How to Get out Of a Secured Loan – Step-by-Step guide

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Understanding a secured loan can be a bit tricky. If you’re asking, ‘Can a secured loan be written off?’ then you’ve found the right place for your answers. With over 6,900 visitors each month, our website offers expert advice on secured loans.

We know how worrying it can be if you’re in debt or concerned about the potential consequences of a secured loan. So, we’ve put together this step-by-step guide to help you on your journey. We’ll cover:

- What secured loans are and how they work.

- Whether secured loans are a risk.

- The true cost of a bad secured loan.

- What happens if you can’t pay your secured loan.

- Different ways to get out of a secured loan.

We’ve been in your shoes and understand your worries. This guide aims to help you make sense of secured loans, so you can make the best choice for your situation. Don’t worry; we’re here to help you every step of the way.

Let’s dive in.

How do secured loans work?

Secured loans work in a similar way to an unsecured loan. You will receive a lump sum amount and repay this loan through monthly payments that include a rate of interest. These payments will continue until you have paid back all of the loan, which may take a few months to over a decade, depending on the loan amount and personal finances.

You might be allowed to pay the loan off early, but you could incur an early repayment charge by doing so.

It’s important that before taking out any loan, you thoroughly understand the loan agreement. This includes understanding all of the terms and conditions, payment plans, interest rates, any additional fees, and potential penalties.

How to get out of a secured loan

So, how can you get out of a secured loan? There are a couple of options you may want to consider. The best option will depend on personal circumstances and your finances.

- Renegotiate your payments – as mentioned earlier, renegotiating your repayments may clear the path to get out of your secured loan more affordably without having to lose your asset.

- Sell your asset – you may decide to sell your asset yourself and use some of the money to pay off the secured loan and any other priority debts you have.

- Consider a debt consolidation loan – A debt consolidation loan is an additional loan taken out to pay off your existing debts, including priority debts. It merges debts together to make them manageable, and the aim is to find a consolidation loan with lower interest.

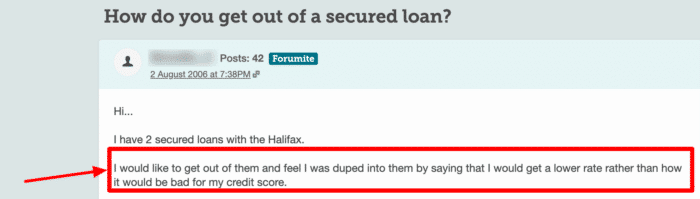

This forum user on MoneySavingExpert is looking for advice on how they can get out of their secured loan.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What happens if you default on a secured loan?

A payment default is when you have failed to make a single loan payment after receiving reminders to pay. If you default on a secured loan, the lender will record the payment default on your credit file, lowering your credit score. This can make it harder to take out a credit card, loan or mortgage in the future.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

What happens if I can’t pay my secured loan?

If you cannot pay your secured loan and have accumulated a string of payment defaults, the lender has a right to repossess your asset used as collateral in the loan agreement. The asset is then sold, sometimes at an auction, and the money is used to clear all arrears and fees. Additional fees could include any auction fees and administrative costs.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

What to do when you can’t pay your secured loan?

If you have missed a secured loan payment, you’ve probably started worrying about what happens next. You can avoid having your asset repossessed and sold by communicating with your lender, explaining exactly why you have not been able to pay the money owed. Lenders would prefer to come to a mutually beneficial agreement rather than having to seize your asset.

This might mean changing interest rates or lowering your payments but extending the repayment term. This could make repayments affordable and mean you pay back more in total, which benefits both you and the lender. You should also seek debt advice from a UK debt charity.

Can a secured loan be written off?

A secured loan can be written off if the lender agrees to do so; however, this is extremely rare and unlikely to happen. Unfortunately, secured debts cannot be included in a Debt Relief Order, which is one way to write off some debts if you are on a low income.

Can I include my secured loan in a debt management plan?

Secured loans are not covered by Debt Management Plans (DMPs), which is a type of debt solution for people with multiple debts they are struggling to keep on top of. Unfortunately, a DMP cannot include a secured loan, student finance debts or arrears owed to HMRC.

Can I move if I have a secured loan?

If you have a secured loan using your property or home equity as collateral in the agreement, you might have to repay the whole loan before moving home. However, some lenders will allow you to switch the asset used as security from your old house to your new home or new amount of home equity (providing it is enough).

Of course, you will need to be buying the new home rather than renting it from someone else.

Are secured loans a risk?

Secured loans are considered a risk because your asset used as security is at risk of repossession if you do not make all your repayments. To mitigate this risk, you should try to borrow as little as needed. This may involve saving more over many months or years, so you only need to take out a lesser loan amount.

Moreover, seeking a secured loan with attractive repayment terms can reduce the risk of the loan becoming unaffordable even further.

On the other side of the argument, these loans can provide more credit and sometimes a lower interest rate than unsecured loans.

Alternative financing options

If a secured loan doesn’t seem right for you and your situation, you could consider other types of borrowing, such as credit cards, overdrafts, Peer-to-Peer lending and Credit Unions. But, in my experience, all of these options also come with risks, so it’s important to do your research.