Freeze Debt App Review (UK) Is it any good?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about how to handle your debt? Perhaps you’re puzzled by the choices out there.

Don’t worry, you’ve come to the right place. Each month, over 170,000 people visit our website seeking advice on debt matters.

This is a simple review of the Freeze Debt App, a tool that may help you. In this review, we’ll cover:

- The key features of the Freeze Debt App

- How the Freeze Debt App can help you write off some debt

- Important details about Freeze Debt Limited

- Common questions about the Freeze Debt App

Debt can be a big worry, and it’s common to feel unsure about asking for help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

But rest assured, you’re not alone. We’re here to help you find the best way to handle your debt.

Freeze Debt App Review UK

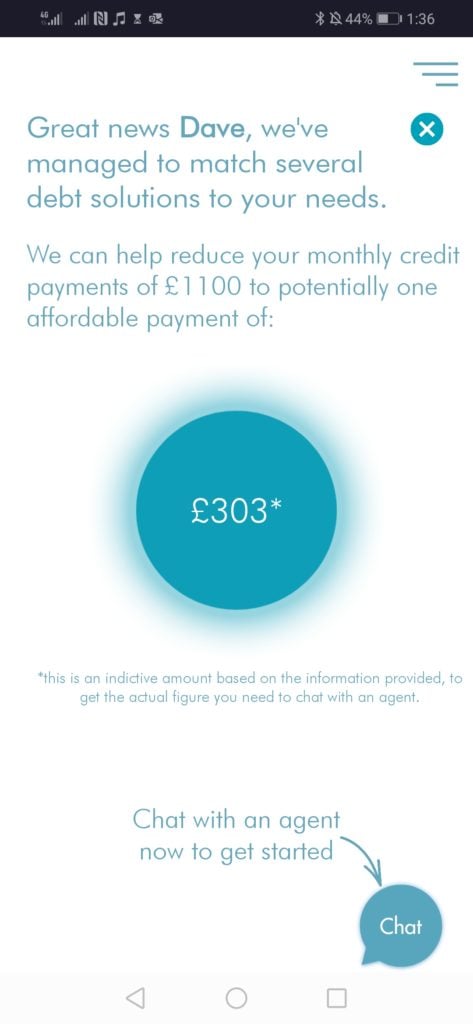

At the time of writing, the Freeze Debt App has a review score of 4/5 on the Apple store, with customers praising the online chat function and the simplicity of the process.

You can see Freeze Debt App reviews by heading to the Apple or Google store.

» TAKE ACTION NOW: Fill out the short debt form

Freeze Debt Solutions

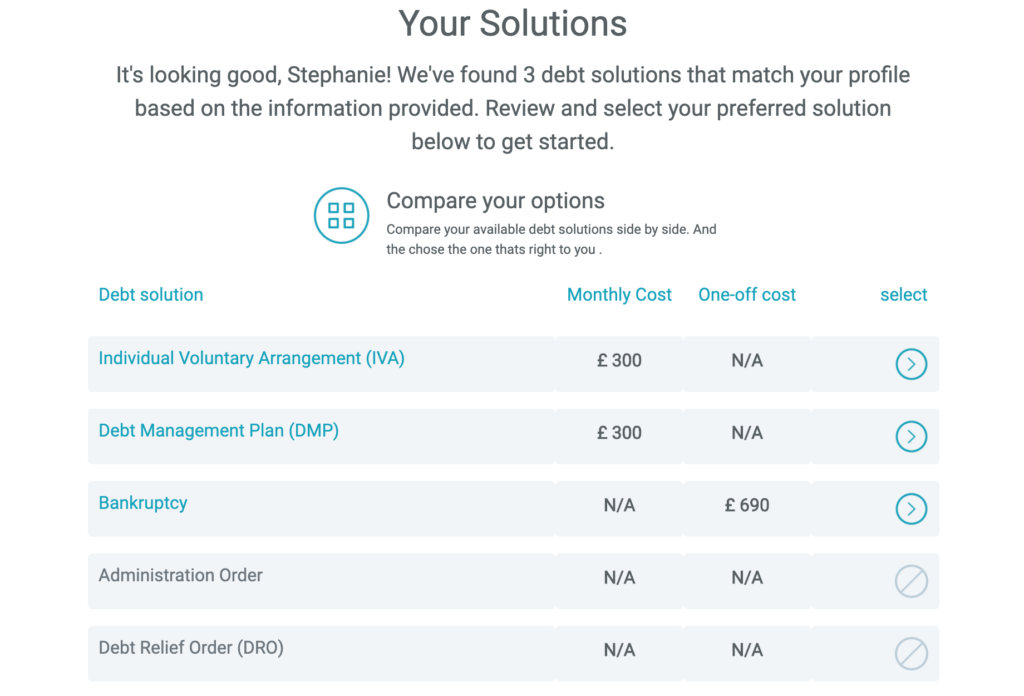

The Freeze Debt App will gather your information and recommend a debt solution which fits your situation and level of income the best. It may recommend one of many popular debt solutions in the UK, such as:

- Debt Management Plan (DMP)

- Individual Voluntary Arrangement (IVA)

- Debt Relief Order (DRO)

- Bankruptcy

Debt Solutions Comparison

I’ve put together this quick table to help you better understand the recommended debt solutions on the Freeze Debt app.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to complain about Freeze Debt Limited?

The FCA (Financial Conduct Authority) lists contact details in their register that you can use to complain about a debt management company, should you need to.

These are the details listed for Freeze Debt Limited:

Ambler House

Trevelyan Square

Leeds

West Yorkshire

LS1 6EDL

UNITED KINGDOM

+4401134290112

If Freeze Debt does not respond to your complaint, you should contact the Financial Ombudsman Service. They will be able to handle your complaint.

Information correct as of 09/08/23 (FCA)

Company information:

Companies House includes important details about every registered business, such as their date of incorporation.

I share below the most important information about Freeze Debt listed on Companies House as listed on their website::

| Address: | Ambler House, Trevelyan Square, Leeds, West Yorkshire, United Kingdom, LS1 6ED |

| Phone number: | +4401134290112 |

| Website: | www.freezedebt.co.uk |

Date of incorporation: 22 February 2019

Company status: Active

Company number: 11842271

Company type: Private limited Company

Information correct as of 09/08/23 (Companies House)

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

FCA registration:

The Freeze Debt App is a legitimate debt solution initiative by a debt advice company.

They want to do things differently and have developed an innovative app. We know they’re legitimate because they’re FCA registered.

The conduct regulator for financial services firms (including debt solution providers) and financial markets in the UK is called The Financial Conduct Authority (FCA).

Freeze Debt Limited is registered with the following details.

FCA regulated: No

FCA status: No longer registered as an Appointed Representative

FCA regulated activities: Act on behalf of another firm (its principal) that is authorised for certain activities in the UK or regulated in another EEA country.

FCA reference number: 840092

Trading names: FREEZE DEBT LTD, FREEZE DEBT

Connected [principal) businesses: PEBBLE PROTECTION LIMITED, Blackberry Finance Solutions Limited

Place of business: Ambler House, Trevelyan Square, Leeds, West Yorkshire, LS1 6ED, UNITED KINGDOM

Information correct as of 09/08/23 (FCA)

Data protection registration:

Data protection registration means that this company is registered with ICO, the UK’s independent authority set up to uphold information rights in the public interest.

The privacy of your data will be protected.

Registration No: ZA525047

Data controller: Freeze Debt Ltd

Address:

10-12 East Parade

Leeds

LS1 2BH

Information correct as of 09/08/23 (ICO)

Freeze Debt Contact Details

Address:

Ambler House

Trevelyan Square

Leeds

LS1 6ED

Website: