How Long Does Bankruptcy Stay on Credit Report?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debts and thinking about bankruptcy? Every month, more than 170,000 people visit our website seeking advice on this very issue.

In our complete guide to bankruptcy, we aim to answer all your questions and help you understand your options better. We’ll explain:

- What bankruptcy really means

- The reasons why someone might go bankrupt

- How to decide if bankruptcy is the right choice for you

- What happens when you apply for bankruptcy and what it might cost

- The impact of bankruptcy on your life and your credit file

We know it’s tough to deal with debt; some of us have been in your shoes before. You’re not alone; we’re here to help you understand your options.

How Long Does Bankruptcy Stay on Your Credit File?

Once you have been declared bankrupt, a record is entered into your credit file. This is a very bad thing for your credit rating. Being declared bankrupt tells lenders you did not have enough income to cover all of the debts that you amassed.

The record of your bankruptcy will stay on your credit report for 6 years. Even if you pay up all your debts sooner, this record stays on your credit file. There is no way to have a record of your bankruptcy erased from your credit file any sooner than 6 years.

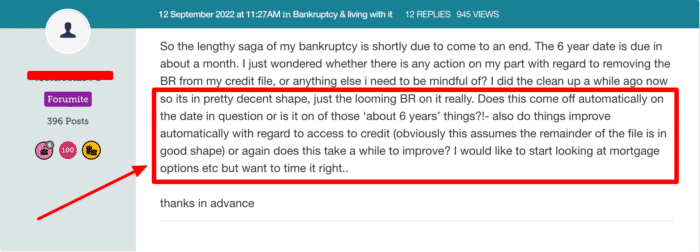

Many people, such as the forum user below, often have questions as to what they need to do to remove bankruptcy from their credit file. However, there is normally nothing for the individual to do. Bankruptcy should automatically be removed six years from the date of the bankruptcy order.

» TAKE ACTION NOW: Fill out the short debt form

How Does Bankruptcy Affect Future Borrowing?

Bankruptcy will negatively affect your credit score. Consequently, it can be very difficult for people who have experienced bankruptcy to obtain credit. This is because potential lenders will perceive the individual as a high-risk borrower.

Unfortunately, this consequence of bankruptcy will persist after it has been removed from your credit report. Some lenders may refuse to lend to anyone who has ever been declared bankrupt. Others may offer credit but charge significantly higher interest rates or particularly strict terms and conditions.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Can You Rebuild Credit After Bankruptcy?

Some of the most popular methods of rebuilding your credit after bankruptcy are:

- Practising good credit habits: After bankruptcy, you should make an extra effort to stay on top of your bills, make debt payments on time, save for emergencies, and pay off credit card balances monthly and in full. Responsible financial behaviour will go a long way in rebuilding your credit.

- Apply for a secured credit card: To qualify for a secured credit card, you normally don’t need good credit. Rather, you qualify by offering the creditor a deposit. However, it is very important to shop around before committing to a particular lender, as rates and fees can vary significantly, and these cards may come with higher interest rates.

- Consider a credit-builder loan: Credit-builder loans work by making monthly payments into a savings account that is managed by a lender. Once the payment term has come to an end, you receive the money paid into the account.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Bankruptcy Be Reversed?

In general, bankruptcy lasts for 12 months. Once the 12 months are up, you will be discharged, and the restrictions placed on you will be ended. At this time, most of your remaining debts will be written off automatically.

However, if you fail to cooperate with the trustee managing your bankruptcy, they can apply for a bankruptcy extension of 12 months. Therefore, if you want to ensure that being declared bankrupt has the minimum impact on your credit rating, you need to do everything that your trustee advises.