How to Pay Off Catalogue Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you unsure about how to handle your catalogue debt? Don’t worry; we’ve got you covered. This guide is here to help you understand:

- The different ways to pay off catalogue debt

- The impact of catalogue debt on your credit score

- What happens if you can’t pay your catalogue debt

- How to deal with debt collectors and bailiffs

- Where to seek professional advice on debt

We know that having a catalogue debt can be hard – it might keep you up at night, thinking about how to sort it out. This happens to many people. In fact, over 170,000 people visit our website each month to get guidance on debt solutions.

Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

But you’re not alone in this. There are many ways to tackle your debt, and we’re here to help you find the best one.

How to Get Rid of your Debt

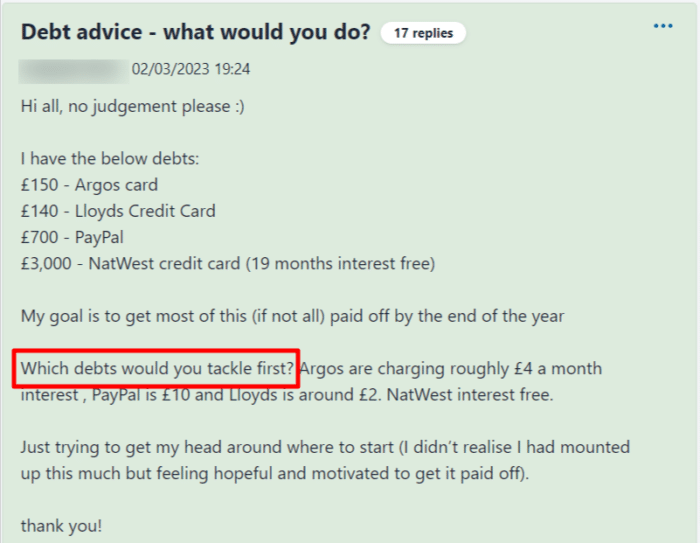

You might need to make an order of priority for your debts if you have more than one.

If you are in a similar position to this forum user, you might benefit from speaking to a debt charity. Their advisors will be able to walk you through your options in detail and find the best course of action for you.

Informal agreement

Debt consolidation

Balance transfer

Reduced lump sum settlement

IVA/Bankruptcy

What Happens If I Can’t Pay?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I Get a Debt Solution?

If you have catalogue debts that you are struggling to pay, you might want to consider a debt solution.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Can You Get It Written Off?

You can write to your creditor and explain your situation and see if they are willing to write off your debt. I have several free letter templates that you can use – including a request to pause action on your account, negotiate about your debt, and make a settlement offer.

Keeping in regular contact with your creditor might be enough to prevent them from selling your debt to a collection agency.

» TAKE ACTION NOW: Fill out the short debt form

Can You Receive a CCJ?

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Bailiffs Come?

Can You Go to Prison for an Unpaid Debt?

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines