Putting a Charge on a Property – Everything You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to understand what it means to put a charge on a property? You’re in the right place for answers.

Each month, over 170,000 people visit our site for guidance on debt solutions, so you’re not alone in this.

In this article, we’ll explain:

- What a legal charge on a property is.

- How a Charging Order works.

- The difference between interim and final Charging Orders.

- If creditors can see a charge on your profile.

- Possible ways to write off some of your debt.

We know you might be concerned about the impact of a Charging Order on the sale of your property, or other potential issues it might cause.

Don’t worry! Many of us have been in your shoes, so we truly understand your situation. We’re here to help you figure things out.

What is a legal property charge?

Simply put, a legal charge on property is a document that converts your unsecured loan into a secured one.

However, the unsecured loan must be covered under the Consumer Credit Act for a charging order to be issued.

A charging order basically comes with a document called a “charge document”. The order secures an outstanding loan of yours with a property you own, most commonly your home/house.

This means that your house is now used as collateral towards your loan.

In the event that you’re unable to pay your lender (who is now a secured creditor) the money back, you could run the risk of losing your property.

Alternatively, if your lender gives you a charge document and succeeds in putting a charge on your property, and you sell the property before your debt is fully paid off, the loan will be paid off using proceeds from the sold property.

As you can probably infer, this isn’t a favourable situation for an individual who is already dealing with repayments.

The best advice we can give in this regard is to check properly if your lender can put a charge on your property and whether someone can dispute it.

» TAKE ACTION NOW: Fill out the short debt form

Is a Charging Order legal?

Your creditors will only be able to get a charging order if they have a County Court judgment (CCJ) against you.

We strongly suggest that you get proper legal advice about your situation and the debt associated with the charge in order to protect yourself.

If the creditors do get a charging order, the situation certainly is not in your favour.

A charging order can be rather destructive depending on your circumstances, such as when applied to mortgages.

What Types Are There?

A charging order can be of more than a single type. These charges do come in different shapes and sizes. Let’s discuss them one by one.

1. Interim Charging Order

An interim charging order is the first step of the charging process. It is a temporary order that can be made permanent through a final charging order.

First, your creditor informs the court that you either fully or partially own your house/property.

If they manage to prove that in court, and if your creditors are eligible to put a charge on your property, the court will issue an interim charging order.

What’s interesting to note is that an interim order on your home is generally issued without a court hearing, and once a lender can prove the charge.

Here’s how it goes from here: if you choose to do nothing about the interim order, you’ll be issued a final charging order 28 days later. This is an additional order that you have to spend time and money on to deal with.

As we see it, you should write to your solicitor and the court within 21 days of first receiving the interim order to object or appeal the order.

The court will likely schedule a hearing so you can present facts and evidence and argue your case.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

2. Final Charging Order

If you choose to do nothing about the interim order, you’ll be issued a final charge that will solidify the status of your property as one with a charge on it.

You’ll be duly informed by the court once you’re issued a final charging order at the request of your solicitor.

At this stage, you may still be able to challenge the court decision, though chances of succeeding are minimal.

For example, you might:

- Apply for the final charging order to be set aside (cancelled)

- Ask for the schedule and conditions of the final charging order to be changed.

- Try to have the facts of the final charging order changed.

From experience, you’ll need very serious extenuating circumstances for the court to consider your request to stop a final charge.

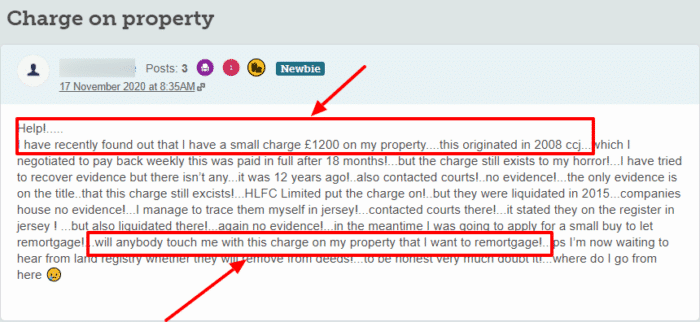

Can Creditors See the Charge?

Lots of people are unsure about whether things such as a deposit, a sale deed, a release deed, or a payment article show up on their credit profiles.

Similarly, many people are also unsure whether a charge shows up on their profile.

Here’s the simple answer: A charge does not appear in your credit file, but a CCJ does.

However, even if creditors can’t see it on your profile, that doesn’t mean it won’t impact your borrowing credibility.

Lenders, particularly with larger loans, tend to be very picky with who they lend to.

If they see a CCJ on your credit profile, they’ll likely search and dig around a bit (e.g. public Land Registry) to see if other creditors have ever applied to get a charge on a property of yours before.

All in all, while they can’t see a charge on your credit file, there are plenty of other ways of knowing that it’s there.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.