How Much Can I Borrow on a Lifetime Mortgage?

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Wondering how much money you can borrow on a lifetime mortgage? This guide is here to help. Each month, more than 7,000 people visit our website seeking advice on equity release.

In this guide, we’ll cover:

- How a lifetime mortgage works

- The risks and rewards of getting a lifetime mortgage

- The amount you might have to pay back

- What might happen if you move house or pass away

- Ways to make sure you get a fair deal

We know that thinking about money can be hard – you might be worried about the costs or unsure if a lifetime mortgage is right for you. But you’re not alone; we understand your concerns, and we’re ready to walk you through the process.

What amount can I borrow?

The amount you can borrow using a lifetime mortgage is predominantly based on the youngest applicant’s age and is usually between 20% and 60% of the home’s valuation (approx).

One authoritative UK source states that you can take out 27% of your equity at the age of 55, rising incrementally for each year older than 55.

The current market value of your property plays a significant role in determining the amount you can borrow on a lifetime mortgage. Lenders typically assess the value of your property through a professional surveyor appointed by them. The higher the market value of your property, the more you may be able to borrow.

» TAKE ACTION NOW: Find out how much equity you could release

How much do you pay back?

Lifetime mortgage debts can grow exponentially over the years. You should expect to repay more than double for holding a lifetime mortgage for around ten years, depending on the lifetime mortgage rates.

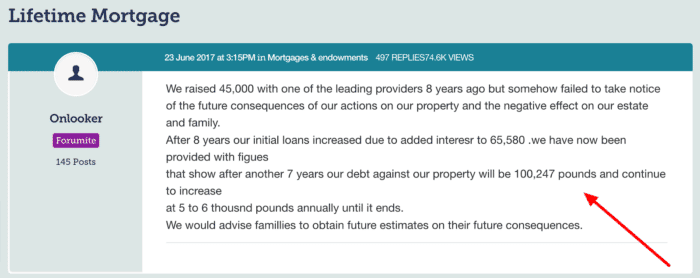

Here is one person’s experience and warning:

Source: https://forums.moneysavingexpert.com/discussion/5668790/lifetime-mortgage

What happens if you die soon after taking it out?

If you die soon after taking out a lifetime mortgage, the interest won’t significantly accumulate, meaning the debt won’t have grown as much.

However, if the borrower passes away within the loan’s early years, early repayment changes might be incurred depending on the lender.

If no other homeowner is named on the lifetime mortgage, the lender can ask executors of your will to sell the property and pay off the debt. However, they may also offer estate beneficiaries to repay the debt with cash and keep the property.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

What if you end up owing more than the home is worth?

You never have to pay more than the sale proceeds of your home to clear the debt if the equity release lender is a member of the Equity Release Council, a trade body representing the equity release industry in the UK. Its role is to promote high standards of conduct and safeguards for consumers considering or already having an equity release plan.

All Equity Release Council members commit to the no negative equity guarantee, which states they can only ask you to pay 100% of the sale proceeds and nothing more from you, your estate, or your estate beneficiaries.

Types of lifetime mortgages

There are some lifetime mortgage products with subtle but notable differences. Two of the most common are:

- Interest-only lifetime mortgages allow you to voluntarily pay the interest and stop the debt from growing.

- Enhanced lifetime mortgages allow homeowners to access a bigger loan if they have an estimated reduced lifespan.

- A drawdown lifetime mortgage, where smaller loan amounts are taken at a time.

- A flexible lifetime mortgage allows for a combination of lump sum payments and drawdowns.

- Home Reversion Plan, where you sell all or part of your property to a reversion company in exchange for a lump sum payment or regular income.

Health conditions can have an impact on enhanced lifetime mortgages. Enhanced lifetime mortgages consider specific health and lifestyle factors to potentially offer a higher borrowing amount or a lower interest rate.

Lenders offering enhanced lifetime mortgages consider various health conditions, such as high blood pressure, diabetes, cancer, heart conditions, and more. The severity of the condition and its potential impact on life expectancy is considered.

The presence of certain health conditions may allow you to access a more significant percentage of your property’s value or borrow more money than with a standard lifetime mortgage. This is because lenders assess that the reduced life expectancy associated with certain health conditions decreases the time for interest to compound.

Some lifetime mortgage providers may also provide lower interest rates for borrowers with specific health conditions. This can result in reduced overall costs over the course of the loan.

It’s important to note that not all lenders offer enhanced lifetime mortgages or consider the same set of health conditions. Therefore, in my experience, seeking advice from an independent financial adviser is recommended.

Can you transfer it if you move?

Equity release companies that are a member of the Equity Release Council will allow you to transfer your lifetime mortgage to the new property if you move. This is a portable lifetime mortgage. However, the new property must be deemed “suitable”.

A suitable property is a property with an equal or greater value and one that the equity release company will have no difficulty trying to sell again in the future. For example, if the new property is in a flood zone, you might not be allowed to transfer the lifetime mortgage.

If you’re downsizing to a less valuable home, you may need to pay off a percentage of your lifetime mortgage to transfer it. This could trigger early repayment costs unless your agreement includes a downsizing clause.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

Can you sell a property with a debt?

Yes, you can sell a property with a lifetime mortgage, but the lifetime mortgage debt will need to be immediately repaid. You could repay this using some of the sale proceeds. You may want to get financial advice first.

Is it right for me?

Lifetime mortgage advice is mandatory as part of the application process. Only an equity release adviser can work with you to help you decide if this is the right option for you.

When seeking independent financial advice for a lifetime mortgage, choose an advisor who is reputable and registered with the Financial Conduct Authority (FCA). This ensures that they meet strict regulatory standards to protect consumers. To make a well-informed decision, it is recommended that you seek advice from multiple advisors. This approach will provide you with a comprehensive understanding of your options, helping you make the best choice for your individual needs.

You may wish to consider other options, such as selling and buying a smaller property or renting out part of your home.

Do banks offer them?

Lifetime mortgages are mostly offered by equity release companies and companies specialising in private pensions and insurance policies. Some high-street banks are partnered with equity release companies and can put you in touch with them.

Quick recap

Depending on your age, you can usually borrow between circa 20% and 60% of your home’s current market value as a lump sum or drawdown loan.

If you qualify for an enhanced lifetime mortgage due to poor health, you might be able to access a bigger loan than you otherwise would be able to.

Things to consider

Equity release will involve a home reversion or a lifetime mortgage, which is secured against your property and will reduce the value of your estate and impact funding long-term care. Our equity release partner, Age Partnership provides a personalised illustration to explain the full details. The money you release, plus the accrued interest is then repaid when you die or move into long-term care. Advice is required before proceeding with equity release and any existing mortgage must be repaid. Age Partnership provide initial advice for free and without obligation. Only if your case completes would Age Partnership’s advice fee of £1,895 be payable. Other lender and solicitor fees may apply.