Can I pay the council instead of the bailiffs?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you have a bailiff company on your heels, it can feel scary. But don’t worry; we’re here to help guide you through it.

Every month, over 170,000 people visit our site seeking guidance on their debt matters. So, you’re not on your own. We’re experts in this area, and we’re ready to help you out.

In this article, we will cover:

- How to pay the council instead of the bailiffs.

- Steps to avoid paying the bailiff fees.

- Ways to reduce the cost of the bailiff.

- Tips on how you could write off some of your debt.

- What a CCJ is and how it might affect you.

We know that dealing with bailiffs can be tough. You might be worried about them coming to your home or taking your things. But we understand your worries, and we’re here to help you feel more at ease.

Are you ready to get some solid advice on dealing with your bailiff problems? If so, let’s get started.

Can I Avoid Paying the Fees?

As stated above, bailiff fees become part of the debt you owe, legally. You cannot expect these fees to disappear if you pay the council the amount owed before bailiff fees were added to that amount. Bailiffs can still visit you and enforce repayment. However, if they are unsuccessful, they may return the warrant to the local authority or the court. The fees are cancelled when bailiffs return a warrant.

Can I Reduce the Cost?

It is possible to reduce the amount you owe to the bailiffs. The Compliance fee can be limited to £75 if you pay the debt off in full. The bailiffs will stop coming to your home if you clear the debt, including the compliance fee. Additionally, this will stop any additional enforcement fee from being added, which currently stands at £235.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can the Debt Be Sent Back to the Council?

If bailiffs can’t collect the money you owe for the debt, they may return the debt to the council. This happens if they are unable to gain entry to your home after trying for a certain period.

If a bailiff comes to your home, it’s important not to let them in. Keep your doors locked and only speak to them through a closed, secured door.

They don’t have the right to force entry unless they have been allowed in on a previous visit.

Tell the bailiff you will call the office to arrange payment. Work out how much you can pay or what instalments you can afford to pay if you’re unable to pay in full. Have evidence to support your proposed amount with proof of your income. This could be a payslip, bank statement or benefits letters.

Keep in mind that there are different rules for vulnerable adults. I go through these briefly below but you can get more detailed and specific advice from a debt charity listed at the bottom of this page.

» TAKE ACTION NOW: Fill out the short debt form

How Much Can They Charge?

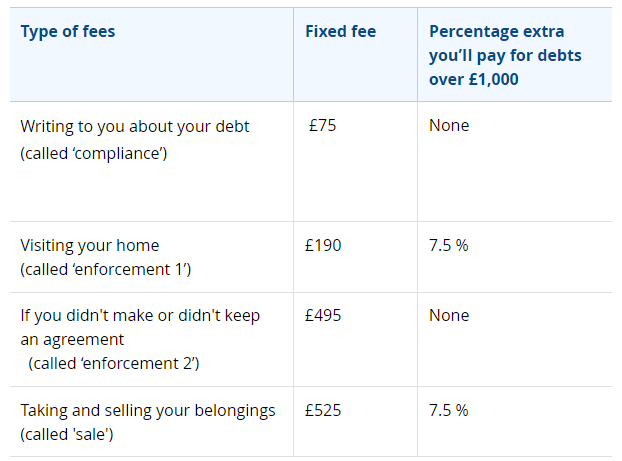

There are three fees’ bailiffs can charge, providing the debt isn’t collected by High Court Bailiffs.

Bailiffs can add extra charges called disbursement costs. These costs are for:

- Storage costs

- Locksmith costs

- Court fees if they need to apply to the court for anything relating to your case

- The costs incurred when selling your belongings

If the bailiffs want to charge you additional costs, they must apply to the court to have them applied. Request a receipt if you pay the bailiffs the money owed for fees and disbursement costs. The receipt is proof of payment but also can be used if you wish to challenge bailiff charges later on.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are They Regulated?

Yes, most bailiffs are regulated by either the Financial Conduct Authority (FCA) or the Civil Enforcement Authority (CIVEA).

This means that you have bodies that you can make secondary complaints to either the FCA or CIVEA if you have an issue with the bailiffs that you are dealing with.

That said, I recommend making your first complaint to the bailiff company directly. This will give them the opportunity to sort out your issues themselves. If their response isn’t good enough or you feel like the matter hasn’t been properly addressed, you can then complain to the above regulatory bodies.

Bailiffs must also follow actual legislation. This includes the Tribunals, Courts and Enforcement Act 2007.

If you need more advice on complaining about bailiffs, I recommend talking to a debt charity. They will be able to look at your situation in detail and advise you on your best next steps.