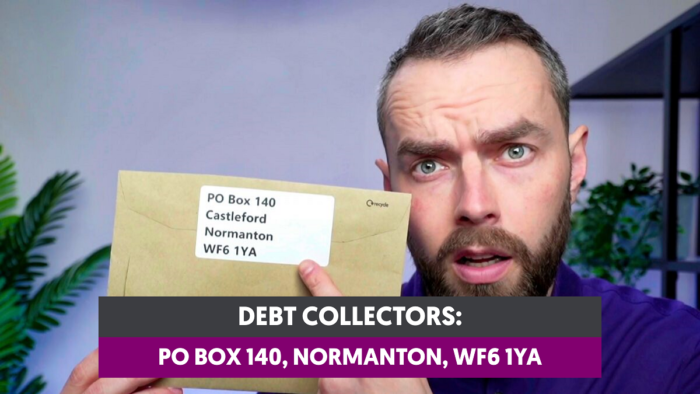

PO Box 140 Normanton WF6 1YA Debt Letter – Who is it?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from PO Box 140 Normanton WF6 1YA about a debt? This can be very confusing and a bit scary.

Don’t worry! You’ve come to the right place. Every month, over 170,000 people visit our website for advice on debt problems.

In this article, we’ll:

- Help you understand who might have sent the letter.

- Show you how to find out if the debt is really yours.

- Give you tips on how to respond to the letter.

- Explain what you can do if you can’t afford to pay.

- Guide you on how to get more help if you need it.

Research shows that 64% of people in the UK find dealing with debt collectors stressful1, so we know how you feel. Some of us have even been in your shoes.

With our experience, we’ll help you understand your options. Let’s work out what to do together!

Should you ignore a letter from them?

We always recommend responding to debt collectors – even just to question the debt’s validity.

You have the right to request proof of the debt. They have to prove it or they can’t charge you. Opening post addressed to you means you get a head start on dealing with any issues that arise.

How should you respond to the letters?

» TAKE ACTION NOW: Fill out the short debt form

It is very important that you keep good records when dealing with your debts. Keeping copies of letters that you have received and sent is the easiest way to maintain healthy records.

Up-to-date documentation will be vital if there is a dispute about your debt in the future – you will have all the evidence you need at your fingertips if you keep copies of letters!

You may also need your documents if your debt is sold and information on your payment status, for example, is lost.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Are the letters legitimate?

How Do You Verify a Company?

Before you respond to any letters, you need to make sure that you are dealing with the right company or that you aren’t dealing with scammers of phishing letters.

Verifying a company before you make any payments is an easy method of financial fraud prevention.

You can verify a company in several ways. Firstly, the company should be registered in Companies House.

You can search for the company name on the letters you have and make sure that the registered company matches. If not, proceed with caution, as they may not be legit.

You can also check other registers like the Financial Conduct Authority (FCA) or the Credit Services Association (CSA).

In our experience, it is very rare that a debt collection or other credit company are not registered with either of these groups.

You can check registration records by using the FCA’s register or the CSA’s membership page.

If you are receiving letters from a law firm that specialises in debt collection, you can check the Solicitor’s Regulation Authority (SRA) register. All solicitor firms must be registered with the SRA to operate.

Finally, if you are being chased by an enforcement firm, you can check the Civil Enforcement Association’s (CIVEA) members list.

If the company that you have had letters from aren’t registered or members of one of these groups, you may need to be cautious moving forward. Most legit companies will be registered with one of them!

If you are unsure, you shouldn’t hesitate to get some advice. There are several charities offering UK financial advice services for free, and will be able to help you verify a debt letter.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do you owe them money?

What should you do if you have debt?

Your Rights With Debt Collectors

It’s important to understand your rights when dealing with debt collectors. That’s why we’ve put together this table. For more information on what debt collectors can and can’t do, check out our specialized guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |