Fines AEO on Payslip – Here’s Why and How to Stop Them

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Seeing ‘AEO’ on your payslip can make you worry, as it means an Attachment of Earnings Order. This is when the money you owe is taken straight from your wages.

You might be asking, “Why is this happening?” or “Can I stop it?” We’ll help you make sense of it all. Each month, over 170,000 people like you visit our website looking for guidance on money troubles.

In this article, we’ll explain:

- What an Attachment of Earnings Order is

- Why you might have one

- How to stop it if you can

- How much money can be taken away

- What happens if you don’t follow the order

We know it’s hard when money is taken from your pay; many of us have been there too. We are here to help you understand what is happening and what you can do.

What Is an Attachment of Earnings Order?

Once the court has issued a County Court Judgement (CCJ) against a debt, your creditor can apply for an AEO to be issued. This would mean that money would be taken from your wages or salary to be given to the creditor.

It is the court that will decide how much you have to pay, and your employer will be legally obliged to take this money out of your pay. But there are a few exceptions to when an order will be granted. We have listed some of these exceptions, below.

- You owe the creditor less than £50.

- You are registered as self-employed.

- You are currently unemployed.

- You are currently serving as a member of the UK armed forces.

- You work on a boat (although not a fishing boat).

» TAKE ACTION NOW: Fill out the short debt form

How Is It Issued?

When a creditor or a debt collection agency such as Lowell Financial tells you they are seeking an attachment of earnings order against you, don’t just ignore this letter. You still have time to arrange affordable repayments with them. You should contact them and try and avoid getting the AEO.

If you have received a notification from the court, as well as an N56 form, it means the AEO has already been applied for and you have to fill this form in and send it back to the court.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

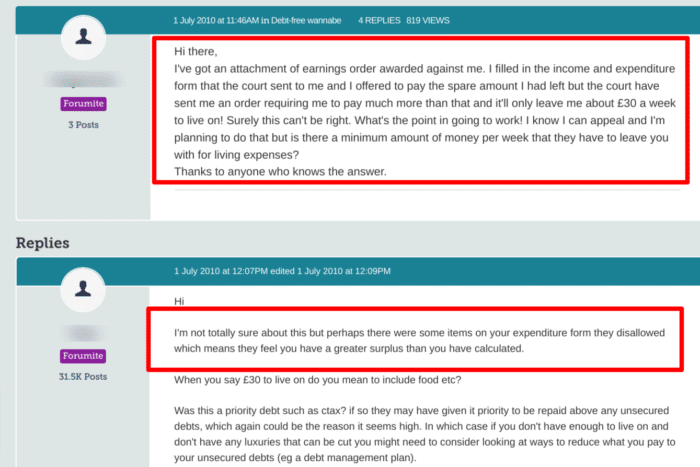

What Are Protected Earnings?

If the court issues an attachment of earnings order against you, it may specify a Protected Earnings Rate (PER). The PER will set the very minimum amount of money you must be left with after the AEO deduction has been taken from your pay.

PER is put in place to make sure you have enough of your income left to pay your basic living expenses. Such as rent/mortgage, utility bills, food, etc. Your employer will be responsible for ensuring that your take-home pay does not fall below this PER when making AEO deductions. You need to give accurate information about your living expenses. Otherwise, the court may set the PER rate too low.

What Is Exempt?

Not all of your income will fall under the AEO. Some types of income are exempt, and no deductions should be taken from them. We have listed these below.

- Pension you receive due to a disability.

- Adoption, paternity or maternity pay.

- Any tax credit you are granted.

- Your guaranteed minimum pension.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Much are the Deductions?

How much your employer can deduct from your weekly earnings, depends on how much you earn. In general, the more you earn the higher the deduction. The table below explains how much AEO will be for specific income ranges.

| Net Pay (Weekly) | Deductions (Weekly) | Percentage of Income |

| £75 or less | Zero | 0% |

| From £75 to £135 | £2.25 to £4.05 | 3% |

| From £135 to £185 | £6.75 to £9.25 | 5% |

| From £185 to £225 | £12.95 to £15.75 | 7% |

| From £225 to £355 | £27.00 to £42.60 | 12% |

| From £355 to £505 | £60.35 to £85.85 | 17% |

| More than £505 | Minimum £85.85 | 17% in respect of the first £505 and 50% of the remainder |

If you believe that your employer has been deducting too much from your weekly wages or monthly salary payments, you can contact the court and query the level of deductions. The court will want you to provide proof of your earnings in order for an adjustment to be made.

What if I Don’t Comply?

Attachment of Earnings Orders are legally binding.

This means that failure to comply with an AEO may result in a fine or, in extreme cases, even imprisonment.

How To Stop It

When you are filling in the N56 form to send back to the court, you can try to have the AEO stopped. If the deductions from your pay are going to cause you significant financial hardship, you can ask that the AEO be suspended. Examples of why an AEO might be suspended are that you have become unemployed, or you won’t have enough money to pay your bills.

You should explain why you are asking that the AEO be suspended, and also whether you are getting any other form of help and advice about meeting your debts. Additionally, you may have recently spoken to your creditor and arranged a different form of repayment of the debt, making the AEO no longer necessary.

How Do I Appeal?

You have 14 days to inform the court that you disagree with the terms of the AEO.

You will need to write to the court and explain why you think the AEO is wrong. From my experience, the most common examples include:

- You think that the court has set the instalments too high

- You want to request that the AEO is suspended while you explain to the court, in detail, why your employment might be affected.

A hearing will then be arranged. You must go to the hearing and take a detailed personal budget and information about any debt repayments or other outgoings that you have.

You can then explain to the judge holding your hearing why you think that the AEO will cause serious problems or how your job will be affected.

Can I Get a Debt Solution?

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.