Step Change Debt Charity Reviews & In-depth Info

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Welcome! If you’re feeling worried about debt, you’re in the right place. We have lots of helpful information about Step Change Debt Charity to share with you. Each month, over 170,000 people visit our website for advice on debt solutions.

In this article, we’ll talk about:

- Who Step Change UK is and what they do.

- The types of debt services they offer.

- How they have helped others with their debt.

- Ways you might be able to write off some of your debt.

- Reviews and experiences of people who used Step Change.

We understand how tough it is to deal with debt. Some of our team have faced debt problems too. We know that it’s a big worry and can feel scary, but remember, there’s always a way to make things better.

We’re here to help you understand how Step Change Debt Charity can assist you with your debt. Let’s get started.

Who Are They?

StepChange UK is a debt charity that provides free debt support and financial counseling to anyone who lives in the UK and is struggling with debt. Last year alone, Step Change claimed to have helped over 600,000 people struggling with their finances.

They welcome debtors to get in touch and discuss their problems with professional advisors, who can then help them with their budgeting and recommend the most suitable and advantageous debt solution to get out of debt.

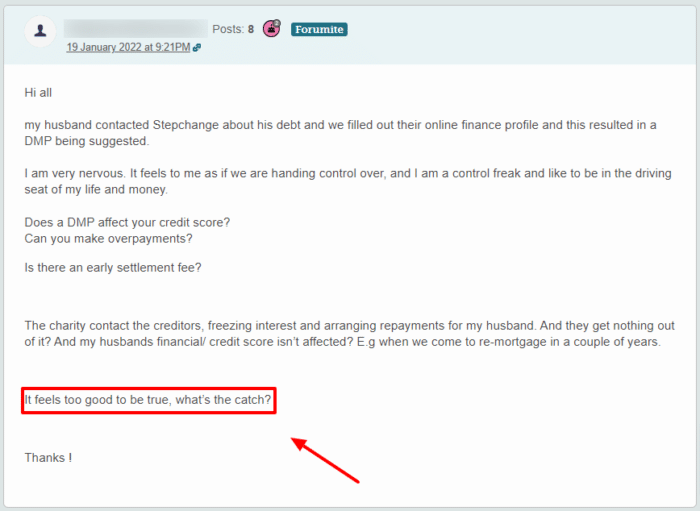

Some people are in disbelief that they can get free help with their debts, like this forum user above. Step Change is funded through donations from the UK Government, banks, and individuals, and the charity is regulated by debt industry groups.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Debt Services Do They Offer?

Step Change offers more services than the average UK debt charity. Whereas most charities can only offer debt advice, Step Change goes the extra mile and offers:

- Free debt advice

- Debt Management Plans

- Individual Voluntary Arrangement (IVA)

- Debt Relief Order

- Bankruptcy advice

- Scottish debt solutions (see our Step Change Scotland review for details)

A Debt Management Plan is one of the popular services at Step Change. These are agreements between yourself and your creditors (via Step Change) to pay a fixed amount each month.

Often, the creditors agree to halt interest on your debt as long as you keep up with the repayments.

The only drawback to a Debt Management Plan is that creditors can change their minds because they are not legally binding. The better news is that Step Change can try to get you a Debt Management Plan and it won’t cost you anything!

» TAKE ACTION NOW: Fill out the short debt form

What Is Their Impact on Debt in the UK?

Step Change has been helping people become debt free all over the UK since 1993. Since its launch, they have helped over 7.5 million people with debt problems take control of their finances. Step Change’s 2022 impact report breaks down and shows us exactly how much they actually do for people in debt!

Online Reviews

StepChange debt charity reviews are mostly outstanding, especially on Trustpilot. Online you can find lots of excellent reviews on Step Change, such as: Yes

“Stepchange have been brilliant all the way through. They have been helping myself for 3 Years now. Everyone you speak to, has the knowledge and shows great empathy towards your situation.”

[Trustpilot]

But everyone has their critics…

“At first everything was good, then it went downhill. I called them to make a change to my DMP I never received the email review. I’ve tried calling, engaged for 3 days really?“

[Trustpilot]

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Your Questions Answered…

Below you can find the most common questions people want to ask when thinking about contacting Step Change UK:

Step Change Contact Details

| Website: | https://www.stepchange.org/ |

| Contact number: | 0800 138 1111 Monday to Friday 8am to 8pm and Saturday 8am to 4pm |

| Address: | StepChange Debt Charity 123 Albion Street, Leeds, LS2 8ER |