Stuck With Electric Meter Debt? Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re struggling with prepayment electric meter debt, you’re in the right place for answers.

Every month, we offer guidance to over 170,000 people through our website. Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1 We understand that it’s a tough time, but remember, you’re not alone.

In this guide, we’ll talk about:

- What a prepayment meter is and how to top it up.

- How you might end up owing money even with a prepayment meter.

- Steps you can take if your emergency credit runs out.

- How to manage and possibly write off some debt.

- How different energy suppliers handle debt.

We’ll also share useful facts about the cost of prepaid meters and if they’re being phased out. Plus, we’ll give you advice on how to deal with unaffordable debt. Stay with us as we walk you through these useful tips and tricks.

How can you owe money on a prepayment meter?

You can still have a debt on your meter if you need to pay back the credit you received in an emergency situation, or if you have a prepayment plan to repay this type of debt and have missed a payment.

You may need to agree to a payment plan to pay back what you owe each week or month.

Remember that debt solutions are available…

There are plenty of debt solutions available to help people on a low income get out of debt. You can read about the different options here.

For example, you may be able to wipe all of your debt within one year by using a Debt Relief Order.

» TAKE ACTION NOW: Fill out the short debt form

Can you be in debt on your meter?

Due to emergency credit and additional emergency credit, you can still get into debt on your meter. You will still need to pay the credit you borrowed.

The debt is usually collected by any future top-up payment. For example, if you borrowed £10 in emergency credit, and add £20 to your balance on your next top-up, £10 of the money will go towards the debt.

You may be able to spread debt payments out weekly to avoid paying back too much debt in one go. If you owe £10 in emergency credit, you can ask your gas and electricity supplier to take smaller payments over a number of weeks to help you out.

This allows some of your money to go towards the energy you require.

If you have a bigger debt, get in touch with your gas and electricity provider to discuss your options.

Different energy suppliers and their policies

It’s important to know that different energy suppliers have different policies when it comes to prepayment meters. Some may offer more favourable terms than others. It’s worth shopping around and comparing suppliers to find the most suitable one for your needs.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if my emergency credit runs out?

If your emergency credit runs out, you may be able to get further emergency credit. This is usually granted to people deemed vulnerable and some other groups.

You may be able to access additional emergency credit if:

- You have a long-term health issue

- You are disabled

- You are struggling with living costs due to debt

- You are at state pension age

It is unlikely that a gas or electricity supplier would deny additional credit in the above four situations.

Debt advice and support

If you have debt worries, you can search for free debt advice online.

Charities like Step Change cover all types of debt and money worries to help you live comfortably.

Phone one of the many great debt charities today for immediate and compassionate support. If you’re interested in learning more about energy debt solutions, please take a look at the table below.

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Can you be in credit on a prepayment meter?

The idea of a prepaid meter is that you are always in credit to prevent unexpected gas and electricity debts. If you switch suppliers, any credit you have should be refunded by the previous supplier.

What is emergency credit?

Emergency credit is a credit to access gas and electricity when you have run out of money, maybe because you cannot afford to top up. Some suppliers will automatically add some emergency credit to your prepay meter when it’s time you top up. Or you may need to ask the electricity and gas company to give you emergency credit when needed.

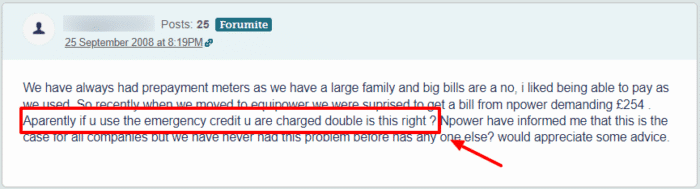

Emergency credit may cost you more to use than your regular credit, so it’s important to check with your energy supplier. As you can see, this forum user is under the impression that you’re charged double if you use emergency credit. While this might not be the case for all suppliers, you’re better off checking so you don’t end up with an unaffordable bill.

This sometimes happens at the beginning of your experience with a prepay meter because you may not be fully aware of the standing charge. Another reason you may receive emergency credit is if the electricity and gas meter is not working correctly when you try to top up. In some rarer instances, the emergency credit will need to be added by someone who comes to your home.

The gas and electricity company may charge a fee for this service.

Are prepayment meters being phased out?

All energy meters where you pay in advance are being phased out. The original date to have these pre-paid energy meters phased out was 2020, but this has now been moved to June 2025.

It is hoped that households will switch to a Smart Pay As You Go Meter, which allow people to pay in more orthodox ways while simultaneously allowing tenants and homeowners to monitor their energy usage.

The smart meter comes with a screen and a display where you can see your daily usage and even helps identify appliances that are using most of your energy and may need replacing for cheaper gas and electricity bills.

Not having a prepayment meter might be a frightening thought for those on a low income, but there are government-backed schemes to help those on low income such as:

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is a prepaid meter more expensive?

A prepaid meter is usually more expensive than a standard (smart) meter. The reason for this is not to charge people who require a prepaid meter more, but rather, because they are more expensive to install and operate for the energy supplier.

They usually include more administration costs, and energy providers prefer to receive regular monthly payments using direct debit rather than sporadic payments.

On the flip side, a prepayment meter is far better if you need help budgeting and want to avoid much larger debts out of the blue.

Also, due to the energy price introduced by the UK government, having a prepaid meter can help offer some protection to those using them because it will limit how much you can go over by, therefore helping with budgeting.

If you want further help with budgeting, you should consult this how-to budget accurately and effectively page. It might help you avoid further debt.