QDR Solicitors Debt Recovery – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried after getting a letter from QDR Solicitors about a debt? You’re in the right place for answers. Each month, over 170,000 people come to our website for advice on matters just like this one.

In this guide, we will cover how to:

- Check if the debt is really yours.

- Learn if you can avoid or ignore QDR Solicitors.

- Stop QDR Solicitors from chasing you too much.

- Set up a plan to pay back the debt.

- Find out if you can write off your debt.

Nearly half of people chased by debt collection agencies report experiencing harassment or aggression1, and even our team knows what it’s like to be chased by debt collectors.

Don’t worry! We’re here to help you understand how to deal with QDR Solicitors.

Why are QDR Solicitors Debt Recovery contacting you?

Debt collection agencies like QDR Solicitors Debt Recovery buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

It makes sense that they’re constantly trying to get you to pay so they can make a profit. They could also be chasing you to try and get you to pay up without checking that you are actually liable for the debt.

We go through the process of verifying debts below.

Do you really owe the money?

From our experience, this is all too common! This is why it is very important that you request proof of the debt before you make a payment.

You can use our free letter template to help you contact QDR Solicitors to request evidence that you are liable as they claim.

It is also quite common for a debt collection agency to try and collect on a debt that is statute-barred.

A statute-barred debt is one that is too old to be enforced legally. This means that 6 years have passed – 5 years in Scotland – since you last made a payment or written communication about the debt.

Keep in mind that not all unsecured debts become statute-barred after 5 or 6 years.

HMRC debts, for example, are enforceable for much longer and any debt that has a CCJ attached to it will be enforceable forever.

If QDR Solicitors can show evidence that you owe the debt, you will need to pay!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you just ignore QDR Solicitors?

We always recommend responding to debt collectors – even just to question the debt’s validity.

Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

» TAKE ACTION NOW: Fill out the short debt form

What are your other debt options?

Debt Management Plan (DMP)

A DMP is an informal debt solution that will allow you to pay off several non-priority debts at once. Keep in mind that this is an informal debt solution as it has no legal weight behind it.

You can negotiate with your creditors and see if they will agree to lower or even freeze your interest. But keep in mind that they don’t necessarily have to agree to your terms!

Individual Voluntary Arrangement (IVA) or Trust Deed

An IVA is a legally binding agreement between you and your creditors. Under the agreement, you pay a monthly sum that is distributed towards your debts. In return, your creditors agree not to chase you for your debts or contact you for the duration of your IVA.

Once your IVA is over, any remaining debts are written off.

To qualify, you need to demonstrate that you have some disposable income every month. You will also need to show that you owe several thousand pounds in unsecured debt to more than one creditor.

A Trust Deed is the Scottish equivalent of an IVA and works in the same way.

Debt Relief Order (DRO)

If you have debts but no real assets and little income, you may be able to qualify for a DRO.

Once your application is approved, you do not make any payments towards your debts for 12 months. During this time your creditors can’t contact you and they must freeze any interest on your debts. After a year your finances are assessed and if they are no better your remaining debts can be written off.

Bankruptcy or Sequestration

Bankruptcy or sequestration in Scotland is often your last option if you have lots of debts but no way of realistically paying them off.

Many of your unsecured debts can be written off using bankruptcy, but keep in mind that it is a serious financial situation that is not to be applied for without serious consideration.

If you are in Scotland and have few assets and a low income, you may be eligible for a Minimal Asset Process bankruptcy (MAP). This process is more straightforward, cheaper, and quicker than sequestration.

Will they send bailiffs to your house?

Here’s a quick table to help you better understand the different rights debt collectors and bailiffs have. If you want to learn more about your rights, be sure to read our specialized guide.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is QDR Solicitor the same company?

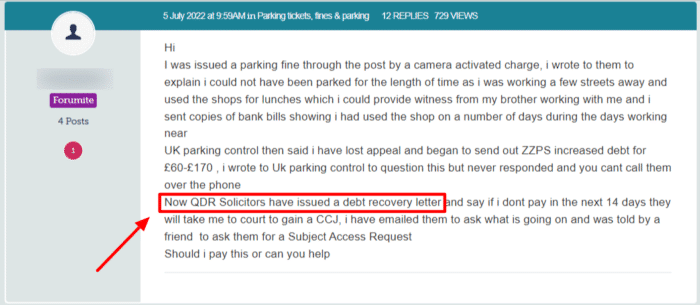

There are lots of examples of QDR Solicitors being used to chase up parking fines. Take the following comment.

This person could do with talking to a debt charity for some advice! We have linked a few at the bottom of this page.

Keep in mind that you don’t have to pay a debt until it has been proven that you owe it, even if you are threatened with a CCJ!

How to stop them from contacting you?

How do you complain about QDR Solicitors?

QDR Solicitors are regulated by both the Solicitors Regulatory Authority (SRA) and the Financial Conduct Authority (FCA). This means that they need to stick to both the SRA and the FCA guidelines.

If you believe that they have broken these rules when dealing with you, you can make a complaint.

You should first make a complaint directly to QDR Solicitors. This will give them the opportunity to deal with the matter with their own policies.

If you feel that your complaint was not dealt with appropriately, you can escalate matters to the SRA. You can also pass your complaint on to the Financial Ombudsman Service (FOS). They will deal with your complaint and, if it is upheld, may fine QDR Solicitors and you may be owed compensation.