How to Remove Charge on Property & How Long Does It Take?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

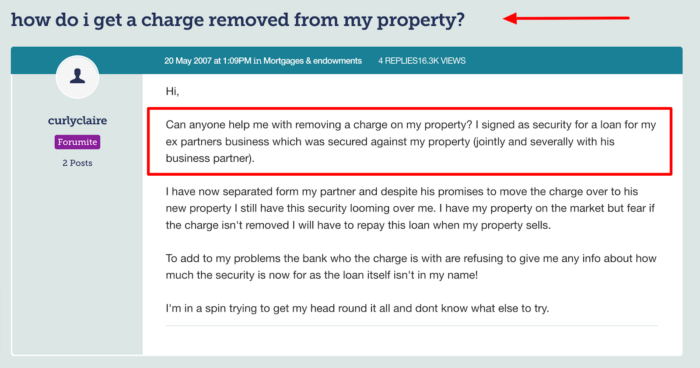

If you’re worried about a charge on your property, you’re not alone. Each month, over 170,000 people come to our website seeking guidance on their debt issues. In this guide, you’ll learn:

- What a charge on a property is.

- Different types of charges.

- How long a charge can stay on a property.

- How to remove a charge from your property.

- What happens if you buy a property with a charge on it.

Between September 2022 and September 2023, the UK saw an average daily increase of 37 mortgages falling into arrears, exceeding 2.5% of the remaining balance.1 So it’s quite common to feel worried about debt and property ownership.

We understand this concern and our aim is to explain everything in a simple way. We’ll tell you how to deal with a property charge and how long it might take to remove it.

Let’s dive in!

What is a charge on a property?

A charge on a property is a document that secures a liability against the property. This liability could be a secured loan or a defaulted unsecured debt subject to a CCJ.

For example, if you take out a secured loan against your property, a charge will be added to the property to stop it from being sold without the loan provider knowing about it.

A charge is also applied when you take out a mortgage to buy the property.

The property can still be sold, but some proceeds will go towards the creditor to clear the outstanding loan or mortgage debt first.

In other words, a legal charge on a property ensures the asset isn’t disposed of without first repaying the secured debt.

Mortgage Debt Solutions

If you’re struggling with mortgage arrears, there are different debt strategies that can help you. These are:

| Debt Strategy | How It Can Help with Mortgage Arrears |

|---|---|

| One-Off Payment | Pay a lump sum, possibly from an inheritance or a bonus, to significantly reduce your overall mortgage balance. |

| Remortgaging | Switching to a different mortgage product or provider could result in lower monthly payments. |

| Hardship Schemes | Lenders often have dedicated hardship teams that assess your situation and offer individualised solutions, such as: -Payment Holidays -Mortgage Term Extension -Interest-Only Payments -Capitalising Arrears -Flexible Payment Arrangements -Fee Waivers or Reductions |

| Government Schemes | -Support for Mortgage Interest (SMI) -Shared Ownership Schemes -Equity Release -Local Council Support |

| Debt Solutions | Formal debt solutions for managing mortgage debt include Individual Voluntary Arrangements (IVAs), Debt Relief Orders (DROs), Bankruptcy, and Administration Orders. Each debt solution has specific eligibility criteria and significant implications for assets and credit ratings. |

| Debt Advice Services | Seek free advice from debt charities who can help you assess your situation, suggest appropriate solutions and negotiate with lenders. |

| Sell or Rent Back | If other options aren’t viable, consider selling your property and moving to a more affordable home or renting it back. |

What are some of the charges?

Let’s explore some of the common types of property charges:

1. Mortgage Charge: This is one of the most common property charges. It occurs when a borrower takes out a mortgage loan to purchase a property or refinance an existing property.

The property serves as security for the loan, and if the borrower defaults on the mortgage, the lender has the right to foreclose and sell the property to recover the owed amount.

2. Charge from County Court Judgment (CCJ): If a creditor successfully obtains a CCJ against a debtor and does not pay the judgment debt, the creditor can apply to secure the debt against the debtor’s property.

This charge is known as a “charging order,” which prevents the debtor from selling the property without settling the CCJ debt.

3. Inheritance Tax Charge: Inheritance tax is applicable when a person passes away and leaves an estate that exceeds the inheritance tax threshold (also known as the nil-rate band).

A charge can be placed on the deceased person’s property to settle the inheritance tax liability. The charge may be lifted once the inheritance tax is paid or certain arrangements are made to pay the tax over time.

4. Income Tax Charge: In some cases, individuals may owe income tax to HM Revenue & Customs (HMRC). If the tax remains unpaid, HMRC can seek to secure the debt by placing a charge on the debtor’s property.

5. VAT Charge: Businesses may be liable to pay Value Added Tax (VAT) on certain transactions. If VAT remains unpaid, HMRC can apply a charge on the business’s or its directors’ property to secure the debt.

6. Stamp Duty Land Tax (SDLT) Charge: Buyers must pay Stamp Duty Land Tax based on the property’s purchase price in the UK. Failure to pay SDLT can result in a charge on the property.

7. Second Charge: Sometimes, a property may already have an existing charge (e.g., a mortgage), but the owner needs to borrow additional funds. In such cases, a second charge can be placed on the property to secure the new loan.

The second charge holder’s rights are subordinate to those of the first charge holder.

It’s essential to note that the procedures and rules for applying property charges may vary depending on the type of charge and the specific circumstances.

Additionally, some charges, such as inheritance tax and income tax charges, may arise due to the debtor’s actions or circumstances, while others, like mortgage charges and CCJs, are typically associated with loans and debts.

If a property owner faces the risk of having a charge placed on their property, it’s advisable to seek professional advice from a solicitor or tax advisor to understand the specific implications and options available to address the situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

A word on Charging Orders

A charge could also be placed on a property as a Charging Order.

A Charging Order can be placed on a property to prevent the property from being sold without first repaying an unsecured debt, such as an unsecured loan or credit card debt.

However, before a Charging Order can be placed on a property for unsecured debt, the creditor must have already taken the debtor to County Court and got a judge to issue a court order for the debtor to pay. This court order is called a County Court Judgment (CCJ).

If a debtor fails to meet the repayments of an unsecured debt subject to a CCJ, the creditor could ask the court to add a Charging Order to the property to ensure the debt is repaid before the debtor’s property is sold.

In some cases, the creditor could even force the sale of the property to clear the debt as part of debt enforcement procedures. But this is quite rare.

A Charging Order isn’t the most common method of enforcing an unpaid CCJ debt. The creditor could instead use bailiffs or have money taken from the debtor’s wages, which can typically be more effective and efficient to recover the money owed.

How long can a charge stay on a property?

A charge on a property will remain until the property is no longer used as collateral within the credit agreement.

In other words, until the debt has been repaid.

The property charge duration is until the debt is repaid in England and Wales. In Scotland, a Charging Order lasts for 12 years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I remove a charge on a property?

The creditor should remove a charge from your property when the debt has been fully repaid. You shouldn’t need to do anything, but this isn’t always what happens.

If you have repaid a CCJ debt, you can apply to the court to have any Charging Order related to the CCJ debt removed yourself.

How to remove a charge on the property?

You can ask the court to remove a charge on a property if the secured lender hasn’t had it removed.

It is always worth seeking professional legal advice if you are not sure about anything – Citizens Advice is a great place for advice, and they can signpost you.

The process to remove a charge from your property is explained below.

How do I discharge a charge from the Land Registry?

To have a charge removed that the lender didn’t remove, you must apply to the Land Registry to have it discharged.

You can ask for the charge to be discharged by completing Form CN1 with evidence that the debt has been repaid.

» TAKE ACTION NOW: Fill out the short debt form

After Form CN1 submission, the Land Registry will contact the creditor as part of the discharge of charge procedure to ask if they agree that the debt has been repaid and the charge should be removed.

The lender will have 15 days to respond; if the creditor fails to respond to the Land Registry, the charge on the property will be automatically removed.

How long does it take to remove a charge from a property?

The lender has 15 days to respond to the application to remove the charge. So once the application is submitted to the Land Registry, it should take just over two weeks, but the processing time can vary.

A Charging Order is never removed until the debt is repaid, except for Charging Orders placed on Scottish properties, which are automatically removed after 12 years even when the debt isn’t repaid in full.

What happens if I buy a property with a charge on it?

If you are buying a charged property, some of the sale proceeds received by the seller will be used to pay off the debt.

The buyer isn’t responsible for the debt; the lender should remove the charge from the property once repaid.

Need help with mortgage debt?

Having a charge on a property might be a sign of financial difficulty while being a homeowner.

If this is true for you, you might benefit by reading our mortgage and debt information guide and seeking financial counselling.