How Long Can You Be Chased for a Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about old debts? You’re not alone! In this article, we’ll answer common questions about how long you can be chased for debt, especially under the 2023 laws.

Here’s what we’ll cover:

- Understanding ‘Statute Barred’ in detail and why it’s important.

- The six-year rule for chasing debts and exceptions to this rule.

- What to do if you think your debt is ‘Statute Barred’.

- How long you can be chased for debt after a County Court Judgement (CCJ).

We know it’s stressful to have outstanding debts. Every month, over 170,000 people visit our website for guidance on such issues.

Some of our team have also been there. We understand your worries and are here to share our knowledge on how to manage debts.

Let’s dive in!

How Long Can You Be Chased?

Most unsecured debt in the UK, which includes payday loan debts, utility bill debts and credit cards, can only be collected within six years.

This is known as Statute Barred.

It prevents any creditor or collection agency from trying to collect these types of debts that are at least six years old.

Statute Barred in Detail

The Statute Barred loophole comes from The Limitations Act 1980, which is legislation that blocks any creditor from asking the courts to make a debtor pay the debt when the debt is at least six years old.

The reason that Statute Barred exists is that the courts’ staff and resources were becoming stretched because so many creditors were trying to claw back old debts.

To protect the courts and their resources, they decided that debts that are at least six years old cannot be discussed in court.

Why is this important?

Without getting a judge to issue a CCJ forcing the debtor to pay, the debt can never be legally enforced.

The debt still exists, but there is no obligation for you to pay it.

» TAKE ACTION NOW: Fill out the short debt form

Your Debt Can Only Be Chased for Six Years, right?

Not exactly!

This loophole that can help you avoid paying your debts comes with other criteria.

- The debt must be six years old, and

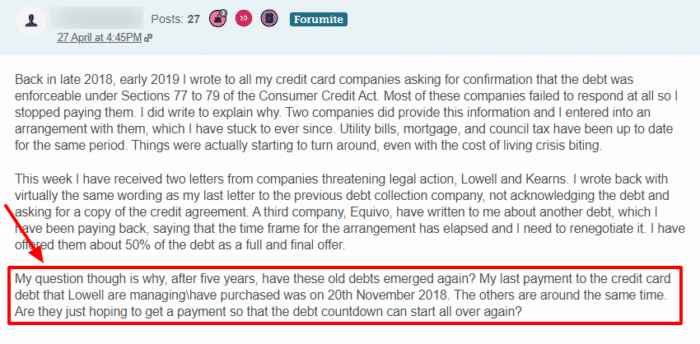

- You, as the debtor, must also not have paid back any of the debt in the last six years, nor should you have acknowledged the debt in the last six years in writing

If you do either of the above, you must wait a further six years for your debt to become legally unenforceable. And in that time, the creditor could take you to court anyway.

For example, if you have a debt from six years ago but made a one-off payment on the debt four years ago, you will need to wait two more years before the debt becomes Statute Barred.

Your creditors or debt collection agencies will try to hassle you for old debts if they realise it’s just a matter of time before the debt becomes statute barred.

Here’s what to do to avoid unintentionally resetting the statute barred timer:

- Do not acknowledge the debt in writing (e.g. letter or email)

- Do not make any payment towards the debt

- Do not enter into a new agreement with creditor/collection agency

- Do not promise to pay, even verbally, as you can be recorded

- Ask the creditor to provide proof of the debt by sending you the credit agreement (this does not acknowledge the debt)

- Seek advice from a debt charity or solicitor

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I Think My Debt Is Statute Barred, What Next?

If you believe your debt is Statute Barred, you should try to get confirmation of this.

Don’t try and confirm this with your creditor, but instead, contact a UK debt charity and ask for free debt advice.

Their professionals will be able to assess the situation and tell you if your debt really is legally unenforceable.

If they say your debt is Statute Barred, you can send your creditors or collection agencies a letter to tell them it is. This is known as a Statute Barred reply letter.

Sending a Statute Barred Letter

As mentioned earlier, if you receive requests for payment and possible legal threats from creditors and your debt is Statute Barred, it is time to make your creditors aware.

To do this, download the Statute Barred letter template from any debt charity website and edit it with your own details.

Send the letter to all applicable creditors and keep a record of the letter sent, possibly even record the delivery.

The letter will tell creditors that the debt cannot be enforced and they should stop contacting you immediately.

What If They Continue to Request Payment?

If they continue to request payment, you can either:

- Inform your creditor that they are committing harassment and their criminal offence will be reported to the Financial Ombudsman if they continue

- Or skip this step and directly report them to the Financial Ombudsman

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Will the Financial Ombudsman Decide?

The Ombudsman can look into the matter, and if you provide evidence that you sent a Statute Barred reply letter, they could take action against the people chasing you for money.

This includes potential fines or even compensation.

How Long Can You Be Chased for Debt After a CCJ?

There is one thing that voids any use of the Statute Barred loophole, and that is if your debt has ever received a CCJ.

If the debt in question has already been discussed in court and a judge told you to pay with a CCJ, your debt can never qualify for Statute Barred.

It is unlikely that six years will have passed since the CCJ was issued because the creditor can use bailiffs to recover the debt if you continue not to pay.

But whatever the situation, no debt qualifies for Statute Barred after receiving a CCJ.

So, if you were to ask: How Long can you be chased for debt that has received a CCJ in the past? The answer is indefinite.