How Long Does a Debt Last in the UK? Rules for Write Off

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Wondering how long a debt lasts in the UK? You’re not alone. Each month, over 170,000 people visit our website to find out about debt solutions.

In this article, we’ll cover:

- The typical time a debt lasts before it’s written off.

- The special cases when this time might change.

- How to know if you can write off some of your debt.

- What happens to student loans and if they can be written off.

- How a written off debt might affect your credit score.

Being in debt can be worrying; some of us have been there too. But rest assured, we’re here to provide you with clear, simple advice to help you understand your debt.

How Long Before a Debt is Written Off in the UK?

In this section, we’ll cover how long it takes before debts are written off in the UK.

By “written off”, we mean that you won’t be liable for paying your creditors anymore.

Moreover, your creditors won’t legally be entitled to chase you for payments.

Interestingly, debts are not “written off” and don’t disappear. It just means you no longer have to pay them and your creditors can no longer chase them.

But it may not mean that debt collectors don’t contact you. Especially if the original creditor sold the debt to them.

Most types of debts in the UK are written off after 6 years, provided certain criteria are met, that is.

It means that your debt to a creditor is active for a period of 6 years from the time you defaulted on payments, or if it has been 6 years since you last made a payment to your creditor/creditors.

Plus, creditors can’t have started legal action against you in those six years and there isn’t a County Court Judgement (CCJ) against you.

» TAKE ACTION NOW: Fill out the short debt form

In short, a creditor can take court action against you for not paying your debt. This period of six years applies to most types of debts, including the following:

- Credit debts

- Personal loan debts

- Store card debt

- Catalogue debt

All the above are referred to as ‘simple contract debts‘ which fall under ‘unsecured loans‘. Things work a bit differently when it comes to mortgage loans.

For this type of debt, it’s twelve years but the same criteria apply.

However, when it comes to interest on a mortgage, it’s 6 years before it is written off.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

At what point are student loans written off?

It depends on the type of repayment plan you chose for a student loan to be written off.

Plan 1 student loans

There are several different factors as to when a student loan is written off.

For example, if you received the loan at the start of an academic year 2005 – 2006 or earlier, and you live in England, Wales or Northern Ireland, it’s written off when you turn 65.

But if the academic year began in 2006 – 2007 or later, it’s written off 25 years following the first April on which it was due to be repaid.

Plan 2 student loans

Plan 2 student loans are much simpler and are written off 30 years after the first April on which it was due to be repaid.

Plan 4 student loans

If the academic year began in 2006 – 2007 or earlier, the loan is written off when you reach 65 or 30 years after the first April on which it was due to be repaid. Whichever falls first.

If the academic year began in 2007 – 2008 or later, the loan is written off 30 years after the first April on which it was due to be repaid.

Plan 5 student loans

Plan 5 loans get written off 40 years after the first April on which it was due to be repaid.

If you’re a postgraduate from Scotland, you fall into Plan 4 student loans

If you’re a postgraduate from Northern Ireland, it’s Plan 1 student loans.

Statute barred debt: A step-by-step guide

This is a term you may have heard before. When does a debt become statute barred? It’s the question we’ll be answering in this section. When a creditor takes too long to recover a debt from you, it may be classed as “statute barred” under UK law.

It essentially means that your creditor cannot recover it through the courts.

So, the answer to the question, how long before debts are written off is that unsecured debts fall under the Limitations Act.

Hence, creditors can no longer chase you through the courts for payment.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

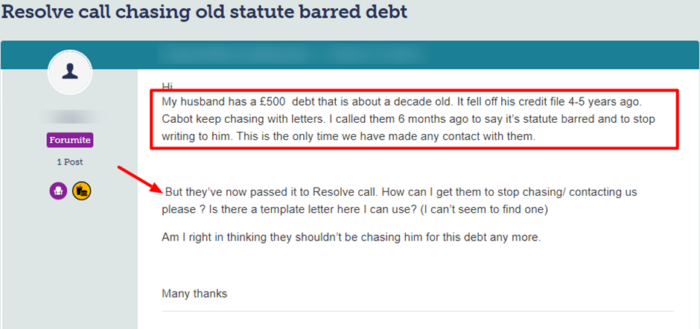

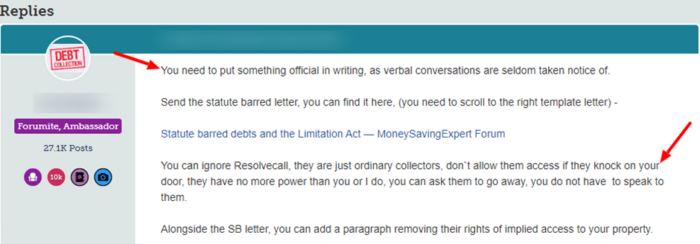

Statute barred debt case study

See the message posted on a popular forum regarding a statute barred debt that a debt collector was chasing a person for.

Source: Moneysavingexpert