What to Expect at Initial Equity Release Appointment?

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

Our preferred equity release adviser is Age Partnership. For free and impartial money advice you can visit MoneyHelper.

If you are invited to go to an initial equity release appointment, don’t worry. It’s nothing to be intimidated about, and it is not designed to catch you out.

Because equity release is a financial product – and a fairly complex one at that -your initial equity release application form is there to ensure that both you and the equity release provider have all of the relevant information before moving on to the next step, to make sure that it is the right course of action for you.

Once you have attended the initial equity release appointment or filled out an equity release application form, there is no obligation to see it through and finish the process. You can pull out at any time before the contracts have been signed and the money has been released.

Here, I will explore what to expect at an initial equity release appointment.

Why do I need an equity release appointment?

An appointment for equity release allows your broker or lender, if you’re not using a broker, to learn more about your circumstances and the reasons you’re interested in equity release. It also provides you with the opportunity to learn more about what it requires to release some of the value you’ve accumulated in your property.

During a typical appointment, you, your partner or anyone else who co-owns the property with you and your broker will all be there. If you want to avoid working with a broker and prefer to communicate with the lender on your own, you will meet with an advisor who represents the lender.

You could find it more beneficial to work with a broker or an independent financial advisor, given that they will be able to provide you with a more objective and comprehensive analysis of the market as a whole rather than trying to sell you items from a specific lender.

If you have not already provided this information, you may be asked for some basic personal details as well as information about your financial situation. In addition, you may be asked for more information about your property and the reason why you are considering releasing equity from it. This is done so that your broker or advisor can adjust their recommendations based on the specifics of your case.

They will typically explain more about equity release as well as some other possibilities that you possibly have not thought about. They will walk you through every plan that is available to you and how much equity you want to take out of your house depending on your age, the value of your home, and how much equity you want to take out.

You should have a lot of opportunities to ask questions of your own and voice any concerns that you might have about the topic. Remember that there are no stupid questions, which is especially important considering how complicated a product equity release might be.

How equity release could help

More than 2 million people have used Age Partnership to release equity since 2004.

How your money is up to you, but here’s what their customers do…

Find out how much equity you could release by clicking the button below.

In partnership with Age Partnership.

What do I need to take with me?

To ensure the process is smooth and that both you and the advisor have all the relevant information, you will need to take the following with you:

- Proof of your current income and expenses

- The details of any mortgage or loans secured on your property

- A rough estimate of the value of your property

- Any financial obligations or outstanding debts

What will happen after my equity release appointment?

After your initial equity release appointment, you may be asked to book a second one. This is where you can discuss specific plans and recommendations that are suitable for your circumstances and needs. If you decide you would like to proceed with an application, the broker or lender will walk you through it.

Does the initial equity release appointment need to be in person?

Your initial appointment to discuss equity release may or may not need to take place in person, depending on the equity release advisor or broker that you select.

Since COVID-19, many have turned to video or phone appointments but may still ask for in-person meetings,

However, a face-to-face discussion will help everyone involved to get a clearer picture of whether or not equity release is the most suitable option for you.

What will be discussed at the equity release appointment?

During the first appointment for equity release, they will go through the various equity release solutions that are available, as well as the costs and dangers associated with taking out equity. This will allow you to make a decision that is well-informed.

Should you make the decision to move forward with equity release, your equity release advisor or broker will assist you in completing the necessary documentation and will walk you through the subsequent steps of the process.

Before making a final choice, they may also suggest that you speak with a third party who can provide you with impartial financial or legal advice.

In point of fact, the Equity Release Council regards the provision of independent legal counsel as a key component of consumer protection, and it places a strong focus on the relevance of this factor.

Before concluding any agreement, both the homeowner and the provider are required to seek their own independent legal counsel in accordance with the requirements set forth by the Council.

Join thousands of others who release equity

Age Partnership have helped over 2 million people release equity from their home.

Mrs Wareham

“I am more than pleased to have taken out Equity Release with Age Partnership.”

Reviews shown are for Age Partnership. Search powered by Age Partnership.

What questions should I ask?

It is crucial to ask questions when meeting with an equity release broker or advisor since doing so will help you better understand the equity release process and enable you to make a decision that is based on accurate information.

The following are some questions that you might want to think about asking:

- What are the equity release products that are available to me?

- How exactly does each different kind of product work, and what are the benefits and drawbacks of using each kind?

- What are the costs involved with equity release, such as interest rates, fees, and charges, and how much do these things cost?

- What kind of effect will releasing some of my property’s equity have on my inheritance and how much it’s worth?

- What kind of changes might I expect to see to my eligibility for means-tested benefits as a result of equity release?

- After purchasing an equity release product, what are my options if I later decide I need to relocate or sell the property?

Do I have to pay for my initial equity release appointment?

You won’t have to pay anything for the initial equity release guidance from the majority of providers, and it’s a good idea to talk to multiple providers before settling on one.

If you follow the advice of an independent equity release expert or broker, that person may charge you a fee or earn a commission from the lender with whom you come to a final arrangement. If you do this, you should be aware of the possibility of either scenario.

If you go through with an equity release plan, you will start being charged fees, which will normally get paid for out of the money that is released from your property.

How long will it take them to make a decision?

The length of time it will take for a provider to make a decision on your equity release application can vary widely depending on how complex your application is.

In some circumstances, a judgement might be reached in a matter of days, and in others, it might take many weeks.

What other factors should I think about before taking out an equity release?

Before scheduling your initial appointment for equity release, there are a few other considerations to make, including whether or not you are eligible for equity release and the potential drawbacks associated with equity release.

Always remember to do your homework, consult with people or organisations whom you can trust for guidance, and give careful thought to all of the possibilities before making a choice.

The following are some other aspects that should be taken into consideration:

- Eligibility requirements include reaching the age of 55 or older and having a home in the United Kingdom with a value of at least £70,000.

- How will it affect your inheritance or your property value?

- Independent legal counsel — If you want assistance with the legal aspects of equity release, you will need to hire an independent solicitor. This is a requirement.

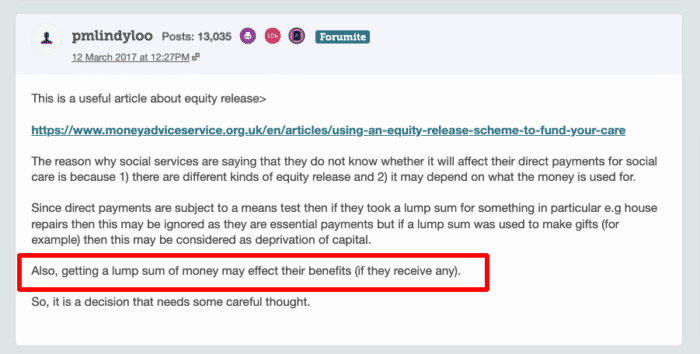

- Will the purchase of an equity release plan stop you from claiming any means-tested benefits, now and in the future? The forum user below states that it will be, depending on what you are using the cash for.

- Do you want the interest on your equity release plan to accumulate and only become payable at the end of the plan, or do you want to opt for monthly repayments to lower the amount of debt you owe?

What are the different stages of equity release?

Discussion

Obtaining a lifetime mortgage requires the assistance of a trained and authorised financial adviser. During your first meeting, they will talk about your specific circumstances.

In addition to that, they will address any questions or concerns that you might have. It’s possible that your advisor will produce an estimate of how much money you’ll be able to release and provide some initial recommendations.

Fact-finding

If you are content with moving forward, it is time to discuss the matter in greater detail. At this point, your adviser will do a more in-depth review of your financial situation. They will talk to you about your priorities in order to assist you in determining whether or not equity release is the best option for you and whether a drawdown equity release plan or a lump sum equity release plan will better fit your requirements.

Present their findings

Your adviser will conduct research to identify the best goods available across the market that are able to fulfil all of your individual requirements and demands, using the information that was acquired during the fact find. After completing this step, the next step will be for them to present their recommendations.

Application

After your adviser has informed you of the positives and negatives associated with their recommendation, it is time to make a decision. After you have considered all of your choices, they will assist you with filling out the equity release application form and submitting it to the provider.

Valuation of the property

Your service provider will now evaluate your application, check your credit references, and send a third-party surveyor to your home to determine its worth.

Mortgage offer

Your mortgage offer will be sent out once the lender has determined that they have sufficient grounds to approve their valuation of your home and your application. After that, you, your adviser, and your solicitor will check to make sure that everything is in order, and if everything is in order, your solicitor will begin working on finishing the legal process.

Legalities

You will need to meet with your solicitor prior to finalising the terms of your lifetime mortgage.

During the appointment, the solicitor will take copies of your identification, confirm that you understand the nature of the arrangement into which you are entering, and arrange for you to sign the mortgage offer acceptance.

Completion

After the mortgage offer has been signed and all of the necessary legal work has been completed, your lender will then schedule a time to release the monies to your solicitor.

References

- Financial Conduct Authority (FCA) (2020) The equity release sales and advice process: key findings. Available at: https://www.fca.org.uk/publications/multi-firm-reviews/equity-release-sales-and-advice-process-key-findings

- Which? (2021). What is equity release?. Available at: https://www.which.co.uk/money/pensions-and-retirement/you-re-retired/what-is-equity-release-aWHbh3k7xmWk

- Money Advice Service (2020). Equity release: Using your home to get a cash sum. Available at: https://www.moneyadviceservice.org.uk/en/articles/equity-release

- Age UK (2021). Equity Release. Available at: https://www.ageuk.org.uk/information-advice/money-legal/income-tax/equity-release/