Loqbox Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

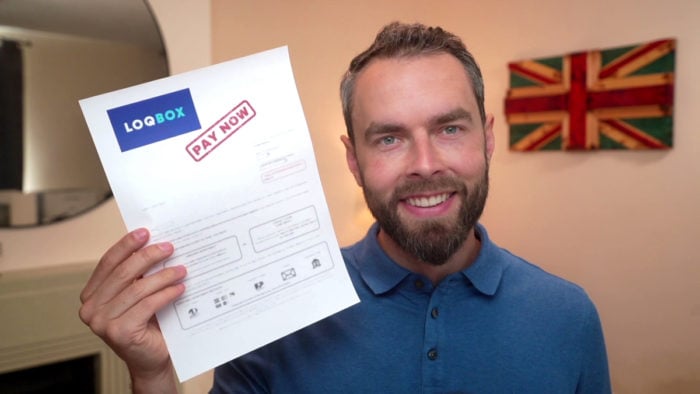

Have you missed a LOQBOX payment and are now worried? Don’t fret; you’ve come to the right place.

Every month, more than 170,000 people visit our website seeking advice on money matters, so be assured that you’re not alone.

In this article, we’ll guide you on:

- What happens if you miss a LOQBOX payment.

- The steps you can take to avoid harm to your credit score.

- How LOQBOX operates.

- Whether you can have more than one LOQBOX.

- How to handle it if you’re struggling to pay.

We know how stressful it can be to miss a payment, as some of our team members have been in similar situations. Let us help you understand what to do if you’ve missed a LOQBOX payment.

What happens if I miss or fail to pay?

A report is sent to credit referencing agencies when you have a LOQBOX missed payment. Your credit score is affected. To avoid this, close your account and retrieve whatever savings you have!

Alternatively, you can pay the missed payment on the exact due day. Like this, LOQBOX marks the payment as received on time, which won’t affect your credit score.

In short, the company gives you a little time to rectify the problem. But it’s better to cancel things when you know you’re about to miss a payment when you can’t afford it.

My advice is: contact their customer support before the due date of a LOQBOX payment. Also, because you pay by Direct Debit, you should inform your bank to avoid charges. This also applies to other companies, like Acorn.

» TAKE ACTION NOW: Fill out the short debt form

What if I forget?

If you forget or can’t make the monthly LOQBOX payment, the company sends a report to credit reference agencies. Unfortunately, it will do the opposite of improving your credit history.

Potential lenders will see you didn’t pay on time, which means you could find it hard to borrow money, get a credit card, or a loan.

Instead of missing a LOQBOX payment, you should end your contract with the company. There’s no penalty for doing so. Plus, you’ll get back all the money you saved using their service up until that time.

When you can’t pay on time, contact their customer support. They may give you a little more time to pay, but it’s not guaranteed.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do they work?

LOQBOX acts as a credit broker. The company organises deals with DDC Financial Solutions, its sister finance company. As a customer, you borrow money from LOQBOX, although it is really DDC that finances the loan.

You effectively buy a ‘digital savings voucher’. The voucher is worth the total amount you saved in 12 months. In short, the value of the voucher is the 12 deposits you made.

Here’s an example:

- You save £50 a month for 12 months

- Your digital savings voucher is worth £1,200

Provided you stick to your savings schedule and don’t miss any payments, you can swap your voucher for cash at the end of the 12 months. You then recoup the total amount you saved over that period.

What’s more, you get both the amount you paid plus any interest on the amount you saved at the end of the year.

The plus about using the LOQBOX service is that credit referencing agencies (CRAs) are told when you make your monthly payments on time. Thus, improving your credit history because it shows you’ve made regular repayments on a ‘debt’.

That said, things start to go wrong when you can no longer afford to keep up with your LOQBOX monthly payments! So the effect of LOQBOX on credit scores can be both positive and negative.

You need a bank account to use LOQBOX to set up a Direct Debit (DD). The DD is automatically applied when you sign up.

Interestingly, the company does not carry out a credit search when you sign up. So technically, anyone can use LOQBOX.

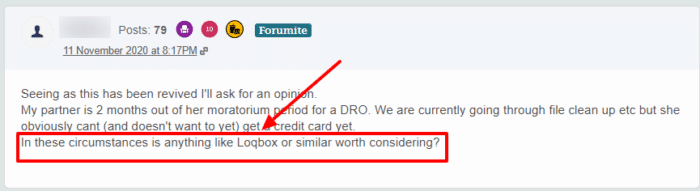

Keep in mind that if you have damaged credit or no credit history like this forum user, a zero-interest credit-builder loan like LOQBOX can help you move toward a good credit score.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

I’m struggling to pay. What should I do?

Cancel your LOQBOX account straight away if you’re struggling to keep up with your payments. Then, the company won’t send a missed payment report to credit reference agencies when you do. In short, by cancelling, you avoid having your credit history harmed.

Contact customer support when you know you can no longer afford a payment or need to get your hands on the money you saved.

For example, if you managed to pay the first four monthly payments of £20 and saved £80 on a loan of £240, you’ll get the £80 back.

LOQBOX settles the loan balance, which means you don’t default on it. As such, your credit score is not affected.

However, your credit score will not have improved as much as hoped when you cancel early.

Remember, things take a turn for the worse when you have a LOQBOX missed payment, and you ignore it. In other words, when a Direct Debit fails, it will harm your credit score.

My advice is to avoid this by staying on top of the situation. First, contact your bank and stop the DD. Next, contact LOQBOX customer support but make sure you do this well before the next payment due date.

Remember, if you need debt advice on becoming debt-free, you may want to consider talking with an independent debt charity. Get in touch with:

Loqbox Contact Details

| Address: | Henleaze Business Centre, Henleaze, Bristol BS9 4PN |

| Website: | https://loqbox.com/ |