Freeze Credit Card Interest – Simple Guide & FAQs

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you finding it hard to pay your credit card debt and thinking about freezing the interest? Then, you’re in the right place.

Every month, more than 170,000 people visit our website seeking advice on debt problems. We understand how tough it is; you are not alone.

In this article, we will explain:

- How to freeze your credit card interest if you are having money troubles.

- The things you need to show your bank to make them stop the interest.

- If freezing your credit card interest can change your credit score.

- How to stop your credit card from getting more interest.

- Ways to clear some of your debt legally.

Some of us have also struggled with such issues, so we know how worrying this can be. So, let’s start learning more about how you can freeze your credit card interest today.

How to Do It

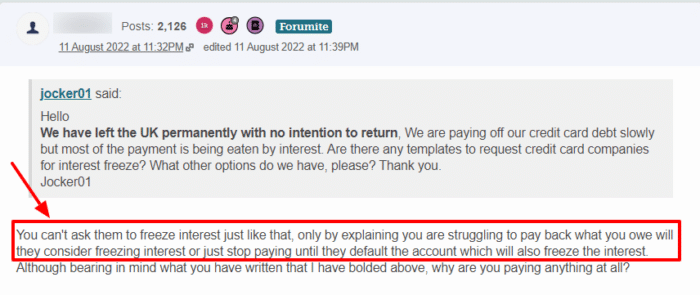

From my experience, not enough people know if, how, or when interest on credit cards can be frozen. Take a look at this example, taken from a popular internet forum:

You must let a creditor know that you are struggling to pay if you want them to freeze interest and other fees.

The majority of the time, they’ll ask you for further details regarding your income, daily expenses, and other debts.

You shouldn’t wait until you’re in serious financial trouble before you contact your credit card company since almost always having the option to lower payments and pay off your debt more quickly is a positive thing.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

Unless your credit card terms and conditions include a period of zero interest (normally only at the beginning), the only way to stop credit card interest is to ask the creditor to freeze interest and charges on your account.

You will still need to pay the capital that you spend.

If lenders do agree to freeze interest and charges, they’ll probably only do it for so long, usually between three months and six months.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Our letter template

If you are unsure of how to ask your creditor to freeze the interest on your card, why not use our downloadable letter template?

We’ve already written a letter you can use to save time and the headache. This template could also be used if you wanted to ask for the interest to be stopped on a loan.

We have a freeze interest letter template for single and joint debts, both written in a polite and professional manner to save you the trouble.

Simply download it and add some of your own personal details, such as your customer number and address – then post it.

Will it affect my credit score?

Stopping interest on credit cards will not affect your credit file. The lender is agreeing for you to pay less for the credit they gave you going forward. It’s not the same as defaulting on payments.

But if you haven’t paid what you should have in the lead up to asking for the interest to be frozen, these missed repayments can negatively impact your credit file.

Don’t confuse stopping your credit card interest with freezing your credit. The latter is something some people do to freeze their credit report and block creditors from checking on your file.

It will also not affect your credit score, but it will prevent you from getting credit. It’s sometimes used as a way to protect against identity fraud.

» TAKE ACTION NOW: Fill out the short debt form

Why should creditors agree to it?

A lender may agree to freeze the interest and charges to stop their customer from getting into debts with them and others.

In doing so, the individual will have an opportunity to put their financial situation right early, and thus, the creditor is likely to have fewer problems recovering future monthly payments.

By helping out the debtor now, the credit card company will hope that there will be no further issues down the line.

How do I stop my card from accruing interest?

You can write to your credit card company to ask them to freeze the interest and charges on your card, but there is no legal obligation for the lender to do so.

The same applies if you want to remove the interest on a loan – you can try but there are no guarantees.

There are some groups that encourage credit card issuers to freeze the interest and charges when asked, namely the Credit Services Association.

The CSA even has this in their code of conduct, which credit card providers agree to when they become a member. The Financial Conduct Authority (FCA) is also pushing for debtors to have their interest frozen during the pandemic.

When making your request, you should provide evidence that you’re struggling to afford to pay and that having the interest frozen will help.

You can prove financial difficulty by providing them with a copy of your monthly budget, highlighting limited disposable income.

If they accept your request to stop all interest and charges on your account, you will likely have to set up a repayment plan, which will entail a breakdown of your expenditures. Then you will be required to make monthly payments to settle the debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

If making payments on your credit card account, even the minimum payments, has become difficult for you as a result of other debts, you may want to get in touch with your creditor to let them know about the difficulties you are having.

It’s important to keep in mind that some credit card companies have a minimum payment limit. If you can afford to pay more I advise doing so. In turn you will pay less interest and clear the debt faster, meaning your credit rating will improve much faster.

Work out your budget easily in this budgeting guide!

Another option is to transfer your credit card balance to another credit card that is offering zero-interest for the first few months.

However, this will require a new application and another credit check. Moreover, you will probably be subject to a balance transfer fee.

This is known as a credit card balance transfer and might be a way for you to avoid persistent debt or multiple debts.

Complain about default charges

Banks and other credit card providers may charge you default fees if you miss a payment.

However, it is generally accepted that an account default fee above £12 is unfair and can be challenged.

If you have paid more than £12 as a default, you could call your credit card company and ask for a refund.