How Far Back Can DWP Claim Overpayments?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you owe money to the Department for Work and Pensions (DWP) because they paid you too much? Don’t worry; you’re in the right place to find out how to deal with this issue.

Each month, over 170,000 people like you visit our site to get advice on debt matters. We’re here to give you clear information about DWP overpayments. We understand your worries about old overpayments and the costs involved.

In this article, we’ll explain:

- What the DWP is and what we mean by ‘DWP debt’.

- How the DWP can claim overpayments, and how far back they can do this.

- Who DWP Debt Management are and what they do.

- How you can pay back DWP overpayments.

- If the DWP can take money from your wages.

Our team has a lot of experience with debt issues, as some of us have even had to deal with overpayments ourselves, so we truly understand your situation. We’re here to help you get through this. Let’s start looking at how you can handle DWP overpayments.

Can DWP claim overpayments?

Yes, the Department for Work and Pensions can ask you to pay back your DWP overpayments.

It’s highly likely that you didn’t update the DWP on your circumstances, which causes the overpayments. But there are also some cases where the DWP could incorrectly overpay you as well.

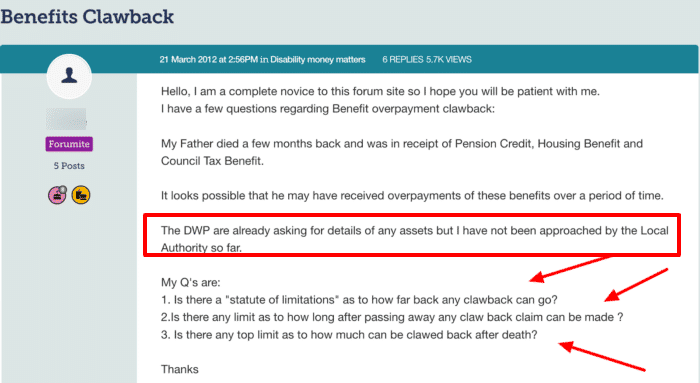

Source: https://forums.moneysavingexpert.com/discussion/3863397/benefits-clawback

Regardless of the situation, the DWP can ask you to repay the overpayments.

If you think you haven’t been overpaid a benefit, you can request a mandatory reconsideration within one month of receiving the DWP letter.

How far back can they claim overpayments?

The DWP can usually only chase you to pay back overpayments that were made within the last six years. Any overpayments made to you more than six years ago are not typically recovered.

However, StepChange states that the DWP can use a Direct Earnings Attachment at any time for any previous debt.

Therefore, you could still end up having to pay back overpayments that were made to you over six years ago.

» TAKE ACTION NOW: Fill out the short debt form

How far back can they claim pension credit overpayments?

The DWP can ask you to pay back pension credit overpayments within the last six years. But they could use a Direct Earnings Attachment to claim back older overpayments.

Pension credits are also a gateway to getting discounts elsewhere, including on council tax. Therefore if you wrongfully received credit payments, you might be contacted by the local authority to pay back the tax you avoided as part of the process.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How about overpayment claims after death?

When someone dies, the DWP can ask the executor of the person’s estate to repay any benefit payments that were paid out after their death.

It’s quite common for the DWP to keep paying some benefits after the individual has passed away because they don’t get notified of the death immediately.

Moreover, the DWP can initiate a full investigation into the deceased’s estate to see whether they should have been receiving the benefit payments they received – and if they were receiving the correct amount. They can even ask for evidence of the person’s assets and finances over the last 12 years.

The DWP will aim to recover all the overpayments made to the deceased during their lifetime. Executors of the estate might wish to wait for DWP clearance before distributing monies from the estate.

Clearance can take anywhere between a few months to over a year, which is understandably frustrating.

But it will be the executor’s personal liability to pay the DWP debt, even if estate monies have already been distributed to beneficiaries.

Can DWP take money from your wages?

Yes, the DWP may look to recover overpayments by taking money directly from your employment income. This is called a Direct Earnings Attachment (DEA).

The DWP requests your employer to deduct an amount from your salary and send it to them instead. The amount goes towards repaying benefit debt.

However, DEAs can only be applied for certain types of benefits overpayments, including:

- Jobseekers Allowance (JSA)

- Employment and Support Allowance (ESA)

- Working Tax Credit

- Universal Credit

- Child Benefit

The DWP does not need to take you to court to set this up like other creditors would be required to do. However, the DWP will inform you that they will be taking money from your wages to clear the debt before starting. You’ll be informed in writing.

That said, you can usually avoid having money taken from your wages if you agree to a repayment plan instead.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you pay them back?

The DWP won’t ask you to pay back overpayments in a single payment, especially if you’re experiencing financial difficulty.

If the DWP debt is a substantial amount due to many months of overpayments, they will probably ask that you repay in instalments.

You can choose to pay off the overpayments in one go, or you could ask for a payment plan, so the debt is repaid over many weeks or months.

The DWP states this within their policy on recovering overpayments:

“It is DWP policy to recover all debt where it is reasonable and cost effective to do so. Debts should be recovered as quickly and cost effectively as possible without causing undue financial hardship to debtors.”

Apart from a repayment plan, the DWP can use the following means to claim back the arrears:

- Making deductions from your continuing benefit payments

- Taking amounts directly from your wages

- Getting a county court judgment (CCJ) to recover the debt

Can you get a DWP debt written off?

A DWP overpayment debt can be written off if the overpayment was made over six years ago, or if repaying the debt is deemed detrimental to your or your family’s health and wellbeing.

For example, if repaying the debt is impossible without causing severe financial hardship to you or your children, the DWP will consider writing off the DWP debt. It’s not common for DWP debts to be written off because flexible and long-term repayment plans can be offered.