How To Start Over After Divorce With No Money

Are you feeling worried about your money after a divorce? Do you have questions on how to live on your own with no money? We’re here to help during this tough time.

Each month, over 8,700 people visit our website for advice on matters such as this. You’re not on your own.

In this article, you’ll learn:

- How to survive with no money after a divorce

- How to protect your money in a divorce

- How to understand your rights

- How to make a plan to get out of debt

Our team has been through what you’re going through; they know it’s hard to face these money worries. But you’re not alone; we’re here to help you determine how to protect your money during a divorce in the UK in 2023.

How to save money on divorce fees

How to save money on divorce fees

Divorces are hard to handle, but the financial repercussions can make a bad situation feel even worse.

The solution? Understanding your next steps and exactly how much they’ll cost.

For only £5, JustAnswer offers a trial chat with an experienced divorce solicitor. They can help you navigate the process and save you from costly face-to-face lawyer fees.

Chat below to get started with JustAnswer

How do I survive financially after divorce?

The future can look bleak when your finances stand at zero after the divorce. It can feel even worse if you’re in debt. Unfortunately, struggling financially after divorce affects many people.

Here are a few steps to take to improve your financial literacy after divorce:

- Work out exactly where you stand financially

- How much money comes in

- How much money goes out

Through this, you can figure out how to go forward and what you can afford.

How can I afford to live on my own after divorce?

After divorce, it can be difficult working on a budget to get back on track while managing the cost of living. If you’re having difficulty paying the bills, you might qualify for the government’s cost of living support package.

You can also alter your current lifestyle to manage everyday costs, such as using public transport instead of your car or buying groceries from discount supermarkets.

As I see it, reducing living costs, post-divorce will help make living on your own more affordable.

Worried About Divorce Finances?

Divorce can be complicated, especially when it comes to navigating the cost. One small error could lead to serious consequences.

But, the support of a good solicitor can help you to understand your next steps.

For a £5 trial, JustAnswer’s online divorce solicitors can help you understand your rights and guide you towards the best financial solution for you.

In partnership with Just Answer.

Should I update anything after my divorce?

Yes. You should update the information on anything held jointly with your ex-spouse.

- Passport (if you took your spouse’s name when you married)

- Credit cards and store cards are held jointly

- Mortgage details, if held jointly

- Bank accounts held jointly

- Other debts and loans are taken out in both names

- Insurance policies

- Your Will

- Voter registration details

- Council tax etc

- Details of how Child Benefit is paid

I also suggest checking out your credit score to see how you can separate yourself from your ex-spouse in the eyes of credit reference agencies. This may have an effect on your credit recovery after divorce.

Note: I recommend getting professional advice if there are children involved.

» TAKE ACTION NOW: Get legal support from JustAnswer

What help and support can I get?

You may be entitled to claim certain benefits if you’re struggling with money after a divorce. As a single person or a lone parent with children, you may be able to claim the following:

- Universal Credit

- Jobseeker’s Allowance (JSA) – specific criteria apply

- Employment and Support Allowance

- Council Tax Reduction

You can find more information on the links below:

- England and Wales – GOV.UK website

- Scotland – mygov.scot website

- Northern Ireland –nidirect website

How do you rebuild your life after divorce?

As mentioned, work out where you stand financially to see how bad (or good) the situation is. Next, make a list of everything you own (assets). Then write down all your debts (liabilities).

Your assets could be:

- Pensions

- Investments

- Savings

- Do you own or part-own a property?

Finally, add everything up to see how much it comes to.

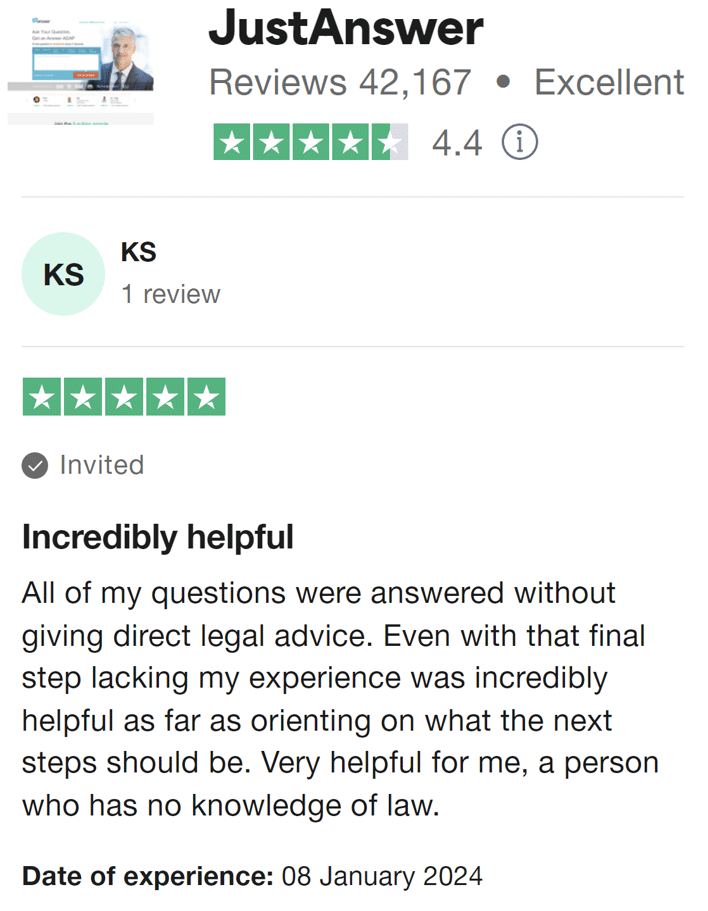

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

What about liabilities?

Your debts (liabilities) could be:

- Credit card debts

- Store car debts

- Car and other loans

Then add all your debts and determine the difference between your assets and liabilities. This lets you establish your current financial situation.

Long-Term Financial Planning

Whether you have received a financial settlement or you have been left with nothing after divorce, it is a good idea to begin thinking about your finances in the long term – even if you can’t afford to build up savings yet. As soon as possible, start putting away money for your retirement savings so that you have something to rely on in the future.

Divorce Doesn’t Mean Financial Ruin

Legal advice can make all the difference when navigating the financial aspects of divorce, and affordable help is within reach.

Normally, the cheapest solicitors in the UK will put you back at least £130 per hour.

But, for a £5 trial, a divorce solicitor from JustAnswer can review your situation and provide personalised guidance. It’s a no-brainer!

Try it below.

In partnership with Just Answer.