it has been properly registered.

- Types and scope – An LPA can be specified as either a Property and Financial Affairs LPA or a Health and Welfare LPA, or both can be established. An OPA is usually limited to financial and property matters and does not extend to healthcare decisions.

- Registration – An LPA must be registered with the Office of the Public Guardian to become effective, especially in situations where the donor loses mental capacity. An OPA does not require registration, but it is not legally valid if the donor loses mental capacity.

- Use cases – An OPA is often used for a specific period or purpose, such as when the donor is out of the country and needs someone to manage their financial affairs. An LPA is generally intended for long-term planning and is especially useful for future-proofing against incapacity due to illness, injury, or old age.

- Legal requirements – The creation of an LPA involves more stringent legal requirements, including the need for a certificate provider to affirm that the donor understands the implications. An OPA has fewer formalities, but this also means it offers fewer safeguards.

- Impact on equity release – An OPA would not be suitable for managing long-term financial arrangements like equity release, especially if there is a risk that the donor may lose mental capacity during the life of the loan. An LPA, however, provides the necessary long-term framework for managing such complex financial matters.

- Revocation – Both types of power of attorney can be revoked by the donor, but an LPA offers more structured provisions for revocation, especially if the donor has lost mental capacity but had planned ahead with an LPA.

A Brief Note on Enduring Power of Attorney

An Enduring Power of Attorney (EPA) is a legal instrument that predates the Lasting Power of Attorney and was commonly used in England and Wales before the implementation of the Mental Capacity Act 2005. Similar to an LPA, an EPA allows an individual, known as the donor, to appoint one or more persons, termed attorneys, to manage their affairs. The key feature of an EPA is its enduring nature; it remains valid even if the donor loses mental capacity. If you took out your equity release product prior to 2005, you may want to check that your original EPA has been converted to a newer LPA format.

When Should You Consider an LPA Agreement?

The consideration of a Lasting Power of Attorney is an important step in long-term financial and health planning. While the necessity of an LPA varies depending on individual circumstances, there are specific instances when it would be prudent to consider establishing such a legal arrangement.

- Ageing and retirement planning – As you age, the likelihood of experiencing health issues that may affect one’s mental capacity increases. It is advisable to consider an LPA as part of retirement planning to ensure that decisions related to finances and healthcare can be effectively managed.

- Diagnosis of a medical condition – A diagnosis of a degenerative condition such as dementia, Parkinson’s disease, or multiple sclerosis may necessitate immediate consideration of an LPA. Even conditions like stroke or heart attack can suddenly impair mental capacity.

- Complex financial portfolio – If you have a variety of financial assets, such as properties, investments, or business interests, an LPA ensures that there is someone with the legal authority to manage these intricate financial matters on your behalf should you become unable to do so.

- Family considerations – To reduce stress on family members during what may be an emotionally difficult time, having an LPA ensures that the process for making decisions on your behalf is clearly defined and legally sanctioned.

- Surgical procedures and medical treatment – If you are facing significant surgical procedures that entail risks of mental incapacity, either temporarily or permanently, an LPA is prudent for both financial and healthcare decisions.

- Planning for the unexpected – Accidents can happen at any age, leading to sudden mental or physical incapacity. An LPA serves as a safety net, allowing your nominated attorneys to act swiftly under such unfortunate circumstances.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

LPA and Lifetime Mortgages

The intersection of a Lasting Power of Attorney and a lifetime mortgage, a common type of equity release scheme, requires careful consideration due to the financial and legal complexities involved. Both instruments carry long-term implications and can significantly affect an individual’s financial security and estate planning. Below are some key points to consider when examining the relationship between an LPA and lifetime mortgages.

- Management of financial obligations – A Property and Financial Affairs LPA grants the attorney the authority to manage the donor’s financial matters, which would include overseeing a lifetime mortgage. Should the donor lose mental capacity, the attorney can liaise with the mortgage provider, ensure compliance with the terms, and make any necessary adjustments to the arrangement.

- Protection of interests – Given that a lifetime mortgage involves a long-term commitment and the potential accumulation of considerable interest, having an LPA ensures that there is someone with the legal authority to act in the donor’s best interests, particularly if adjustments need to be made due to changing circumstances.

- Planning for care costs – If the donor moves into long-term care, both a lifetime mortgage and an LPA can play crucial roles. The LPA allows for decisions about care that may affect the financial terms of the lifetime mortgage, while the lifetime mortgage can offer a means of funding care.

- Impact on estate – Both a lifetime mortgage and an LPA have implications for estate planning. A lifetime mortgage will reduce the value of the estate which will eventually be passed on to heirs. An attorney acting under an LPA can manage the complexities of this scenario, perhaps even deciding to repay the lifetime mortgage if that proves to be in the donor’s best interest.

- Decision-making autonomy – A Health and Welfare LPA can also indirectly affect a lifetime mortgage, especially if decisions need to be made regarding long-term care. Knowing that an attorney is empowered to make such decisions can be reassuring, as the outcome could have an impact on the home that is tied to the lifetime mortgage.

- Regulatory compliance – Financial institutions that offer lifetime mortgages may have specific clauses regarding mental capacity and decision-making authority. Having an LPA can simplify the process of meeting these requirements.

Putting an LPA Agreement in Place

Putting a Lasting Power of Attorney agreement in place is a multi-step process that requires careful attention to legal requirements and procedures. The procedure outlined below is applicable to England and Wales, as governed by the Mental Capacity Act 2005.

- Determine the type of LPA – Decide whether you need a Property and Financial Affairs LPA, a Health and Welfare LPA, or both. Each type serves a different purpose and grants different powers to the appointed attorney.

- Choose the attorneys – Select one or more individuals whom you trust to act as your attorney. Ensure that they are at least 18 years old, willing to take on the responsibilities, and have not been declared bankrupt.

- Complete the LPA forms – The relevant forms can be downloaded from the government website or obtained from legal professionals. These documents must be filled out in accordance with the guidelines.

- Certificate provider – Appoint a certificate provider, a neutral third party who will confirm that you are making the LPA of your own volition and that you understand its implications.

- Witnesses – The signing of the LPA form must be witnessed. There are specific guidelines regarding who can act as a witness.

- Register the LPA – An LPA must be registered with the Office of the Public Guardian to be legally valid. There is a registration fee involved, though fee exemptions and reductions are available for those who meet certain criteria.

- Waiting period – There is a statutory waiting period during which interested parties can raise concerns about the LPA. The process takes a minimum of several weeks to complete.

- Notification of relevant parties – You may choose to notify close family members or friends about the LPA. This can provide an additional layer of protection as they have the right to raise concerns during the waiting period.

- Activation – A Property and Financial Affairs LPA can be used as soon as it is registered, unless specified otherwise. A Health and Welfare LPA can only be used when you lack the mental capacity to make decisions for yourself.

- Safeguarding measures – It is advisable to include restrictions or guidance within the LPA document to clarify your intentions and provide direction to the attorney.

- Legal advice – Given the complexity and long-term implications of an LPA, it is highly recommended to seek professional legal advice to ensure that the document accurately reflects your wishes and meets all legal requirements.