HMCTS Historic Debt Team – Who Are They & What to do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

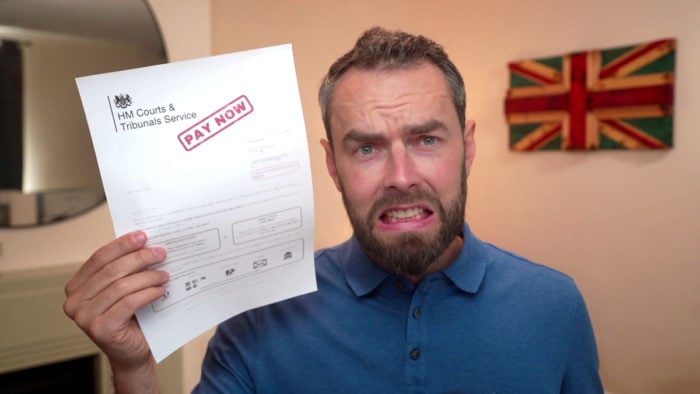

Are you dealing with the HMCTS Historic Debt Team and feel unsure about what to do? You’re in the right place for answers. HMCTS is a group set up by the UK government to find people with unpaid court fines and get the debt paid back.

Each month, over 170,000 people visit our website seeking guidance on debt matters, so if you don’t know where to start, please keep reading.

In this easy-to-understand guide, we will cover:

- Who the HMCTS Historic Debt Team are.

- Why this team was created.

- What happens if they chase old court fines.

- How you can repay your debts to them.

- What to do if you can’t afford to pay.

Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. So, concerns about debt and its implications are common.

But don’t panic; we’re here to help you. With our guide, you will find out how to deal with the HMCTS Historic Debt Team in the best possible way. Let’s dive into what your options are.

Will They Chase Old Court Fines?

Yes, when HMCTS Historic Debt Team was initially created they were aiming to collect fines over the previous ten years.

However, the HMCTS debt recovery service was so successful at recovering the money owed that they were allowed to recover court-ordered payments from over ten years ago.

» TAKE ACTION NOW: Fill out the short debt form

But, Isn’t My Fine Statute Barred?

A Statute Barred debt is a debt that is at least six years old and never received a CCJ. A legal loophole in the Limitations Act states that debts of this age cannot be legally enforced and the debtor is never forced to pay.

However, court fines do not apply. Because the court fine is the result of breaking the law, these types of debts can never be too old to be enforced.

And for the same reason, court fines are not allowed to be repaid as part of some popular debt solutions. For example, you cannot include court fines in a DRO, IVA or bankruptcy application.

Simply put, you’re going to have to pay up.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What are the Consequences of Not Paying?

Court fines are priority debts. If you don’t pay a court fine, you could face serious legal consequences. For example, the court could:

- Take money from your benefits or your wages

- Deploy bailiffs to your home

- Register the fine

In some rare cases, you could be sent to prison. However, this only happens if the court has reason to believe that you are deliberately not paying your debt.

There are also added costs associated with not paying a court fine. For example, if bailiffs are sent to your home, you will be required to pay bailiff fees, on top of your debt. Or, if the court registers the fine, you will likely struggle to take out credit in the future.

Typical Bailiff Fees and Charges

I’ve put together this table to help you better understand the typical bailiff fees. For more information on how bailiffs operate, don’t forget to read our specialized guide.

Should I Ignore the Letters?

You should not ignore any request for payment from the HMCTS Historic Debt Team. If you believe the letter is not genuine, we have created a post to help you spot debt collector scams.

You might want to be more cautious if the letter comes from an enforcement agency that isn’t one of the three listed above. But this on its own is not a sign of a scam, so do your research.

By ignoring these letters, you might have to pay more to cover enforcement agency costs. And remember, the HMCTS Historic Debt Team will listen to your repayment proposals if you can’t afford to pay the fine in a single payment.

To avoid escalated fees and legal actions, contact the HMCTS Historic Debt Team as soon as possible.

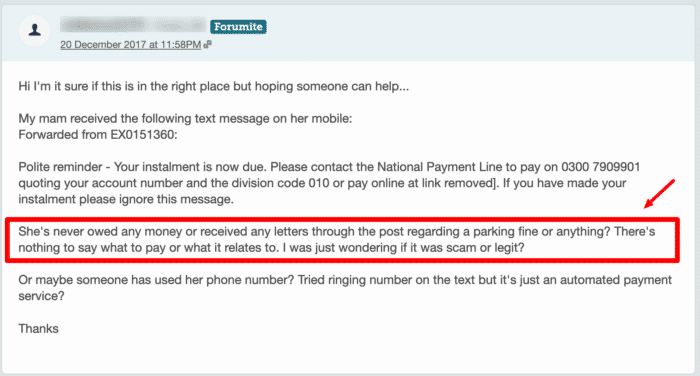

How to Check if It’s Legit

If you have received a letter, email, or any other correspondence from HMCTS, you must ensure it is legitimate before making any payments. To check legitimacy, you should:

- Cross-reference any contact details provided with the contact details on the HMCTS website.

- Look for errors in the content, e.g., spelling mistakes. Official HMCTS communications are unlikely to contain errors.

- Be wary of threatening language.

- Check the suggested payment method, e.g., don’t trust a letter that suggests an untraceable payment method.

- Contact HMCTS directly to discuss your case.

- Get free financial advice from a registered UK debt charity, such as StepChange, if you are unsure.

This forum user on MoneySavingExpert is concerned about a text message supposedly from HMCTS. In this case, it would be recommended to contact the National Payment Line using contact details on their official webpage (not the ones in the text) to discuss the issue further.

Will They Use Enforcement Agencies First?

No, the HMCTS Historic Debt Team will try to resolve the matter without needing enforcement services. They do this with what is called a Further Steps Notice.

This notice outlines the action which will be taken if you don’t pay. Ultimately, it allows you to respond before enforcement agencies or other tactics are used against you.

You have the right to appeal within ten days of this notice.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

I Can’t Afford to Pay Them…

If you cannot afford to pay your HMCTS debt, you can offer to pay in installments. The HMCTS Historic Debt Team should work with you to create to a reasonable repayment plan.

Will They Always Accept a Payment Plan?

If HMCTS Historic Debt Team have already passed your debt to an enforcement agency, they are unlikely to not accept a repayment schedule. In this situation, HMCTS Historic Debt Team will have employed enforcement agents to come and recover payments.

Keep in mind that our financial expert, Janine Marsh, advises: ‘If a bailiff has proven you owe money and you don’t have cash to hand, you’re within your rights to suggest a payment plan. It’s not a guarantee, but many will accept this as it’s easier than repossession.

If you somehow make a payment to HMCTS Historic Debt Team when enforcement agents have already been employed, your payment is forwarded to the enforcement agency. The payment will still count towards your court fine repayment, but you might now also have to pay additional fees.

Can I Make a Statutory Declaration (Section 14)?

It is possible to make a Statutory Declaration to reduce the fine you owe. Yet, this doesn’t happen often and many people choose to just pay the full amount.

How Do I Contact them?

The HMCTS Historic Debt Team provides their contact details in the letter they send out informing you of the unpaid fine.

Alternatively, you can discuss these debts by calling The National Enforcement Service. Their number is 0300 123 9252.

Tips on Communicating with them

If you cannot pay your debt instantly or need more information on the details of your debt, it’s important to communicate clearly and professionally with the HMCTS team to ensure all interactions are productive. For example, you should:

- Stay calm and collected.

- Keep records of your correspondence to ensure your rights are protected.

- Request written confirmation of any agreement you make over the phone.

- Ask for clarification if you need it.

- Have all of the necessary personal information and formal documentation to hand.

- Follow up if you haven’t received a timely response.

Historic Debts Contact Details

| Phone | 0300 1239252 |

| Website | www.gov.uk/government/news/hm-courts-tribunals-service-advice-to-debtors-on-unpaid-historic-fines |