Mortimer Clarke Solicitors Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprise letter from Mortimer Clarke Solicitors about a debt? You may be asking, should I pay this debt? Is this company real? Where has this debt come from? If you can’t pay, what will happen?

Don’t worry; you’ve found the right place for answers. Every month, over 170,000 people come to our website for help with debt issues, and believe it or not, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

In this post, you’ll learn:

- Who Mortimer Clarke Solicitors are.

- If you should pay the debt they say you owe.

- Ways you can manage this debt.

- If Mortimer Clarke Solicitors and Cabot are the same.

- How to deal with Mortimer Clarke Solicitors.

We understand how confusing and scary debt letters can be, as our team has dealt with debt collectors before, and we’re here to help.

Let’s figure out your options together.

Why are Mortimer Clarke Solicitors contacting you?

There could be several reasons why you’ve received a call or letter from Mortimer Clarke Solicitors. Often, the most likely reason is over an outstanding debt that they’re trying to collect.

Although the name Mortimer Clarke Solicitors may not mean much to you, they’ll likely be collecting on behalf of another company, such as a bank, credit card provider, or hire purchase company.

Debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £12, so it makes sense that they’re trying to reach you through any means possible to make a profit.

Usually, the original company owning the debt will try and get in touch before they refer your case to Mortimer Clarke. If you’ve not received such letters or you’ve ignored them, the company will escalate their efforts or sell your debt to another company.

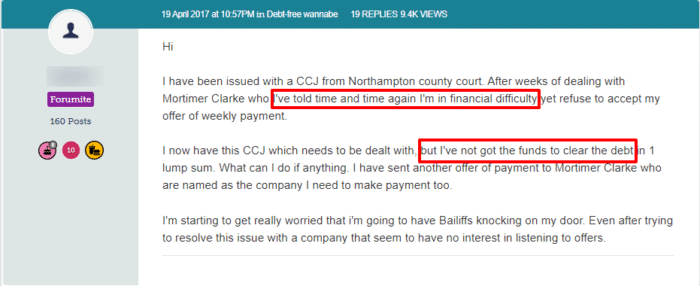

Some people find that they’re issued a County Court Judgment (CCJ) against them for the money. When a CCJ is issued, the debtors must find a way to pay the money back. Alternatively, if you’ve been uncooperative, they may send bailiffs to remove your possessions in order to fulfil your debt.

This only happens if you’ve ignored prior written warnings about the debt.

If you do have a CCJ against you but, like this person, you will have difficulty paying it, you have some options.

You can go back to the court and tell them that you can’t afford it. You will need to provide information about your income and spending habits. If you are in this position but need more information, we recommend contacting a debt charity.

StepChange has a lot of information on this subject.

Of course, in some rare instances, you may receive a letter from Mortimer Clarke Solicitors in error. Someone who previously lived at your address or someone with a similar name may actually be responsible for the debt.

Are Cabot and Mortimer Clarke the same company?

Mortimer Clarke Solicitors is actually a part of the Cabot Credit Management Group, which owns six similar businesses across the UK. As part of the Solicitors Regulation Authority, they follow a fairly strict code of conduct. They’re also bound to the Credit Services Association’s code of conduct.

All this means that you have certain guarantees and legal rights when you’re dealing with them.

If you’re wondering whether Mortimer Clarke Solicitors are legitimate, you can rest assured that they are.

They’re registered in England and Wales under Company Number 06211733. This means that any correspondence you receive from them is real.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to deal with Solicitors

There are some simple steps for dealing with debt collection agencies like Mortimer Clarke Solicitors. By following these, you can hopefully resolve the matter in a way that’s beneficial to everyone.

1. Don’t ignore them

Although it’s tempting to dodge calls or throw letters in the bin, ignoring debt collection agencies is never a good idea. You may feel scared about not being able to repay the money or feel that it’s not your debt in the first place.

However, ignoring the matter won’t make it go away.

If anything, ignoring Mortimer Clarke Solicitors will only make matters worse. They have the power to escalate their efforts to reclaim the money that you owe.

So, it may start with a letter or two, followed by some calls. But if you don’t respond, they may visit your home to try and get you to pay.

In the worst-case scenario, they may be able to request a CCJ against you. This can be disastrous for your credit rating and have long-term impacts on your financial health.

Don’t let it get to this stage.

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

2. Get your details in order

Once you receive a letter or call from Mortimer Clarke Solicitors, you’ll want to get your details in order before dealing with them. Carefully read the letter(s) they sent to understand the details of what they’re requesting.

There will be some information about who you owe money to and how much. They may also provide a date they want you to repay it by. If you can, find out any statements or paperwork related to the initial debt. Look for credit card and bank statements and credit agreements.

You’ll want to have these handy when you’re dealing with the debt collection agency. It may also refresh your mind about what exactly they’re trying to collect.

This step is also important for identifying whether or not you actually owe the amount they say you do. Act quickly, but remain composed.

3. Know your legal rights

It can be intimidating when you receive contact from a debt collection agency or similar organisation. You may be worried about losing your possessions, vehicle, or even your home.

However, it’s unlikely to reach this stage unless you fail to act. Thankfully, you have some legal protections in this matter.

Firstly, Mortimer Clarke Solicitors aren’t a bailiff. This fact means that they can’t directly reclaim your possessions to cover the cost of your debt.

They also can’t force entry into your home and must leave your premises if you ask them to.

There are also several things they can’t do in accordance with the CSA code of conduct. This includes calling you during unsociable times, harassing you, discussing your debts with others, and pressuring you to borrow more money to pay them back.

It’s important that you know all your rights when facing a situation like this to have an edge over the debt collectors. Here’s a small table summarizing the key aspects.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

» TAKE ACTION NOW: Fill out the short debt form

4. Contact Mortimer Clarke Solicitors Limited

Once you’re familiar with what Mortimer Clarke Solicitors Limited want from you, you can get in touch with them. By this point, you should also know what your legal rights are and whether or not you owe what they say you do.

You can contact the business in several ways. They may give details on the letters they send you, and you can also check out their contact page for more information. They offer three main ways to get in touch:

| Address: | 16-22 Grafton Road, Worthing, West Sussex, BN11 1QP |

| Post: | Mortimer Clarke SolicitorsPO Box 130, BLYTH, NE24 9FA |

| Telephone: | 0330 045 0779 Monday – Friday 8.00am – 8.00pm Saturday 9.00am – 1.00pm Sunday Closed |

| Email: | [email protected] |

| Website: | https://www.mortimerclarke.co.uk |

If you’re contesting the amount owed, you may want to write to them in person. By sending a recorded delivery, you are making sure that they acknowledge and have a record of your correspondence. This can be useful later on, particularly if you need to make a complaint.

5. Don’t let them enter your property

If you don’t contact Mortimer Clarke Solicitors after they write to you, they may write to you again to let you know they’re going to visit your home.

Usually, they have to give at least seven days’ notice of doing so. If you respond to them before this time to arrange payment, they may call off the visit.

Representatives from Mortimer Clarke Solicitors have no legal powers to enter your home. However, they may try and persuade you to let them in. They’ll then do all they can to get you to pay them money. You shouldn’t let them in, and you can deal with them from the doorstep if you so choose.

You can ask them to leave at any time, and they must do so. However, they may try and hand your debt over to the bailiffs if their visit is unsuccessful.

Although they have to go through the courts to do so, it can mean that the bailiffs can then come and seize your belongings to cover the cost of the debt.

6. Get them to confirm the debt

When you reach out to Mortimer Clarke Solicitors, one of the first things you should do is get them to confirm your debt. Like any debt collection agency, they must be able to prove that the debt is really yours. If they can’t do so, they have to mark the debt as settled.

You can create what is known as a ‘Prove the Debt’ letter.

This is a physical letter that you’ll send to them. It cites the FCA’s (Financial Conduct Authority) Consumer Credit sourcebook, which states that the company must prove the debt. You shouldn’t sign the letter, as they may try and use your signature against you.

7. Think about paying them back

Once you’ve confirmed that the debt really is yours, you can start making preparations to repay it. Although this doesn’t seem like an attractive prospect, we all must pay our debts at some point.

The sooner you do so, the sooner Mortimer Clarke will stop trying to contact you.

Often, you’ll be able to pay the outstanding amount either on the phone or online. The letters you’ve received from the company will have a reference number to use, and should detail exactly what you need to do. They often provide a range of ways for you to make the outstanding payment.

8. Speak about payment plans

You may not be able to pay the full amount in its entirety. If this is the case, you should consider contacting Mortimer Clarke Solicitors to see whether they’ll accept a payment plan.

They may let you pay back a small amount each month until the debt is paid off. Often, debt collection companies will try and accommodate your plans to repay the money.

However, they don’t have a legal requirement to do so. Make sure to consider what you can afford each month and propose an amount that works for you.

You may have to make compromises and work with them to find a repayment plan that is suitable for everyone involved.

9. Check whether the debt is statute-barred

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will always be enforceable.

10. Check other debt solution options

There are several options for debt solutions in the UK, some of which will allow you to clear some of your unsecured debts.

We recommend speaking to a debt charity before starting a plan so you know that you are doing what’s best for your finances.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, insolvency is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and not valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

UK Personal Debt 2021 Update:

There were 29,291 individual insolvencies in England and Wales in March to May 2021, a fall of 8.6% from 32,047 for the same period in 2020.

(Source: The Money Charity)

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Can You Complain About Mortimer Clarke?

If you think that Mortimer Clarke has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Mortimer Clarke so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You then go to the Financial Ombudsman Service (FOS) complaints department. They will investigate and, if your complaint is upheld, Mortimer Clarke may be fined. You could even be owed compensation.

Mortimer Clarke are also regulated by the Solicitors Regulation Authority. This means that they must follow the SRA guidelines. If they don’t, you can make another complaint to the SRA.

Final Thoughts

Although it can be unpleasant receiving contact from debt collectors such as Mortimer Clarke Solicitors, it’s not the end of the world. The important thing is that you don’t ignore their correspondence and hope they go away – they won’t.

With a little bit of know-how and preparation, you can start taking the right steps to deal with the problem.

You can get free debt advice from a number of UK charities such as Step Change. Whether or not you actually owe the debt, you can soon arrange for it to be cleared, allowing you to move on with your life.