Selling Debt in the UK – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for information on how debt is bought and sold in the UK? You’ve come to the right place. Our website is trusted by over 170,000 people each month for advice on debt solutions.

In this article, we’ll explain:

- What does it mean to sell a debt?

- Why do creditors sell debts?

- Should you pay a debt collection agency?

- Who buys debt and why?

You might be worried about your debt being sold to a different company. We understand your concern, as some of our team members have been there too.

But don’t worry! We’re here to explain why creditors sell debts and what happens when they do.

Why Do Creditors Sell Debts?

It is, therefore, more cost-effective for the lender to pass the debt to professional debt collection services than try to recover the debt themselves.

» TAKE ACTION NOW: Fill out the short debt form

How Does it Affect You When a Lender Sells off Debt?

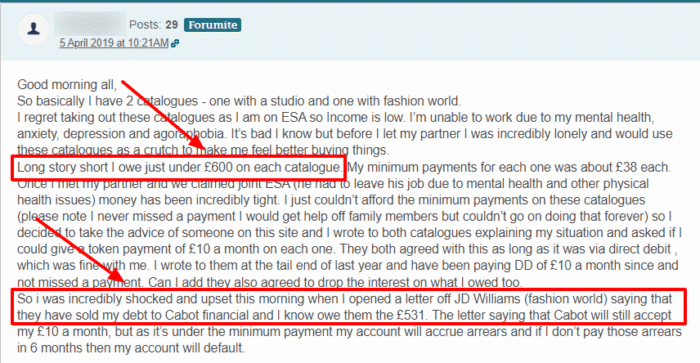

When a debt is sold to a collection agency, you then owe the money to them instead, meaning you still have to pay what you owe.

Contact them straight away to explain your situation. Let them know your affordability, especially if you’re vulnerable.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should You Pay a Debt Collection Agency?

- If the agency now owns the debt, you should communicate and start a repayment plan if possible.

- If you think the debt you’re being contacted for doesn’t belong to you, you can dispute this with the agency. Ask them to send proof by way of the original agreement.

- If the agency doesn’t own the debt and is harassing you or threatening to have you jailed, you can invoke some methods and legal procedures to get them to back off, at least temporarily.

Remember, if you do not make payments, then the agency can take you to court to register a County Court Judgement (CCJ) against you. The CCJ will order you to pay the debt.

A CCJ only happens if the debt collector has been chasing you for some time and failed to get a response from you. They will first have to send you a warning letter (default notice) to ask you to make payment to avoid court.

I must also point out that a debt collection company does not have the power to send bailiffs to your home.

If they send their agents to your door, do not allow them inside.

I suggest you do everything to come to an agreement with them via the phone or a letter so it doesn’t reach here. They could be more willing to work with you to create an affordable payment plan.

Now, if you fail to repay their debt even after a CCJ is issued, the agency can apply for further enforcement action, which might include the use of bailiffs.

Who Buys Debts & Why?

That’s how debt collection agencies make their profit from buying defaulted debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.