Payplan or Stepchange – Which is Best?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about debt and looking for the best way to manage it? You’re in the right place. Each month, over 170,000 people visit our website for advice on debt solutions.

We’ll answer your questions about:

- The role of PayPlan in a debt management scheme

- How StepChange can help with a Debt Management Plan (DMP)

- Ways to write off some debt

- The differences and similarities between PayPlan and StepChange

- How to contact StepChange and PayPlan

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9201. So rest assured you’re not alone, as it’s quite common for people to struggle with debt.

Don’t worry, we’re here to help you find the best way to manage your debt.

What is the role of PayPlan in a debt management scheme?

PayPlan is one of the largest debt advice providers in the UK.

They offer free help and financial advice to their customers to help them get rid of their debt problems. Payplan is funded through contributions from the credit industry and commercial partners.

Moreover, they provide freephone debt line and debt help tools through their website.

How can StepChange help with a DMP?

If you have a Debt Management Plan with a commercial debt management company, your monthly payments could be going to the debt management company as fees.

However, switching to a Stepchange Debt Management Plan will make all your monthly payments go towards paying your debt.

This could help you pay off your debts faster.

You can also get other debt solutions and debt relief from Stepchange. They will be able to talk you through their options when you speak to their advisers.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What are the similarities?

PayPlan and StepChange both help people deal with debt problems in the UK, at no cost to the individual.

They provide confidential debt advice which is for free. The advice could be taken through a call or online.

Moreover, they are a 100% free service for people residing in the UK.

» TAKE ACTION NOW: Fill out the short debt form

What is the difference?

While both offer free debt advice and debt management plans, there are some differences between the two.

Payplan provides help with a large number of debt solutions, such as IVAs (through their partner companies).

PayPlan is a company, funded by donations from the credit industry, while Stepchange is a registered charity.

Stepchange also offers some debt solutions, including IVAs through Stepchange Voluntary Arrangements.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What if I am unhappy with their services?

Customer experiences with Payplan and Stepchange are both generally very positive. But sometimes things just don’t work out.

If you are unhappy with either company, the best thing to do is make a complaint to them.

You can make a complaint to Stepchange by post, phone call, or email. You will get an acknowledgement of your complaint within 5 working days and Stepchange will take a maximum of 4 weeks to investigate.

You can make a complaint to PayPlan by post, phone call, or email and they aim to get your issue resolved within 3 business days of receipt. If this is not possible, your complaint will be passed onto the Complaints Team and you will be notified if there is any further investigation.

If you feel that either Stepchange or PayPlan have not dealt with your complaint adequately, you can make a complaint to the Financial Ombudsman Service (FOS).

They will investigate your complaint and how both companies responded. They may even issue you compensation if your complaint is significant enough.

What do people say?

Payplan and Stepchange have thousands of positive reviews between them. Here are just a couple.

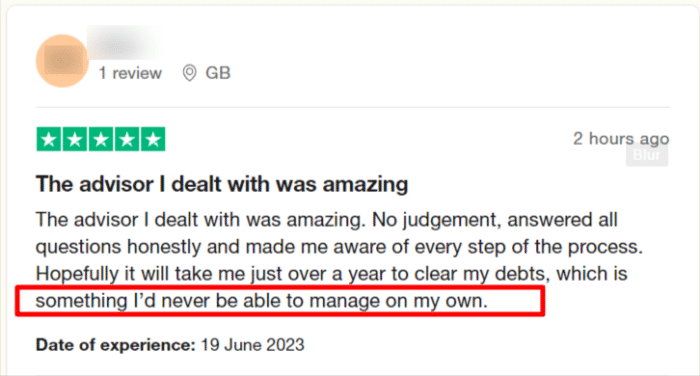

This person used Payplan to start clearing their debts. Sometimes having some extra support can make all the difference!

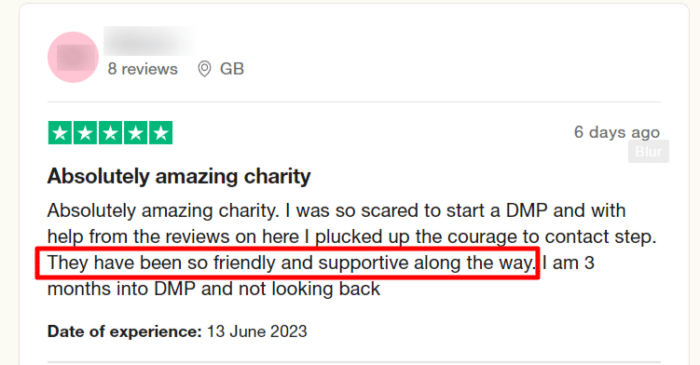

This reviewer used Stepchange to get their DMP up and running.

As you can see, both Payplan and Stepchange can be excellent tools in your arsenal when dealing with your debts. If you want to get back in control of your finances don’t hestiate to contact them today!

Payplan Contact Information

| Phone: | 0800 280 2816 |

| Registered Office: | Kempton House, Dysart Road, PO Box 9562, Grantham, NG31 0EA |

| Website: | https://www.payplan.com/ |

Stepchange Contact Information

| Phone: | 0800 138 1111 |

| Online Debt Advise Service: | https://www.stepchange.org/setting-expectations.aspx |

| Website: | https://www.stepchange.org/ |