Liability Order Council Tax – What is it and What to do?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with council tax debt can feel hard and scary. But don’t worry; you’re not alone. Every month, more than 170,000 people come to our website seeking guidance on their debt problems.

In this article, we will talk about the following topics:

- What a Liability Order for Council Tax is and what it means for you.

- What you should do if you’re finding it tough to pay your council tax.

- How a Liability Order can change your credit rating.

- How long a council tax Liability Order lasts and how long you can be chased for council tax debt.

- What happens if you ignore a Liability Order, and if not paying council tax can lead to jail time.

StepChange reports that over half of their clients contacted by bailiffs were struggling with council tax arrears, and many of them expressed feeling unfairly treated.1

We know that this may be concerning, but we’re here to help you understand what to do next.

Let’s get started!

What is a liability order?

A liability order is a document that a court can give to a local authority if you have not paid the amount of council tax you owe.

The document gives the council the power to collect what’s owed in different ways. The way the council enforces the collection is up to them, though there are rules and limits guiding what they can do.

» TAKE ACTION NOW: Fill out the short debt form

How much does it cost?

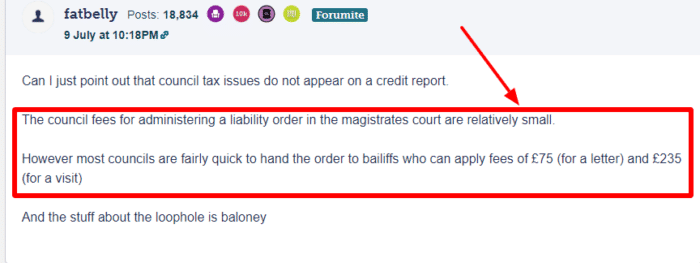

A liability order costs £20 to be issued, but it varies between councils. Such costs can be added to your debt.

As this forum user observes, council tax liability order doesn’t cost much, but the amount you owe can rack up pretty quickly when bailiffs are involved.

What happens when a liability order is granted?

Once a liability order has been granted, you still have an opportunity to pay the council tax you owe in full, and possibly agree on a repayment plan if you cannot afford to pay in full.

You should do this as soon as possible to prevent enforcement action.

You can also seek help from a reputable charity for advice on dealing with council tax arrears. Just let the council know you’ve applied for assistance. They may be able to put the liability order on hold until your claim is dealt with.

If the council does use the liability order to enforce the debt, they can do this in several ways.

The council tax enforcement methods can include:

- Using enforcement agents – Janine, our financial expert, warns that not paying council tax debt can result in bailiffs visiting your home and potentially seizing possessions. They cannot, however, force entry. Discuss future payments with them from a safe distance.

- Attachment of earnings – this is when the council can apply to have money taken from employer wages directly from your wages. Or they can take payments from DWP benefits, such as employment and support allowance, pension credit, universal credit, income support etc. The amount of employer wage deductions they can make is regulated by law.

- Charging order – this will prevent you from selling a property without paying what you owe to the council first. You will be subject to additional legal costs.

- Bankruptcy – the council can make you bankrupt if they have had difficulty with other enforcement actions. You may be able to complain to the Local Government and Social Care Ombudsman (LGSCO) if you feel the council tax arrears bankruptcy is unfair.

The impact of a liability order can take a toll on your mental health. Contact a charity for advice if you are worried or think the costs are too high.

Council Tax Debt Solutions

The consequences of council tax arrears can be quite scary, but don’t worry. There are different debt strategies that can help you.

Some of them are:

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long does a council tax liability order last?

A liability order does not expire, meaning it gives the council indefinite time to use the various means of enforcement action.

In other words, the length of council tax order is infinite.

However, it does not override Statute Barred law that prevents creditors (including the council) from collecting debt after so many years.

What happens if you ignore the order?

If you ignore a liability order and do not make arrangements to pay, your local authority will use one of the methods of enforcement explained above, i.e. bailiffs, attachment of earnings (DWP deductions), charging order or bankruptcy.

If you show to willfully avoid these debt recovery methods, they can apply to the Magistrates’ Court for a court hearing, which might result in a short prison sentence.

From my experience, paying off the debt, even if it’s in small instalments, is the key to avoiding council tax payment consequences.

Rather than stop paying, make an offer for an affordable council tax payment plan to stop further action from happening.

Can you go to jail for not paying council tax?

Council tax debt imprisonment is possible.

If you evade all forms of enforcement, further legal action will take place through the Magistrates’ Court, and you could receive a prison sentence of up to 90 days.

They will apply for a hearing at the Magistrates’ Court. You will then receive a summons asking you to attend a court hearing in person at the court.

If you do not go to court when asked, the judge can issue an arrest warrant against you.

At the court hearing, you will be asked why you did not clear your bill. If you are found to have willfully rejected making a payment (not the same as not being able to afford to pay!), you can be sent to jail in England. But you cannot be jailed for county tax debt in Wales.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can arrears be written off?

If you are having difficulty paying the money you owe, there are ways to write some or all of it off through debt solutions.

One of the most effective ways for someone with little leftover money each month to write off council tax debt is through a DRO.

In a nutshell, a council tax debt relief order will prevent the council from requesting payment for a full year. A search will be completed on your finances to ensure you meet the criteria. And if your financial situation doesn’t improve after a year, all debts included in the DRO can be wiped.

You can find other debt solutions on our dedicated page

How long can you be chased for council tax debt?

The length of time you can be chased for council tax depends on where it originates. If the debt is in England or Wales, it can not be enforced after six years or six years since your last payment towards the debt.

In Scotland, you will owe the money for 20 years.

If you have been issued with a liability order, which does not expire, it still doesn’t stop the debt from becoming unenforceable after six or 20 years in England and Wales or Scotland, respectively.

Note that these time limits are for the council to obtain a liability order. Once they have this order, they can enforce it at any time.

Does it affect credit rating?

A liability order is not the same as a County Court Judgement (CCJ) and will, therefore, not affect your rating. But I must emphasize this should not a reason not to pay your council tax debt.

There are ways to check your current credit rating.