Will I Lose my House if I File Bankruptcy?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about debts and thinking about going bankrupt? Are you wondering if you may lose your house?

You’re not alone in this. Every month, over 170,000 people come to our website, looking for guidance on how to handle debt.

In this guide, we aim to ease your worries and answer the big question: ‘Will I lose my house if I file bankruptcy? 2023 rules’. We’ll help you understand:

- What it means to go bankrupt

- How it might affect your house

- The steps you can take to protect your home

- The rules about equity in your home

- How renting a home is affected by bankruptcy

Our team is here to help because we understand your struggles; some of us have been there too. Dealing with debt can be hard, but remember, there’s always a solution.

Ready to find out more about bankruptcy, and how it might affect your home? Let’s dive in.

Will it result in losing my home?

If your home is mortgaged and there’s some equity, an official receiver will typically sell the property to cover any outstanding debts.

In short, some of the money in your home is used to pay:

- An official receiver’s fees and costs

- Your creditors

Don’t worry, here’s what to do!

There are several debt solutions in the UK, choosing the right one for you could write off some of your unaffordable debt, but the wrong one may be expensive and drawn out.

Fill out the 5 step form to find out more.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if you’re the sole owner?

An official receiver would take all of the equity in your home if you’re the sole owner.

However, if the property is jointly owned, an official receiver can only take your share and no more.

That said, it depends on the equity available. For example, an official receiver could:

- Sell your property, or

- Place a charging order on the property which means they receive the equity owed when you sell your property further down the line

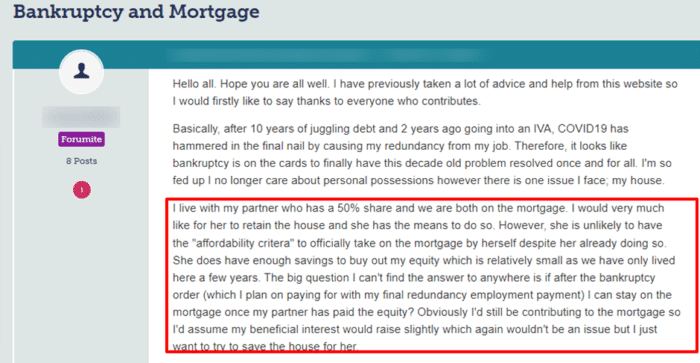

Check out what happened to one person who posted this message on a popular forum:

Source: Moneysavingexpert

Can someone else pay the equity to a receiver?

Yes. An official receiver could agree to someone else paying the equity if you’d like to keep your home when filing for bankruptcy.

Moreover, a family member or friend could be the one who bails you out.

What if there’s less than £1,000 equity?

An official receiver will not sell your home straight away if there’s less than £1,000 equity in it.

There are actually two reasons why they wouldn’t which I’ve listed below:

- There’s less than £1,000 equity in your home

- There’s negative equity in your home

Rather than sell the property straight away, the official receiver will review the situation 2 years and 3 months from when you declared bankruptcy.

You should be allowed to stay in your home if after this amount of time, there’s still no equity in the property.

In short, you could keep your home. Plus, if you get a pay rise, your wages won’t be impacted during an IVA.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if there’s more than £1,000?

An official receiver would consider selling your home if there’s more than £1,000 equity in it when you file for bankruptcy.

Should this be the case, you’d have another nine months to sell your home. In short, you could remain in your house for up to 3 years from when you went bankrupt before you have to sell it.

What happens after your house is sold?

You’re typically allowed to remain in your home for 12 months after it’s sold. This allows you enough time to find a rented property.

It’s worth noting that when you ‘give up your home’ after declaring bankruptcy and there’s negative equity, the debt becomes part of the bankruptcy.

In short, you won’t have to pay what’s owed back!

What if I am renting from a private landlord?

If you’re living in a rented property and you declare bankruptcy, you should be allowed to remain in the house. However, you’d have to keep your rent payments up to date.

There is a catch though because when you’re in arrears with your rent, the debt is included in the bankruptcy. Although a landlord can’t take you to court for rent arrears, they can legally evict you from the property.

» TAKE ACTION NOW: Fill out the short debt form

Can you avoid eviction from a rented property?

Provided you continue to pay any rent arrears after bankruptcy, you could avoid being evicted.

However, it’s worth noting that in some instances, an official receiver could set up a payment arrangement for rent arrears.

This is known as an ‘income payment agreement’ and it won’t let you make any rent arrear payment directly to your landlord.

In short, you can’t repay any rent arrears yourself. But a friend, other tenant or family member is allowed to pay the arrears on your behalf.

What if your tenancy agreement includes a bankruptcy clause?

If your tenancy agreement contains a ‘bankruptcy clause’, it means your tenancy could end when you file for bankruptcy.

Although a landlord may not choose to evict you, there’s always a risk that they will. You should always check a tenancy agreement before deciding to go down this route.

Do private landlords check?

Yes. Private landlords are known to check whether a potential or current tenant has gone bankrupt. They can do this on the Insolvency (bankruptcy) Register.

You may have difficulty renting a new place after you’ve gone bankrupt. Or you may be asked to pay a higher deposit. Some landlords may ask for a guarantor before they’ll rent to you.

What if you rent from a local authority?

Provided you keep up with your rent, you should be allowed to stay in a property you rent from the council. The same is true if you rent from a housing association.

However, much like renting from a private landlord, any rent arrears to the council are included in the bankruptcy.

In short, you won’t be taken to court but you risk being evicted although less likely if you’re in social housing.

How hard is it to rent another home?

A new private landlord may check the Insolvency Register before they’ll rent a property to you.

It can make finding a new place to live a lot more challenging.

For starters, a landlord could refuse to rent to you. Or they could ask for a larger deposit from you. Or you may have to get someone to act as a guarantor for you.

What’s the major benefit of declaring bankruptcy?

The major benefit of declaring bankruptcy is that it takes away the financial pressure you’re experiencing.

Your debts are ‘discharged’ which means you won’t have to repay all or some of the debts you have. It means it could be worth considering an IVA but not before seeking advice from a debt expert.

Quick Recap

Whether you get to keep your home when you file bankruptcy depends on whether you own the property. It also depends on whether there’s any equity in your home.

You may be able to stay in your home if there’s less than £1,000 equity in it. The same is true if you’re in negative equity. An official receiver could wait two years and three months to see if things change before putting your home on the market!

However, if there’s more than £1,000 equity, chances are you’ll eventually have to move out. In short, in this instance, you stand to lose your home if you file for bankruptcy.

That’s how debt write off works when you choose an IVA to get your finances back on track!