Loans for People on Benefits with No Upfront Fees

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable

Looking for a loan while you’re on benefits without upfront fees? You’re in the right place! Every month, nearly 7,000 people just like you visit our site for help with secured loans. It’s a subject that can be hard to understand, but don’t worry, we’re here to help.

In this simple guide, we’ll look at:

- Why getting a loan on benefits can be tough.

- The real cost of a bad secured loan.

- How fast you can get a loan on benefits with no upfront fees.

- The role of credit unions and specialist brokers in helping people on benefits to get loans.

- The difference between secured and unsecured loans.

We know that it can be stressful trying to find a loan, especially if you’re worried about damaging your credit score. But remember, you’re not alone – many people are in the same boat, and we’re here to give you clear advice to help you make the best choices. Let’s get started and learn more about loans for people on benefits with no upfront fees together.

Why is it Difficult Getting a Loan on Benefits?

When you apply for any type of loan, be it a short-term, long-term, unsecured or secured one, it’s the lender’s responsibility to do a complete financial and ethical check on you.

This check is to ensure that you will be able to pay back your debt in full within a reasonable time frame.

Thus, it’s essential for you to check out a lender’s eligibility criteria before you apply to them for a loan.

One of the most basic requirements that all lenders have is for you to be able to prove that you will be able to make your debt repayments in full according to the repayment plan offered by the lender.

The minimum income requirement may change from lender to lender, and it will also vary depending on how much money you are borrowing.

If you are a person who is on benefits, there are a number of lenders you can look to who will be responsive to your loan application.

Am I more likely to be able to get a loan if I am on long-term benefits?

You are more likely to get approved for a loan if you have benefits that are long-term or permanent.

For example, you’re more likely to get approved for a loan if you have Disability Living Allowance, but if you have some other sort of benefits which are temporary, then lenders may look upon your application less favourably.

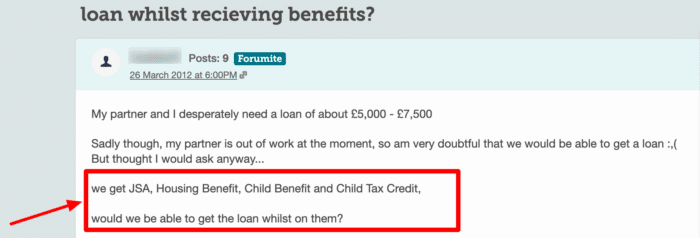

As you can see here, this forum user on MoneySavingExpert is looking for advice on whether they will be able to get a loan whilst they are receiving multiple benefits.

How Quickly Can I Get a Loan on Benefits with No Upfront Fees?

This can depend on a number of factors, such as your lender as well as the amount of money you want to borrow.

It’s true that there do exist lenders that can process your application and send the money to your account on the same day, but they are rare.

In reality, you will most likely have to wait at least a few days before your application is processed and your loan is approved.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 6.95% |

£220.40 |

£26,447.92 |

| Selina | 7.5% |

£221.35 |

£26,562.50 |

| Equifinance | 7.7% |

£221.70 |

£26,604.17 |

| Spring | 10.5% |

£226.56 |

£27,187.50 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What are Some Basic Requirements to Apply for a Loan?

To apply for a loan, you should:

- Be over the age of 18

- Be a citizen of the UK

- Have a UK bank account

- Have a source of income. This could be your benefits; you don’t necessarily need to have a job.

What Information Do I Normally Need to Give When Applying for a Loan?

Firstly, when you’re looking at lenders, it’s very important that you ensure that they are registered in England, Wales or Northern Ireland.

You must also ensure that they are authorised and regulated by the Financial Conduct Authority (FCA). This is because lenders authorised and regulated by the Financial Conduct Authority have to follow a strict set of guidelines which ensure that you are dealt with fairly throughout the entire process.

Most lenders will ask you for the following information:

- Your personal information, such as your name, contact, address, etc. You will be asked to provide proof of identification. A driver’s licence or a passport can work for this.

- Information regarding your UK bank account.

- Proof that you have been a resident of the UK for a minimum of a three-year period.

- An estimate of your monthly income as well as your monthly expenditures. The more documentation you can provide regarding this, the stronger your application will be.

- Complete details about what your salary is and the amount of money you receive each month as benefits.

- Any expenditures you have regarding other debts, such as a mortgage. Your essential living costs also need to be included in your expenditures, such as money spent on fuel, utilities, groceries, etc.

Secured loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking to fund a home improvement project?

- Dreaming of finally taking the once-in-a-lifetime trip?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

Always Assess Your Eligibility and Other Information on Your Own Before Applying for a Loan

Most lenders have their eligibility criteria available publically before you even apply for their loan.

Thus, it’s a very good practice to look at their eligibility criteria before you actually approach them with a loan application.

There are two main reasons for this:

- Firstly, some lenders may charge you money to perform their affordability assessment. Obviously, you do not want to spend money on fees for a loan application and end up not even getting the loan.

- Secondly, if you get rejected for a loan, then this shows up on your credit file and has a negative impact on your credit score. Not only does your credit score suffer, but you may also be prevented from applying to other loans for a short period of time if this happens.

Thus, when considering short-term loans, you should always assess your eligibility on your own.

This goes without saying, but you should also look thoroughly at all the information the lender has provided to ensure they don’t have any upfront fees or hidden costs throughout the process.

As I mentioned earlier, one more thing you must keep an eye out for is that the lender is registered in England, Wales or Northern Ireland.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

The Role of Credit Unions in Obtaining Loans for People on Benefits

If you’re struggling to find a lender who provides loans to people on benefits with no upfront fees, then looking towards your local credit union may be a smart approach.

In fact, it’s one of the main goals of credit unions to help individuals who are excluded from the mainstream avenues of obtaining loans for a variety of reasons obtain credit at an affordable rate.

Since credit unions are nonprofit organisations, you will not have to pay any type of upfront fees when you go to them to find a loan.

You will also find that their interest rates are much lower than those you may have seen in the mainstream financial market.

Credit unions assess all individuals who apply for loans, including those who are receiving benefits.

Credit unions may assess your application and ask you further questions, which would help them respond favourably to your application.

Furthermore, they will also offer you advice as to how to best pay back your debt to them once you’re approved.

What types of benefits do credit unions offer loans for?

Credit unions accept loans from individuals who are receiving many different types of benefits as well, such as:

- Universal Credit

- Income Support

- Child and Working Tax Credit

- Disability Living Allowance

- Child Maintenance Benefits

- Employment and Support Allowance

- All other types of benefits available in the UK

If you are looking for a loan and you are receiving benefits, you can find your local county credit union.

The role of specialist loan brokers for people on benefits

Professional brokers have better access to lenders and can often select better loan programs for you, so it can be worth considering using one if you’re on benefits. They can help you compare rates and choose the one that is best for your own circumstances.

However, they do cost money, so you will need to weigh up whether it is likely to be worth it for you.