Further Advance on Mortgage – How to Increase Your Loan

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

A further advance is the process of borrowing more from your current mortgage provider. Unlike the process of remortgaging, getting a further advance doesn’t mean that you have to switch mortgage deals.

But, for your application to be successful, you need to meet strict eligibility criteria. Sounds confusing? Don’t worry, you’re in the right place. Each month, more than 6,900 people visit our website for advice on secured loans.

In this easy-to-understand guide, we’ll explore:

- What a further advance on a mortgage is.

- The difference between a remortgage and a further advance.

- How a further advance can be used.

- If you can get a further advance on your mortgage.

- The time it takes to process a further advance.

Remember, you’re not alone in this. We’re here to support you with clear and simple advice. So, let’s get started and learn more about further advance mortgages together.

In a Nutshell

A further advance on a mortgage is when you extend the borrowing on your current mortgage. However, the additional borrowing could be subject to a different interest rate than your initial and outstanding mortgage loan.

The further advance will typically be offered based on current interest rates, which could be different to your existing mortgage interest rate. Nevertheless, the interest rate is likely to be more competitive than unsecured loans.

But it’s still worth comparing a mortgage advance with other loan products on the market before asking for a further advance on your mortgage.

How does it differ from a remortgage?

The main difference between remortgaging to borrow more with your current or a different lender and taking a further advance on your existing mortgage is that the latter doesn’t force you to switch mortgage deals.

It’s possible to extend your borrowing by remortgaging your current deal and asking to borrow more if you have sufficient home equity to borrow against. This will mean completely switching the mortgage deal you currently have, and possibly switching lenders. You might have to pay early repayment charges by clearing the initial mortgage as well.

A further advance on a mortgage means you keep your current mortgage with the same lender. This can be beneficial if current mortgage deals aren’t as attractive as what is currently available on the market.

Moreover, you won’t have to pay any early repayment charges. You’ll simply extend your current mortgage, but any additional borrowing might be subject to the latest market rates.

On the other hand, if current mortgage deals are more attractive, it could be cost-effective to not ask for a further advance, and instead, remortgage your whole loan and simultaneously ask to borrow more as part of the process.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.69% |

£218.21 |

£26,185.42 |

| Equifinance | 6.2% |

£219.10 |

£26,291.67 |

| Selina | 6.34% |

£219.34 |

£26,320.83 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.4% |

£221.18 |

£26,541.67 |

| Norton | 9.05% |

£224.05 |

£26,885.42 |

| Masthaven | 9.65% |

£225.09 |

£27,010.42 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

Can I get it on my mortgage?

Whether you can get a further advance on your mortgage will depend on several considerations, including how much home equity you currently have, your credit rating and the affordability of the prospective larger mortgage.

First of all, you will need sufficient home equity to get an advance on your mortgage. Most lenders require you to have at least 20% home equity in a residential property at all times.

This means you’ll still be required to have at least 20% equity in the property after you have taken the advance!

For example, if you purchased a £200,000 property to live in with a £40,000 deposit, you would immediately have 20% home equity. But you wouldn’t be able to get an advance on your mortgage just yet.

You would have to wait until you had built up more home equity through monthly mortgage repayments or property value increases before being able to get a further advance on your mortgage. This could take months or years.

The lender will also need to complete checks to ensure you can afford the additional repayments and if your credit score meets their criteria. For example, these guys are seriously maybe the best mortgage brokers around West London.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

What can it be used for?

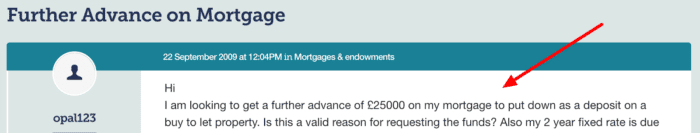

Further advances are most often used to help fund home renovations and improvements, but they’re also used to help top up a deposit for other property purchases, especially investment properties.

Here’s just one example of people thinking this way:

Source: https://forums.moneysavingexpert.com/discussion/1962821/further-advance-on-mortgage

A further advance on a mortgage could also be a good way to consolidate existing debts and save on interest repayments. Interest on secured loans and especially mortgages is likely to be lower than other loan types, which can save you money when consolidating debts.

Ultimately, there aren’t usually any restrictions on what you can spend the mortgage further advance on. Many lenders like it when you want to spend the money on home improvements. Making home improvements will usually increase the property’s value, which somewhat reduces the risk taken by the lender.

Second charge mortgage for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Getting it on a buy-to-let

Getting a further advance on an existing buy-to-let mortgage can be a little more tricky. Investment properties are considered a greater risk to banks, which is why you usually need a bigger deposit to get a BTL mortgage.

The same caution is applied by lenders when approving BTL mortgage advances. You might need to have at 40%+ equity in the property after your advance has been approved to get the mortgage advance.

How long is the process?

The timescale to get a further mortgage advance approved and in your bank account can vary. If the lender doesn’t need to revalue your property, it’s possible to receive the funds within a week or two. But if complications arise, the advance could take longer than a month.