Payment Agreement Form Free – All You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you struggling with debt and unsure how to manage it? Don’t worry; you’re in the right place for answers. Over 170,000 people visit our website each month to find solutions to their debt problems.

In this article, we will:

- Explain what a Payment Agreement Form is.

- Show you how to set up a Payment Plan.

- Discuss if you could possibly write off some debt.

- Help you understand details that need to be included in the Payment Agreement Form.

- Provide information about a Payment Agreement Template.

We understand that debt can be worrying. Our team has offered guidance to many people in the same situation as you to find a way forward and we’re here to do the same for you.

Whether you’re trying to find a way to freeze your debt payments or you’re just looking for more information about payment plans, we’re here to help.

Let’s dive in.

Payment Agreement Template

Full, Legal Name Of Debtor

Full, Legal Name Of Creditor

Loan Date

Total loan amount

Payment schedule

Minimum payment amount

Total repayment duration

Agreement Terms:

I, *debtor name*, borrowed £1,000 from *creditor name* on *loan date*. By signing this agreement, both the debtor and the creditor acknowledge that the debtor will pay back the creditor using the detailed payment schedule.

The debtor agrees to repay the creditor with a personal check for £100 on the first of each month for 10 months beginning with January 1, 20__. The last payment will be made October 1, 20__, at which time the loan will be fully repaid.

Both the debtor and the creditor agree to the payment agreement defined above.

Signed:

__________________________________________

Signature of the debtor with Date

__________________________________________

Signature of the creditor with Date

__________________________________________

Signature of Witness or Notary with Date

Details to be included in the form

Details that should definitely be included within the payment agreement form include:

- Creditor’s name and organisation (or address)

- Debtor’s name and address

- Acknowledgement of the amount owed

- Details of the amount owed

- Interest rate (if applicable)

- Debt repayment duration

- Payment instructions (details of how the payments are to be made)

- Details regarding late payments (if any)

- State of governing law

Once the creditor and debtor sign the document, it becomes legally binding for the two parties.

It’s essential to keep all communication documented for record-keeping and possible future references.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Details and Being Thorough

It’s important to be as detailed as you possibly can in your discussions with your creditors as well as in the payment agreement form.

Having terms written down for different situations and scenarios will ensure that disputes don’t arise between the two parties.

Furthermore, the written payment agreement allows the creditor to prove that a well-planned payment schedule was devised that the debtor was not able to follow.

It’s important to note that a single-page document is all that’s required to make the payment schedule legally binding to the debtor.

Setting up a Payment Plan

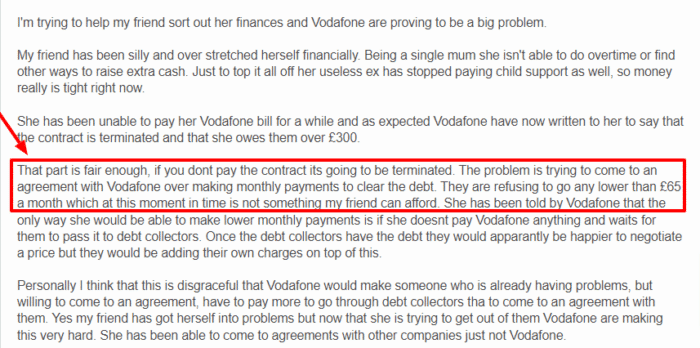

Before you can draft a payment agreement, you’re going to have to agree on what the terms of the agreement should be.

For this, you’re going to have to get together with your creditors and negotiate the payment terms with them.

You can choose to negotiate with creditors on your own, or you can hire a debt management company to do it for you.

If you choose to get your payment plan negotiated by another party, it’s vital that you select an organisation that does not charge you for their services.

If you’re already in debt and are possibly having financial problems, it would make no sense for you to avail of the services of an agency that charges you for them.

Thus, instead, you should choose to go to an independent debt charity for assistance in negotiating with creditors.

They have trained professionals who will assess your financial situation and negotiate with your creditors on your behalf.

When you’re negotiating a payment plan with creditors, it’s important to strike a balance between what’s affordable to you and what will be acceptable to your creditors.

This is something you should discuss with the professional who’s helping you negotiate with your creditors beforehand.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Interest Rate

Negotiating the interest rate can be a bit tricky when it comes to setting up payment plans.

Your lender may want to put interest on your payments, but please know that this is typically not common.

Most payment plans have little or no interest, given that the monthly payments are submitted on time and in full. It’s commonly used as an incentive for debtors to make their instalment payments on time.

If you do end up with a payment plan that has an interest rate attached to it, it can be a good idea to pay off your debt as soon as possible.

Making timely payments may positively impact the credit score. This would mean that, if you can afford it, you should submit more than the minimum payment every month.

If you have interest on your debt repayments and you pay off your debts early, you’d be saving a lot of money that you would have otherwise paid in the form of interest.

If you’re struggling to make payments due to unexpected financial hardships during the repayment period, contact your creditor immediately. They may be willing to:

- Renegotiate terms

- Defer payments

- Modify the agreement

If you don’t know where to start, you can use my free interest calculator to see how interest affects your monthly bills and work out which debts need to be paid off first.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.