Is PIP Classed as Income? UK Tax Laws

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if PIP is classed as income? You’ve come to the right place for answers. Each month, over 170,000 people visit our website seeking guidance on debt matters.

In this article, we’ll answer the following questions:

- What is Personal Independence Payment (PIP)?

- How to apply for PIP and how it is assessed?

- How PIP is linked with Disability Living Allowance (DLA)?

- Is PIP counted as a benefit or income, and is it included in Debt Management Plans (DMP)?

- How PIP can be used to pay off debts and its relation to council tax and housing benefit?

We understand how hard it can be to manage debt, as some of our team members have been there too.

With our experience, we’ll help you understand if PIP is classed as income under the 2023 UK Tax Laws and how this affects your financial situation.

Is PIP counted as income?

PIP is a type of income, but it is not subject to taxation.

You will not have to pay any tax back on it, and there is not even an obligation to spend the money on things related to your disability.

There are other benefits that are not classed as income for fiscal purposes, such as Child Benefit, Attendance Allowance and Bereavement Support.

» TAKE ACTION NOW: Fill out the short debt form

Is it classified as income for council tax?

Anyone paid PIP will be eligible for a reduced rate of local authority tax (if you pay it!).

The amount of money you can get deducted from your bill will depend on the component of PIP you receive and at which rate. I suggest you contact your local authority for assistance.

Also, anyone who receives PIP might be applicable for an additional award on other their other benefits.

If you receive any of the following benefits, you could receive a top-up payment:

- Income Support

- Pension Credit (Living component only)

- Universal Credit

- Working Tax Credits

- Employment and Support Allowance (Living component only)

Is Personal Independence Payment counted as income for housing benefit?

PIP can increase the amount of housing benefit money you receive.

If you receive either component of PIP, you automatically qualify for a premium top-up payment on any housing benefit you get.

Your housing benefit money could increase if your child (aged between 16 and 20) receives PIP and is still in training or education.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you include it as income on a DMP?

If you are setting up a Debt Management Plan (DMP), you can take two approaches to declare PIP as income or not.

Both of these approaches are likely to lead to the same end result.

Option 1: You might want to not include PIP as declared income, but simultaneously not include any living expenses and costs associated with your disability.

As PIP is given to you to cover these costs, by excluding everything, you are keeping the records correct.

Option 2: Include all the pay you receive from PIP, but make sure you also include all the expenses you are frequently paying from the funds you receive.

If you are applying for a more formal debt solution, such as an Individual Voluntary Arrangement (IVA), you should consult with your Insolvency Practitioner (IP) when declaring your income.

Can you use PIP to pay off your debts?

It is your decision if you want to use PIP to repay some of your debt.

Using PIP for debt repayment is less of a risk if you are doing so as part of a DMP because if your situation changes, you can ask to change the DMP as it is not legally binding.

This is not the same for an IVA.

For more information on practical debt solutions, check out our debt solutions guide.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can it be classed as a benefit?

PIP is classed as a benefit payment, but it is different from other benefits because it’s not income-based.

PIP is financial aid without income restrictions.

In other words, the payments are awarded to you no matter how much savings you have.

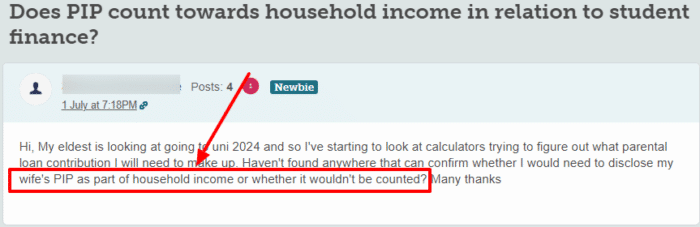

Remember, PIP is not a taxable benefit, and therefore, you don’t need to include it when declaring your household income.