Can You Swap Council House With Rent Arrears – Laws Advice

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if it’s possible to swap your council house while you have rent arrears? You’re not alone. This is a common question, and we are here to help you understand your rights.

This article can help you if you:

- Are concerned about moving home while you have rent arrears.

- Need clear information on the laws for swapping council houses in 2023.

- Want to know how to deal with rent arrears.

- Are curious about how rent arrears affect your credit score.

- Wish to explore alternatives to a tenancy exchange with rent arrears.

Every month, over 170,000 people visit our website for advice on issues like this. We have a lot of experience, and we understand what you’re going through.

We’re here to help you find solutions to these problems. Let’s explore your options together.

What are Rent Arrears?

If you rent your property, you’ll be expected to pay rent on that property.

If you don’t pay this, it is known as rent arrears. A rent arrear is considered a priority debt, just like council tax debt.

What this means is that the consequences of not paying it will usually be more severe for this debt when compared to other debts, for example, credit card debt.

What if I Don’t Pay?

If you rent and you’re not paying it, then landlords usually have the right to seek a court order to evict you from the property.

When it comes to a landlord choosing to seek eviction, it comes down to the landlord themselves and the tenancy agreement that you have with them.

So, how can you deal with rent arrears?

How to deal with Rent Arrears

Well, the obvious way to deal with rent arrears is to pay your rent, but of course, this is easier said than done. If you’ve missed payments, you can’t pay, or you’re just worried that the payments aren’t going through, then you’ll want to sort it out as quickly as you can.

As I’ve said, rent arrears are seen as a priority debt, and therefore sorting them out sooner rather than later is advised given the consequences that can follow and the fact that they don’t expire or go away in the same way other debts do.

Thankfully, there are ways in which you can deal with rent arrears.

- Checking it’s your responsibility

- Making sure what you owe is actually correct

- Agreeing with a way to pay it back with your landlord

These are all very small things that you can do that may help you deal with rent arrears. However, if it’s more complicated than this, then you may need to seek advice from elsewhere.

Citizens Advice is incredibly helpful in situations like this and offers free, confidential conversations dealing with delicate matters.

Can It Affect Your Credit Score?

While rent arrears are a priority debt – meaning you should prioritise these above things, such as unsecured loan repayments and credit cards – having rent arrears will not generally affect your credit score. However, if your landlord or the council takes you to court to recover the unpaid rent and you are issued with a County Court Judgment (CCJ), this will show on your credit score and affect it for at least six years.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Tips for Effective Communication with Landlords

Effective communication is key when tenants are facing rent arrears. Here are some tips on how tenants can communicate with their landlords regarding rent arrears and work towards possible resolutions:

-

Contact the Landlord Promptly:

- Don’t delay in informing the landlord about any financial difficulties that may lead to rent arrears. Early communication is crucial to finding a solution.

-

Choose the Right Communication Channel:

- Use a formal communication channel such as email or written letter to ensure that the communication is documented. This helps both parties keep a record of the discussions.

-

Be Honest and Transparent:

- Clearly communicate the reasons for the rent arrears. Whether it’s a temporary financial setback or a change in personal circumstances, honesty helps build trust.

-

Propose a Repayment Plan:

- Present a realistic and detailed repayment plan that outlines how you intend to catch up on the rent arrears. Include specific dates and amounts to demonstrate your commitment to resolving the issue.

-

Provide Supporting Documentation:

- If possible, provide supporting documentation such as pay stubs, bank statements, or proof of any financial assistance you’re receiving. This helps validate your situation and shows your commitment to resolving the issue.

-

Express Willingness to Cooperate:

- Make it clear that you are willing to cooperate with the landlord to find a resolution. This may involve negotiating a temporary reduction in rent, deferring payments, or exploring other mutually beneficial arrangements.

-

Seek Professional Advice:

- If you’re unsure about your rights or the best way to approach the situation, seek advice from professionals or organizations that specialize in housing and tenant issues.

-

Respond Promptly to Landlord’s Communication:

- If the landlord responds to your communication, make sure to respond promptly. Open and timely communication helps build a positive relationship and demonstrates your commitment to resolving the issue.

-

Request a Meeting:

- If the situation is complex or if a face-to-face discussion would be more productive, consider requesting a meeting with the landlord. This allows for a more comprehensive and interactive conversation.

-

Explore Mediation Services:

- If communication becomes challenging, suggest the use of mediation services. A neutral third party can assist both parties in finding common ground and reaching a resolution.

-

Know Your Rights:

- Understand your rights as a tenant, including any tenant protection laws in your jurisdiction. This knowledge can empower you during negotiations and ensure that your rights are respected.

Remember, communication is a two-way street. Both parties need to be open to discussion and compromise. It’s in the best interest of both the tenant and the landlord to find a solution that allows the tenant to catch up on rent while maintaining a positive landlord-tenant relationship.

» TAKE ACTION NOW: Fill out the short debt form

I Rent Privately – Does that change Anything?

Dealing with rent arrears may change with who you rent from. If you rent privately, then you may be expected to pay it back quickly. However, the landlord shouldn’t take action against you to get payment sooner. For example, they cannot turn off the gas or electricity to elicit payment.

If you rent from the council or a housing association, then whilst you will still be expected to pay it back fairly quickly, there may be a more gradual plan in place that you can take to pay them back. For example, a repayment plan may be set up to help you, and if this then fails or you still don’t pay, only then might take you to court.

What is a Tenancy Exchange?

A tenancy exchange is where two tenants legally swap houses with permission either from the landlords or another council association. It’s also called a mutual exchange.

Before doing so, however, you will need to tick off a couple of important details.

- Find someone to swap homes with

- Get written permission from your landlords/council or housing association tenants

- Complete the legal paperwork

This is different from a tenancy transfer, as someone is moving into your house and you move into theirs, as opposed to you just moving into a new house.

It’s important to complete all of the steps above, as not doing so can run the risk of both parties being evicted.

How to Find a Tenancy Exchange

There are many ways that you can find someone to swap houses with. Websites like House Exchange and Exchange Locata are two sites for example. Some of them may charge, and some are free.

When this happens, you’ll be asked about your home, its features, size, location, etc., and the kind of home that you’re looking to move into. For example, a large family may be looking to get a larger house. However, regardless of whether it’s an individual move, a lone move, an upgrade or a downgrade in size, you have to get permission from your landlord first.

Can my Landlord Refuse?

Yes. Your landlord can refuse your tenancy exchange. However, they can only do this on certain grounds. The only time a landlord can refuse this is when:

- You’re in the process of already being evicted

- You work for your landlord, and the house comes with the job.

- Your home is adapted for someone with disabilities, and new tenants have no need for it

- The new home is larger than you require

- The new home is smaller than you require

If your landlord does refuse your move, they have to let you know, just like you have to let them know that you want to move.

If they don’t let you know with written confirmation within 6 weeks, they cannot legally stop you from moving; however, you must still get written consent from them that you’re allowed. If this is the case, then you may need to take them to court to guarantee this goes through.

So, if you want to move house, but you’ve got rent arrears – what happens?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

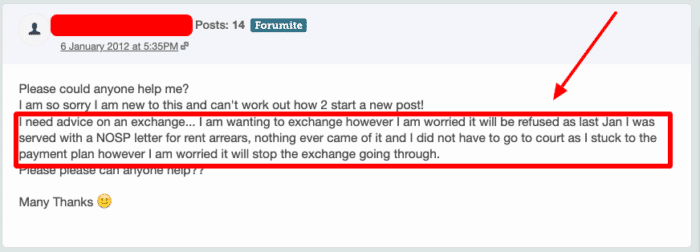

Can I Swap with Rent Arrears?

Technically, yes, but it comes down to the individual.

Landlords will more often than not insist that any unpaid rent arrears are levelled before they allow you to move. However, some tenancy exchange sites like Exchange Locata will deny you the chance to move if you have any rent arrears.

Therefore, technically, you can swap a council house with rent arrears. However, due to it being a serious form of debt, the person or association that you rent from can differ, and the sites as well, actually being able to swap, can be much more difficult. Many would-be exchangers also worry about whether having rent arrears in the past will affect their prospects of an exchange. Again, this varies depending on the landlords, but in many cases, if the arrears are paid off, especially without court action, it doesn’t cause a problem.

Alternatives to a tenancy exchange with rent arrears

If a tenant is experiencing rent arrears and a tenancy exchange is not a viable option, there are several alternatives that both landlords and tenants may consider. These alternatives aim to address the outstanding rent while allowing the tenant to remain in the property or find a more sustainable solution. These include:

-

Negotiate a Repayment Plan:

- Landlords and tenants can negotiate a repayment plan for the outstanding rent. This involves agreeing on a schedule for the tenant to pay back the arrears in instalments along with the ongoing rent.

-

Mediation:

- Mediation can be a useful alternative where a neutral third party helps facilitate communication between the landlord and tenant. The goal is to reach a mutually acceptable agreement, which may involve a repayment plan or other arrangements.

-

Financial Assistance Programs:

- Tenants facing financial difficulties may be eligible for financial assistance programs, such as housing benefits or universal credit. These programs can help cover housing costs, including rent.

-

Legal Aid and Advice:

- Tenants should seek legal advice to understand their rights and explore potential solutions. Legal aid may be available to assist tenants facing eviction due to rent arrears.

-

Forbearance Agreements:

- A forbearance agreement is a legal contract between the landlord and tenant where the landlord agrees not to take immediate legal action for rent arrears, provided the tenant agrees to a repayment plan.

-

Rent Payment Platforms:

- Some platforms and organizations provide financial tools that allow tenants to pay rent over time. These platforms may work with landlords to ensure they receive the rent owed.

-

Local Support Services:

- Local authorities and community organizations may offer support services, including financial counseling or emergency assistance programs, to help tenants facing rent arrears. These include places like Citizens Advice, Stepchange and Shelter. They offer free and impartial advice on housing and debt problems.

-

Renegotiate the Lease Terms:

- Landlords and tenants can consider renegotiating the terms of the lease, such as adjusting the rent amount or agreeing to a new lease term that better suits the tenant’s financial situation.

-

Explore Housing Options:

- In some cases, it may be beneficial for both parties to explore alternative housing options. This could involve finding more affordable housing or seeking assistance from housing associations.

Thanks for reading. I hope this helped. Be sure to check out some of my other articles to help you with debt.