Can I get stopped at an airport for debt in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about being stopped at an airport for debt? You’re in the right place for answers.

Each month, over 170,000 people visit our website to get advice on their debt problems, so we understand your concerns and are here to give you clear answers.

In this article, we’ll explain:

- Why you can’t get stopped at an airport for debt in the UK.

- How to manage your debts if you are leaving the country.

- What to do if you have unpaid debts.

- What happens if you don’t give a forwarding address.

- How to deal with debt if you plan on coming back to the UK.

We know how stressful it can be to have debt, as some of our team members have had debt problems, too.

With our experience, we’ll help you find the best solutions for your debt. Let’s get started.

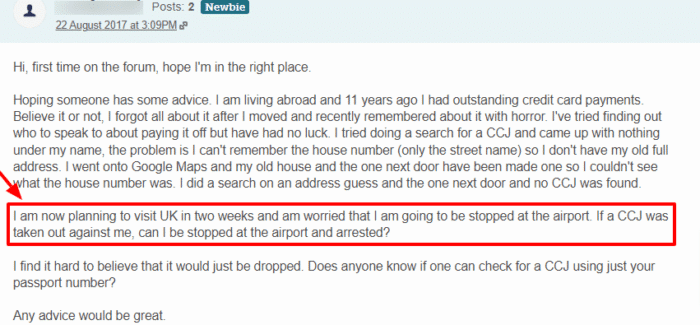

Can you get stopped at an airport for debt?

If you’re worried about whether you might be stopped at the airport coming back from your holiday because of your outstanding debts, the quick answer is you don’t need to.

You can’t be stopped, detained, or arrested at a UK airport for debts alone.

» TAKE ACTION NOW: Fill out the short debt form

Do you have to pay debt if you leave the country?

Some people wrongly believe that by leaving the country, even temporarily, you can get away from your debts.

Whilst you won’t be stopped at the airport for debt at a UK airport, you will still have to continue paying as you were before you left the country.

This applies only if you are leaving the country temporarily.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if you’re planning on coming back to the UK?

If you aren’t moving on a permanent basis, you will, of course, have to return at some point.

Once you return, you can be assured that your outstanding debt will have accrued additional fees and substantial interest payments, resulting in it being much higher than the original debt you owed.

You cannot be stopped at the airport because of CCJ debt.

However, the debt collection agency could go to court and ask for special permission to enforce the old CCJ using bailiffs once you’ve returned.

How far can debt collectors go to get you to pay?

Being stopped at an airport for debt in the UK is one of the last resorts a debt collection agency will take to getting you to cover your unpaid debts.

This will only happen if you do not acknowledge them and offer up a forwarding address in your new country of residence.

Debt collection agencies have a bad reputation, mainly owing to their quite stringent methods of getting you to pay the debt you owe.

They do have to follow specific guidelines, some of which you can find out about here.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if you don’t give them a forwarding address?

If you do not supply your debt collector with a forwarding address, then they may be allowed to stop you at the airport for not paying your debt.

If you do not do this, and you retain some assets in the UK, the creditors may go after these.

You could end up with all sorts of problems on your plate if you don’t let your creditors know where you are relocating to.

By letting them know your forwarding address, they may reach out to a partner agency that has jurisdiction in the country you’re going to.

This then means that you can go about repaying the debt using these foreign services.

You will, however, potentially have to deal with their different methods of getting their debt back.

What happens if you don’t give them any information?

If you do not supply this information, they could take possession of any assets you have remaining in the UK.

These can include physical, tangible items or assets contained within bank accounts.

As well as claiming any assets you may have in the country of origin, they can also ensure you are stopped at the UK airport for your debt.

In accordance with the laws of the country you have moved to, an agency can go to quite severe extents to get you to pay. These can include, but aren’t limited to, taking you to court and sending agents to your home.