How To Calculate Interest on Debt? Step by Step Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

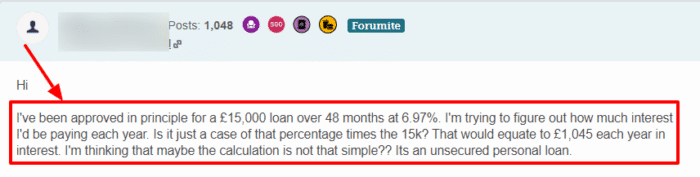

Figuring out how to calculate interest on oyour debt can feel like a big job. But don’t worry, you’re in the right place. Each month, over 170,000 people come to our website for guidance on debt questions just like this one. You’re not the only one who needs to know more about this topic!

In this easy guide, we’ll explain:

- What is debt interest and the two main types: contractual and statutory.

- How to use a simple interest calculator.

- When a payment is seen as late and extra costs.

- The difference between simple interest, compound interest, APR and flat interest rate.

- Tips on how to manage unaffordable debt and write off debt legally.

We understand that being in debt can be tough, as some of our team members have been in the same situation. We’re here to help, so let’s learn more about calculating interest on your debt.

How You Can Do It

Interest is expressed in percentages, and it is applied annually to your debt.

The calculations are fairly simple, but there are some different applicable scenarios.

If you’re wondering:

“What if I want to pay the interest on a monthly basis? Do I still have to pay the same amount?”

The answer to that question will be No. If you want to make monthly payments, you will simply divide your annual rate of interest by 12.

Finally, let’s cut to the chase:

Simple interest is calculated by the following formula:

A = P( 1 + rt )

This formula might seem perplexing, but it is very simple.

Here,

- A means the amount to be paid.

- P is the principal amount that you borrowed from the lender.

- r is the interest rate divided by 100

- t is the number of time periods that have elapsed.

For example, if the additional amount to be paid is 5% annually on a debt of £100, at the end of two years, you will have to pay an additional amount of 0.05*100*2 = £10. This is the price you pay for borrowing £100 for two years.

» TAKE ACTION NOW: Fill out the short debt form

Simple Vs Compound

The interest you pay on a loan can be a simple interest or compounded.

- Simple interest is calculated only on the principal amount, or on that portion of the principal amount which remains unpaid,

- Compound interest is calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a loan.

Compound interest can be thought of as “interest on interest,” and will make a loan grow at a faster rate than simple interest.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

Difference Between APR and Flat Rate

Annual Percentage Rate (APR) takes into account the total cost of borrowing over a year, including interest, fees, and other charges. This gives you a comprehensive view of the true cost of a loan or credit on an annual basis. For example, interest on overdrafts is typically charged at a single APR.

In contrast, a flat interest rate is calculated on the full original principal amount throughout the entire loan tenure, regardless of the monthly payments made. This makes it generally a less accurate way of calculating the total cost over time.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When Does a Payment Become Late?

When you borrow money, your lender decides a due date by which it is to be returned. If you miss this due date by even one day, you must pay an additional fee for being late.

This fee can be in the form of daily interest, which charges you according to the number of days passed since the due date.

Other than that, there can be a fixed late fee for the delay in payment. The exact details vary from contract to contract.

However, late payments don’t get reported to credit bureaus until they are at least 30 days late. This means that a late payment will only appear on your credit report if you miss the due date by 30 days. This mistake will then stay on your credit report for 7 whole years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.