How Is Debt Divided in Divorce?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about how debt is divided in divorce? You’re not alone – every month, over 170,000 people come to our website for advice on debt issues like this one.

In this article, we’ll explain:

- Who is responsible for debt during divorce.

- How to divide assets, such as property and pensions.

- The impact of your partner’s debt on you.

- What legal and financial advice can help you.

- How to handle debt in separation and bankruptcy.

We understand that dealing with debt during a divorce can be stressful, which is why we want to help you understand your options. Our team has helped many people in similar situations, so we know what you’re going through.

So, let us guide you through the process of how debt is divided in divorce, according to the 2023 UK laws.

How are Debts Split in a Separation?

Debt under joint names such as credit card debts, mortgage payments of your mortgage company, and long-term and short-term debts are all part of your daily life.

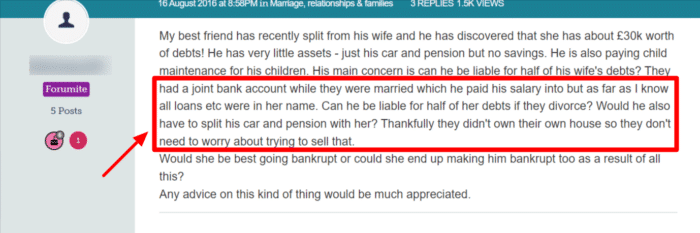

All debts under a joint name are often split among the separating couple in a separation; however, this can vary and depends on the circumstances of each case.

Source Money Savings Expert

Mortgage

Mortgage payments to a mortgage lender have to be made by both parties. Property dealing with a mortgage company is always complicated.

If a particular party wants out of the mortgage deal, they can do so, and the responsibility of paying the loan will solely be upon the other partner.

However, if your partner wants out of your mortgage payments, make sure you get their name out of the asset’s title. Mortgage payments under a joint name usually mean that the asset is also listed under a joint name.

Make sure to get that corrected once you separate.

The cleanest solution in such a situation is to sell the house and divide the money. This way, your mortgage lender wouldn’t be able to come after you, plus you will also be relieved of the financial pressure of paying off your mortgage on time.

Mortgage debt usually goes to the spouse in charge of the children or the spouse with greater financial banking. The court outcome is unpredictable and can go either way. Selling off your property and any additional mortgage payments is sometimes a good idea.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Car Loans

These are different from property loans and mortgage payments. You can either insist on an automatic payment from their account or ask to refinance any remaining debts in your name.

Even if one spouse refuses to pay, it results in a bad history for both of them, and that road is never suitable.

Medical Debt

Medical loans in a separation are sometimes split up in a 50/50 manner. However, often some considerations are made, like when was the loan acquired? Was it during the marriage? Will the debt affect the children?

This isn’t like property dealings and cannot be split up straight away, presenting a more complicated case.

Auto Loan

It is similar to car loans. You can either refinance the payment in your own name or ask your spouse to pay their share.

Credit Card

Credit cards are issued in one single name usually. You are not liable for this debt if it is issued in only your spouse’s name. However, several plans are available if it is a joint credit card. Contact your card lender for additional information that applies to your case.

» TAKE ACTION NOW: Fill out the short debt form

How To Distribute Assets?

Asset distribution during a divorce varies from case to case. Property disputes usually continue for a long time before they are ever settled.

It is hardly ever the case that your assets are split in the same way somebody else’s is.

It depends on your lawyer, the type of asset and your relationship with your ex after the marriage is over.

Property

In many situations, married couples can decide how property in joint names will be split up. Property cases are the main disputes presented in the court day in and day out.

To avoid the hassle of fighting for property in court, couples usually come forward with an already made agreement and have to get a ‘consent order’ so that their agreement is legally binding and cannot be avoided.

If no agreement can be reached, going to court over the division of marital property should be the last resort, and legal advice should be sought long before that point.

Moreover, your mortgage lender should be contacted and informed of the circumstances to avoid confusion later. Mortgage problems become increasingly common later on if you don’t take timely action on your property.

Pensions

When it comes to divorce, financial provision is a crucial aspect which must be addressed. Pensions are usually dealt with off-setting. This is a process in which one partner receives the whole pension, and the other gets cash and assets of equal value as opposed to the pension. This avoids disputes like there are in property dealings.

This process involves valuing your entire pension over its lifetime, giving the other assets of the same value.

Investments

When it comes to the financial settlement on divorce, many factors may come into play. Generally, if any generated income comes from your investments, the income is often split in half and given to both parties.

However, there are some exceptions.

One exception is that the investment was made before the marriage, and the income was generated while the marriage was solid. The court has different specific rulings for each minor dispute, and ultimately it is up to the judge to decide how the assets and debts will be split.

This happens because the circumstances after every marriage aren’t the same at all, and the judge has to put great consideration into every case to ensure he gives the correct verdict.

Other factors include the length of that marriage, each party’s contributions, and other assets owned by each party.

Savings

Regarding the separation of assets, the starting point for splitting savings is often 50/50. However, the verdict entirely depends on the circumstances of the couple separating and their relationship after the marriage. It varies from case to case taking into consideration the financial needs of each party, the length of the marriage and contributions made by each party.

How Does My Partner’s Debt Affect Me?

Marrying someone with a bad credit history does not affect your credit score. You are not liable for debts taken solely in your partner’s name. Financial implications of divorce will apply to debts taken jointly and on which you are a cosigner are your debts.

Debts taken in your partner’s name are not your debts, and taking care of them is not your job.

Should I Pay It All Off Beforehand?

It is an intelligent solution to pay off all debts equally before the divorce. However, sometimes, such as in the case of a mortgage, the debt to pay back is too high and cannot be resolved instantly.

If you have the financial power, you should ideally pay all your debts before divorce.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Bankruptcy and Divorce: Impact on Assets and Debts

Divorce and bankruptcy is a more complicated matter. If one or both parties file for bankruptcy during a divorce, it can have implications regarding the divisions of the assets and debts.

If one partner goes bankrupt, their assets will be under the control of their trustee and be used to pay off their creditors. Any assets that are owned jointly may also be taken into account.

If both partners go bankrupt, assets will be used to pay their debts.

In the case of property, bankruptcy may not change how it is divided, and the court will still aim to share property fairly between both parties, considering income and any contributions made during the marriage.