PRA Group UK Limited Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a debt letter from PRA Group UK Limited can be concerning. But don’t worry! More than 170,000 people visit our website each month for help with debt issues.

In this article, we will:

- Explain who PRA Group UK Limited are and why you’ve received a letter from them.

- Discuss how you can check if the debt is really yours.

- Guide you on how to deal with PRA Group.

- Provide options if you’re unable to pay, including writing off your debt.

- Show you how to stop PRA Group from chasing you.

Research shows that 64% of people in the UK feel stressed when dealing with debt collectors.1. Some of our team members have also experienced this, so you’re not alone.

We’re here to help you understand your options and learn how to deal with your debt,

Why Have You Received a Debt Letter from PRA Group?

PRA Group Unenforceable Debts

Remember, the easiest way to stop PRA Group UK Limited from contacting you is by talking to them and offering to pay what you can.

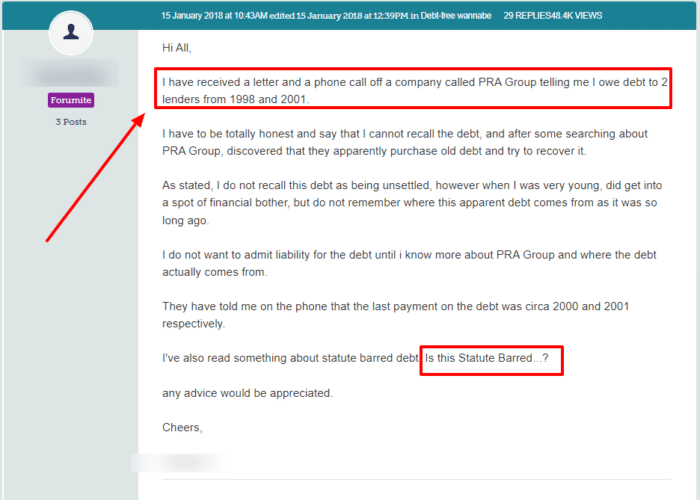

Is Your Debt Statute-Barred?

If it has been 6 years – or 5 years in Scotland – since you last made a payment towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable.

It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will always be enforceable.

But sometimes, debt collection companies make a mistake or push their luck! Take this example:

Writing to a company asking them to prove that you owe the debt is not going to restart the 5 or 6 year timer for statute-barred debts. Especially not for a debt that old!

The Debt Collectors Proved Your Debt

Typical Debt Collection Process

As mentioned earlier, debt collectors will send letters and call to prompt payment. Don’t worry; this is quite normal, as it’s part of the first stage of the debt collection process.

I’ve prepared this table to provide a clear overview of the debt collector timeline. Understanding each stage is crucial to managing your financial situation effectively.

If you’d like to learn more about the process, be sure to read our detailed guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Can PRA Group Take You to Court?

» TAKE ACTION NOW: Fill out the short debt form

Can They Send Bailiffs?

Portfolio Recovery Reviews

Portfolio Recovery Scam Calls

Will Debt Collectors Like PRA Write Off Debt?

You may be able to write off some of your unsecured debts that you owe PRA.

From our experience, there are two main ways of doing this – negotiating, or a formal debt solution.

Unfortunately, financial hardship and debt collection go hand in hand so you may benefit from some financial advice if you are considering a debt solution or settlement offer.

Settlement Offer

You may be able to pay off some of the debt, but not all of it, in one go. If this is you, you could try a to make a settlement offer.

Not all companies will accept these, and you are more likely to have it accepted the more you offer.

You may find that your offer is accepted if you negotiate it with a repayment plan. Just make sure that you only agree to pay what you can realistically afford!

Individual Voluntary Arrangement (IVA) or Trust Deed

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

If you are in Scotland, you will need a Trust Deed. These work in the same way as an IVA.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and not valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration so worth considering.

If you are considering a debt solution or making a settlement offer, you can contact a debt charity for some advice. We have linked some organisations that offer free debt advice services towards the bottom of this page.

How Do You Complain About Them?

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Make your first complaint to PRA Group so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Arvato may be fined. You could even be owed compensation.

The PRA Group Debt Recovery Contact Details

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.