Receiving debt collection letters for someone else

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When you get a debt letter for someone else, it can be quite confusing. You might ask, “Why did I get this? Should I pay? Is this real?”

If you’re feeling like this, don’t worry; you’re in the right place. Every month, over 170,000 people visit our website seeking advice on debt problems.

In this easy-to-understand guide, we’ll explain:

- What to do if you get a debt letter for someone else.

- How to find out if the debt is really yours.

- Ways to stop debt collectors from coming to your home.

- How to deal with debt collectors when they call.

- What to do if you can’t pay your debts.

Unfortunately, nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1. So, we know how hard it can be when they chase you.

Some of our team have been in your shoes, and we’re here to help you figure things out.

Is the debt yours?

Many creditors and debt collection agencies use automated systems to send out debt collection letters. So, if you default on a payment, you’ll usually receive some sort of notification within a month or two at the most.

However, these systems are far from infallible so you will probably need to do some work on verifying debt that these companies claim you owe.

They’ll usually automatically send such letters without checking whether the details are right. As a result, you could end up receiving debt collection letters for someone else.

The first thing you should do when you receive a letter about debt is to check whether it’s actually yours.

Although it may have your address on, it might not necessarily have the rest of your details correct. It could also be addressed to someone with the same or a similar name to yours.

Finally, it’s worth checking whether you’ve guaranteed a loan for someone else or have a joint credit agreement. This could mean that you’re liable to pay some of the money.

Am I Responsible For Someone Else’s Debt?

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9202. With the weight of these rising financial challenges, the last thing anyone needs is the added worry of being responsible for someone else’s debt.

Don’t worry! Very rarely will you hold any sort of liability for third-party debt. Even then, you will usually have express knowledge that this type of liability agreement has been struck!

Of course, there are some instances where you might be liable for someone else’s debt. For example, if you acted as a guarantor for someone else’s rental agreement or credit and that person hasn’t paid, the creditor may turn to you.

Similarly, if you’ve taken out a joint credit agreement, you’ll be responsible for repaying that even if you no longer have any relationship with that person.

So, if you do receive contact about missed payments of either of these, you shouldn’t ignore them. Instead, you should contact the other person involved and make them aware of the situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if I’m being chased for the debt at my address?

It can be frustrating when someone moves out of your address and doesn’t update their details with their creditors. It can also be scary handling erroneous debt collection at home!

This can often mean that the creditor either writes to you or sends a debt collection agency round to your property to collect the money. Of course, this is far from ideal and can be stressful for everyone involved.

You don’t have to legally provide proof that you’re the resident at the property. However, doing so can help to settle the matter. You can usually send something like a copy of your council tax bill to whoever is chasing the debt, and they’ll desist.

Your Rights With Debt Collectors

Even if you’re being chased by a debt that’s not yours, it’s crucial to understand your rights when dealing with debt collectors. This way, you’ll keep them from harassing you.

Here’s a table that explains what debt collectors can and can’t do. If you’d like to learn more about your rights, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

How to clear a debt that’s not yours

If you think that the debt has been placed in your name by mistake, there are a few things you can do in disputing incorrect debt.

The first thing you should attempt is to check your credit file with a credit reference agency. If there are any missed payments, defaults, or court actions against your name, they’ll appear here.

If the debt definitely isn’t yours, but it appears on your credit file, you’ll need to get it removed. Such black marks against your name can be costly.

The best thing you can do is to contact the credit reference agency and correct any mistakes that they might have.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Ignore Debt Collectors?

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

At the very least, you need to tell the debt collection company that the person they are trying to get hold of is not known at your current address.

If you don’t respond at all, you may end up with a County Court Judgement (CCJ).

A CCJ is an order from a judge that will force you to pay the debt in the way that they say. From our experience, they are quite commonly issued against someone who has not responded to the debt collection company at all.

CCJs can have a disastrous impact on your credit and are visible on your credit report for 6 years.

To avoid a CCJ for a debt that isn’t yours, all you need to do is respond to the debt collector and explain. Just that brief bit of involvement is usually enough to make them realise and to stop them chasing the wrong person!

» TAKE ACTION NOW: Fill out the short debt form

Can the bailiffs visit?

Possibly, yes, there is potential bailiff involvement if you can’t communicate to the debt collection company that they are chasing the wrong person.

In some circumstances, the original creditor will get permission for the bailiffs to visit a property. If this happens and they have the wrong address, it could mean you get a visit based on someone else’s debt.

If this does happen, you shouldn’t let them in. Instead, talk to them through your letterbox or from a distance outside your house.

Often, showing proof of your council tax bill will make them leave. However, if they refuse to leave, you can make a complaint about them.

Remember, no matter what, they can’t take your goods to pay for someone else’s debt.

Dealing with creditors

If creditors are writing to you or phoning you, you might want to take some other steps to get them to stop. The action you take will vary depending on the methods they’re using to contact you:

Dealing with letters

Perhaps the easiest way of dealing with letters is to leave them unopened (if they’re not addressed to you) and write ‘not at this address’ on the envelope. You can put this back in the post box, and it will be returned to the sender. You won’t have to pay any postage fees for doing this.

If they keep writing to you, you can write to the company directly to ask them to stop. You can write a formal complaint either to their email or postage address. You can also use our free letter template to explain that you don’t owe the debt.

Remember – unless they can prove you are liable for the debt, you are under no obligation to pay.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

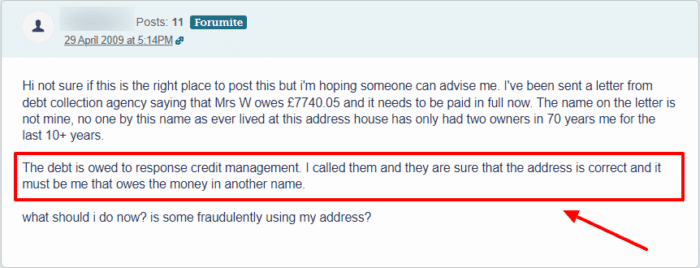

They need to provide actual proof or evidence that you are liable for the debt. They can’t just assure you that they’re right! Take this example:

This person can write to the debt collectors and explain that they have the wrong person. If they carry on harassing them, they can make a complaint to the Financial Ombudsman Service (FOS).

If you are in a similar situation and unsure of your rights, we recommend speaking to a debt charity for some free debt and legal advice. We have linked some charities that offer these services at the bottom of the page.

Dealing with calls

Calls can be quite annoying to deal with, as debt collection companies and creditors tend to be persistent. Again, the first thing you should do is explain to them that you’re not the person they’re looking for. Ask them to immediately stop contacting you.

If this doesn’t work, you can make a written complaint to the company, either by email or post. This should make them stop, but if not, you can also block their number on your mobile.

How Do I Complain About a Debt Collector?

If you think that a debt collector has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they are registered with the Financial Conduct Authority (FCA) and have broken any of the FCA’s guidelines.

Fortunately, filing a complaint against debt collectors is usually quite straightforward.

Make your first complaint to the debt collection company directly so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS) if the company is registered with the FCA. They will investigate and, if your complaint is upheld, the debt collection company may be fined. You could even be owed compensation.