Moriarty Law Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Moriarty Law and are feeling concerned? Don’t worry; you’re at the right place. Each month, over 170,000 people use this website to learn about different debt solutions.

In this article, we’ll discuss:

- How to check if the debt is really yours.

- What to do if a debt collection agent visits your home.

- How you might be able to write off some Moriarty Law debt.

- How to stay on top of your debts.

Research shows that 64% of people in the UK find dealing with debt collectors stressful1. Some of our team members have also experienced this.

We truly understand your concerns and are here to help you learn more about dealing with Moriarty Law Debt Collection.

How to Deal With Moriarty Law Debt Collectors

The first thing that you need to do is ask Moriarty Law to prove that you owe the debt.

If they can’t prove that you owe the debt, you are not liable to pay it. You may need to use one of our free letter templates to write to them and explain the situation.

From our experience, it is too common for people to pay a debt before checking to see if they owe it!

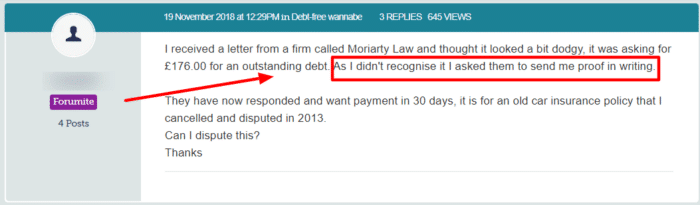

This person did the right thing – Moriarty Law are in the wrong! They need to show that this person owes them money and not issue time frames!

Keep in mind that most debts are statute-barred after 6 years or 5 years if you are in Scotland. If you have not made a payment towards or written to your creditor for this window then there is no legal way for you to be forced to pay.

But some debts last longer than others!

HMRC debts, for example, don’t become statute-barred and any debt that already has a County Court Judgement (CCJ) attached to it will always be enforceable.

Typical Debt Collection Process

If you’ve missed a payment, Moriarty Law can call you and send letters. This is quite normal, as it’s part of the first stage of the debt collection process.

We’ve put together this table to help you better understand the debt collector timeline. For more information, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

What to Do If You Can’t Pay Your Debt?

Paying your debt immediately is the easiest and quickest way to get Moriarty Law off your back. But sometimes that’s not possible!

You can negotiate a repayment plan that you can afford if you can’t pay in one go. Most debt collection agencies will have a few ready-to-go payment schedules for you to choose from.

If you can’t afford to pay via a repayment plan, you may need to consider a debt solution.

There are several options, depending on your financial circumstances. Many of these solutions are also some of the only debt write-off options in the UK.

We recommend speaking to a debt charity if you are thinking about debt solutions. Their advisers will be able to guide you through your options and find the best one for you.

Individual Voluntary Arrangement (IVA) or Trust Deed

An IVA is a legally binding agreement between you and your creditors.

You agree to pay a monthly sum that is distributed amongst your creditors, and they agree to not contact you or chase the debts for the duration of your IVA. This is usually 5 years.

At the end of your IVA, any remaining debts are written off.

To qualify, you need to owe several thousand pounds to more than one creditor. You also need to demonstrate that you have some disposable income each month.

IVAs are unavailable in Scotland, but there is a Trust Deed. A Trust Deed works in the same way as an IVA – you pay an agreed sum for several years, your creditors can’t contact you, and any outstanding debt at the end of your term is written off.

Debt Relief Order (DRO)

If you have debts but little income and no valuable assets, you may qualify for a DRO.

Once your DRO application has been accepted, your creditors must freeze any interest on your debts and they can’t contact you for 12 months. You don’t make any payments towards your debts either.

After a year, your finances are reassessed and if you are no better off your remaining debts can be written off.

Bankruptcy or Sequestration

Bankruptcy or sequestration in Scotland is often the final step for some people.

While it does have a negative association, it may be your only way to clear your debts and get a financial head start.

If you have few assets and live in Scotland, you could apply for a minimal asset process bankruptcy (MAP) instead. This is a cheaper, quicker, and more straightforward process than sequestration.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Ignoring Debt Letters from Moriarty Law

We always recommend responding to debt collectors – even just to question the debt’s validity.

Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

What Rights do they Have?

If you don’t pay the debt, and Moriarty Law can prove that you owe it, they are allowed to take legal action against you. This is usually a County Court Judgement CCJ).

» TAKE ACTION NOW: Fill out the short debt form

CCJs are an order from the court that you have to pay the debt. You will usually be given a payment plan for a set timescale that you have to stick to.

If you don’t, Moriarty Law can get the judgement enforced and use bailiffs to recover the debt.

This means that bailiffs will enter your home and take goods. Your goods are then sold at auction and the proceeds will go towards paying off your debt.

Can You Lose Your House Because of Moriarty Law?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can You File a Complaint?

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others.

If they violate these rules, you can complain.

Moriarty Law is regulated by both the Financial Conduct Authority (FCA) and the Solicitors Regulation Authority (SRA). This means that they have to stick to both the FCA and SRA guidelines.

If you think that any of these rules have been broken, you should first complain to Moriarty Law directly.

This will give them the opportunity to sort out your problem by themselves, per the Moriarty Law complaints process.

If you feel that they have not dealt with your issue appropriately, you can escalate your complaint to the SRA or the Financial Ombudsman Service (FOS). If your complaint is upheld, Moriarty Law may be fined and you could be due some compensation.

Moriarty Law Debt Collection Contact Details

| Phone: | 0203 126 4544 Monday to Thursday – 9am – 5:30pm, Friday 9am – 5pm and Saturday 9am – 1pm |

| Mail: | Moriarty Law Debt Collection 20 Old Bailey, London EC4M 7AN |

| Website: | https://moriartylaw.co.uk/ |

| Email: | [email protected] |

There is no doubt that receiving a letter from Moriarty Law chasing you for debt can be stressful, and there may be all sorts of questions you have about dealing with this debt, as well as your general financial situation.

These are some of the most common questions being asked, and hopefully some useful answers.