How to Get Out of Black Horse Finance Debt

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re trying to get out of your Black Horse Finance car contract, you’ve come to the right place for help. Each month, more than 170,000 people visit our website looking for guidance on debt matters.

In this simple guide, we’ll cover:

- Who Black Horse Finance is

- How to handle your car finance deal

- Ways to legally write off some Black Horse Finance debt

- How to give your car back to Black Horse

- Details on Black Horse Finance’s voluntary termination

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’re here to help you understand your options and find a way forward.

Let’s start exploring your Black Horse Finance solutions.

Can you pull out of a finance deal?

The Consumer Credit Act states that all consumers should be given 14 days to withdraw from an agreement.

This applies to all forms of consumer credit, including car financing agreements.

Can I get out of a car finance deal?

There are only two ways to get out of a car financing deal:

a) pay off the remainder of the agreement

b) exercise your right to voluntary termination.

As most people want to get out of their car hire purchase (HP) agreement because they can’t afford to keep up with repayments, the first option is usually off the table.

Ending a car finance agreement early may have implications unless it is within the 14-day cooling-off period.

Implications of terminating a car finance deal can affect your credit score, leading to difficulties obtaining future credit.

You may be required to pay back money already loaned, plus any fees and interest charges.

You may wish to consider other options, such as refinancing car loans or transferring the balance to a lower-interest-rate credit card.

I recommend seeking professional help from reputable debt-help organisations such as the Citizens Advice Bureau Step Change or National Debt Line to discuss the option best suited to your circumstances and to get general advice on managing your debts.

Debt Solutions Comparison

Struggling with debt can be quite challenging. But don’t worry, there are different debt solutions available that can help you.

These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I give my car back?

It may be possible to return the vehicle to Black Horse and end the HP Agreement. To do this, you must voluntarily terminate the agreement using Section 99 of the Consumer Credit Act.

The Consumer Credit Act was introduced in 1974 to protect customers in credit agreements, it sets out rules and regulations that lenders must follow when providing credit to customers.

If they fail to follow the regulations, then action can be taken against them.

Section 99 Consumer Credit Act states that;

- The customer can terminate the agreement within 14 days of signing. However, if there is any damage to the vehicle, you may have to pay for repairs.

- The customer has the right to receive a statement at least once a year detailing all transactions.

- Customers may request a statement within 30 days if they have entered into a running account.

We explain the process in detail below!

» TAKE ACTION NOW: Fill out the short debt form

Black Horse Finance voluntary termination

Black Horse Finance voluntary termination (VT) is when you give back the vehicle to end the agreement and don’t have to make any further payments.

However, you also won’t get refunded for the money you’ve paid. Nevertheless, it can stop you from getting into account arrears and serious debt.

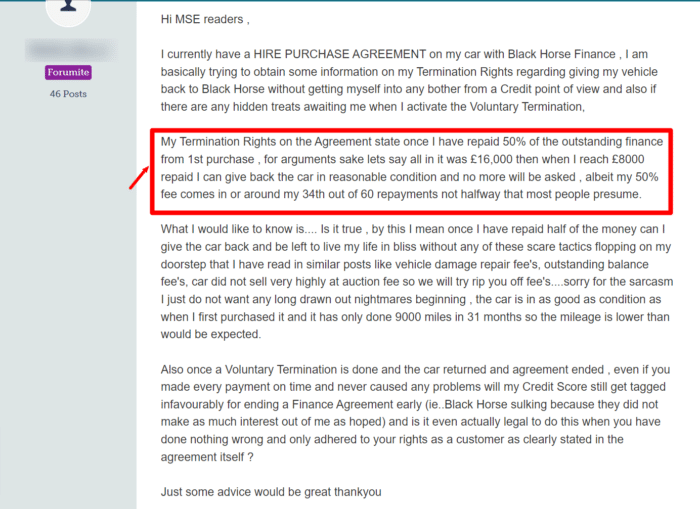

You can return the vehicle to Black Horse under Section 99 and Section 100 of the Consumer Credit Act, providing you’ve already paid at least 50% of the money, fees and interest owed in the agreement.

If you’re short of this amount, you must pay the difference before you can return the vehicle.

If the vehicle is damaged in any way, then you will be responsible for the repairs.

The steps for voluntary termination are as follows;

- Check your loan agreement for the terms of VT

- Contact Black Horse Finance for an up-to-date statement of your account so that you can work out what you owe.

- Provide written notice stating that you wish to voluntarily terminate the agreement under section 99 of the credit consumer act. Also, provide details about the card, such as make and registration.

- If you are required to return the vehicle yourself, then do so.

- Once you have sent the letter, cease payments.

- Keep a log of all correspondence.

Source; Money Savings Expert

Black Horse Finance Contact Details

| Post: | Black Horse Finance Customer Services, St William House, Cardiff CF10 5BH |

| Phone: | 0344 824 8888 Monday to Friday 8:30am – 6:00pm and Saturday: 9:00am – 1:00pm Text Relay Service: Please dial 18001 followed by the phone number above |

| Website: | https://www.blackhorse.co.uk/ |