Can HMRC Take My House? What You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about HMRC debts? You’re not alone. Over 170,000 people visit our website each month looking for advice on debt problems.

We understand that it can be very stressful. That’s why in this article, we will share important facts about HMRC and your house. We will talk about:

- Common HMRC debts and how they affect you

- What to do if you can’t pay your HMRC debts

- How HMRC can take money from your property sale to cover your debts

- Ways to repay your HMRC debts

- How some of your debt can be written off

Our team knows a lot about dealing with debt; some of us have been there too. With our expertise, we’ll help you understand more about HMRC debts and what you can do.

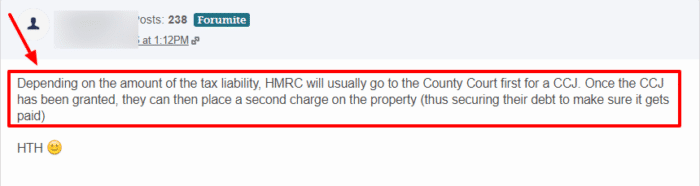

Can HMRC repossess your house?

Can they take your house for company debts?

» TAKE ACTION NOW: Fill out the short debt form

Can the debt be written off?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Bear in mind that having HMRC debts can also affect your credit rating, and ability to secure financing or loans in the future.

How can you repay HMRC debts?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

HMRC Contact Details

| Post: | Pay As You Earn and Self Assessment HM Revenue and Customs, BX9 1AS, United Kingdom |

| Phone: | 0300 200 3300 +44 135 535 9022 outside UK |

| Relay UK: | dial 18001 then 0300 200 3300. |

| Official app: | official HMRC app |

| Website: | https://www.gov.uk/government/organisations/hm-revenue-customs |