Trust Deed Car Finance – What You Can Do, FAQs & More

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about trust deed car finance? Do you need to know more about this process?

You’re in the right place. Over 170,000 people visit our website each month seeking advice on debt solutions.

This article will help you understand:

- What a trust deed is

- How your car plays a role in a trust deed

- What you can do if you have a trust deed and need car finance

- How to handle your car during and after a trust deed

- If a trust deed can affect your chance to get car finance

According to the Money & Pensions Service, 700,000 people are either in problem debt already, or are at risk of experiencing problem debt.1 We know how tricky it can be to deal with money troubles.

But don’t worry; our team has lots of knowledge about debt and trust deeds, and we’re here to help you understand your options.

What happens to my car?

What happens to your car in a Protected Trust Deed relies on what you agreed with your Trustee prior to providing it as collateral.

On the off chance that you own your car and the worth is under £3,000, it isn’t treated as an asset in the event that you can show you have a reasonable requirement for it.

When it is worth more than £3,000, the Trustee will practice some discretion concerning how they manage it.

This implies they can offer it to pay your debts.

In the event that they do place the car in a position to pay off debt, they ought to have discussed this with you before you agree on your Trust Deed.

However, there is the chance they may consent to value it toward the end of the Trust Deed.

This implies it will most likely fall in value/worth towards the end of the deed, reducing it to below the £3,000 bracket.

On the off chance that it is worth under £3,000, and you still have a necessity for it, the Trustee can surrender their interest in it.

Is financing possible?

Although difficult, it is possible to get car finance with a Trust Deed.

However, you should always bear in mind that entering a Trust Deed will make getting any sort of credit very troublesome, which may reduce your options for car finance.

Any new lender will generally charge you a higher rate of interest, which would then eat into your agreed disposable income.

Because of this, it’s highly unlikely that you can get a good rate of car finance along with a Trust Deed -however, it’s not impossible.

Key Components

As we delve into the details of car finance with a Trust Deed, it’s crucial to understand the core aspects of this financial setup.

The table below explains the key components of a Trust Deed.

| Trust Deed Aspect | Details |

|---|---|

|

Average Length |

Typically 4 years; varies based on individual circumstances |

| Eligibility | Must be a resident of Scotland with unsecured debts of at least £5,000 |

| Assets | High-value assets like property and vehicles may be included in the arrangement and may have to be sold to pay off debts |

| Credit Impact | Credit score is negatively impacted and stays on your credit file for 6 years |

| Debt Types Included | Unsecured debts such as credit card balances, personal loans, overdrafts, store cards, catalog debts, and some types of tax and utility arrears |

| Debt Types Excluded | Secured debts such as mortgages and secured loans, court fines, child support arrears, Social Fund loans, student loans, certain taxes, hire purchase agreements, debts from fraud and debts incurred post-Trust Deed |

| Monthly Payments | Based on what you can afford, reviewed annually |

| Creditor Contact | Creditors typically can’t contact you directly or take legal action for debt recovery |

| Discharge from Debts | Most remaining unsecured debts are written off at the end, assuming compliance with all terms |

| What You Can Do | -Keep daily essentials and work-related tools -Continue using current bank accounts -Stay in your home, but equity may be used to repay debts -Live and work abroad, with trustee’s agreement -Receive certain types of income, benefits, and pension |

| What You Can’t Do (without trustee’s permission) | -Incur new debts over £500 -Acquire significant-value assets, sell or alter assets -Refinance or secure additional loans -Change jobs, act as a company director, or hold certain public positions |

Can I keep my vehicle?

On the off chance that you need a car, you can generally keep it during your Trust Deed term.

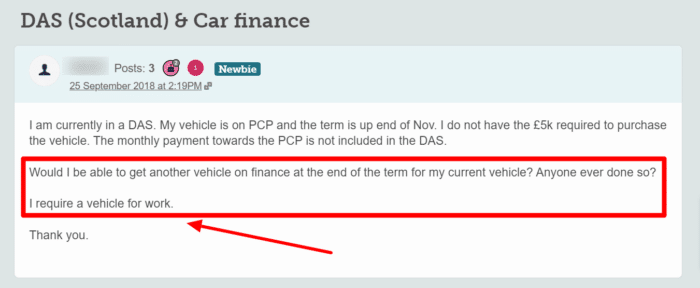

There are a number of reasonable requirements for buying a car during a Trust Deed or other debt plan – for example, you may need it in the case of a car breakdown or for an essential job change/work travel, as this forum user discusses:

In any event, living distantly or taking kids to class is seen as a reasonable need to keep a car during a Protected Trust Deed.

This incorporates vans and motorbikes as well.

If car finance is already secured for your vehicle under any current arrangement, you’ll continue with the installments. This is because if you neglect to make the monthly payments, the vehicle may be repossessed by the car finance lender.

When entering a Trust Deed, a recompense gets included in your month-to-month spending plan to keep paying the secured car finance, as long as your month-to-month account installment isn’t regarded as exorbitant and you have a reasonable requirement for the car.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I get it?

During your Trust Deed term, you will need to have the consent of your Trustee to acquire any type of credit.

Not informing your Trustee breaches the terms of your arrangement and could prompt your Trust Deed to fail.

Your Trustee will decide whether your request to take out car finance is sensible.

The Trustee will choose if taking out a car on account is appropriate for you, depending on your pay and consumption.

Your Trustee is likely to approve your request if the car finance is practical with your present spending plan and living expenses.

Special consideration will be given when you require the car for work purposes.

Considering selling your car?

You should always discuss and agree on any car sale with your trustee before you sell.

There might be no issue, or your trustee may have an interest in the sale proceeds. It relies on the circumstance, so you should get the proper guidance and assistance before you sell.

» TAKE ACTION NOW: Fill out the short debt form

Is it necessary for your trustee to sell it?

Another method of obtaining car finance with a trust deed in place might be to agree (at the start) that you will make extra installments, in order to take care of any surplus value over £3,000 toward the finish of the Trust Deed.

On the other hand, the trustee may agree that an ‘outsider’, similar to a relative or companion, can purchase out their advantage in the car by making contributions during the Protected Trust Deed.

What happens once it’s completed?

Once your Trust Deed term has been completed, you are free to rebuild your credit rating and then borrow funds as you go.

When you have been released from your Trust Deed, you will be removed from the Insolvency Register.

Unfortunately, the Trust Deed will stay on your credit file for six years from the date you took out your Trust Deed.

So, if your Trust Deed is in place for the standard time period of four years, it will stay on your credit document for an additional time period of two years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will completing it affect my ability to obtain financing?

Having a trust deed on your credit report will affect your credit score, which can make it harder to secure an appropriate lender (than if you had no financial disparities).

Waiting until you have rebuilt your credit score might be a more appropriate choice when considering taking a car out on finance, as you will have the option to get better market rates and arrangements (as long as you are proceeding to use credit wisely).

In the event that there isn’t an alternative, you may wish to search around and use comparison websites to locate the best poor-credit car finance lender.