Affordable Car Insurance with TT99 Banned Driver Conviction for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you trying to find car insurance after a TT99 conviction? You’re not alone. Each month, over 9,300 people come to our website looking for guidance on this issue.

Here is what we are going to talk about in this article:

- What a driving conviction is and how a TT99 conviction can lead to a driving ban.

- The effect of a TT99 conviction on your car insurance.

- The difference between losing your licence and being banned from driving.

- How to find car insurance you can afford even with a TT99 conviction.

- The importance of telling your insurance company about your conviction.

We know you might be worried about affording car insurance or even being able to insure your car at all. These are common concerns, and we’re here to provide clear and useful advice to help you through this tough time.

Let’s dive in.

What is a TT Code?

There is only 1 TT code. This is classified as a “special” code that will stay on the record for 4 years from the date that the conviction took place. This is because a TT conviction is issued when the driver may have other driving convictions or offences in place. They can potentially lead to a driving disqualification if you go on to reach 12 points or more within 3 years of this code being issued.

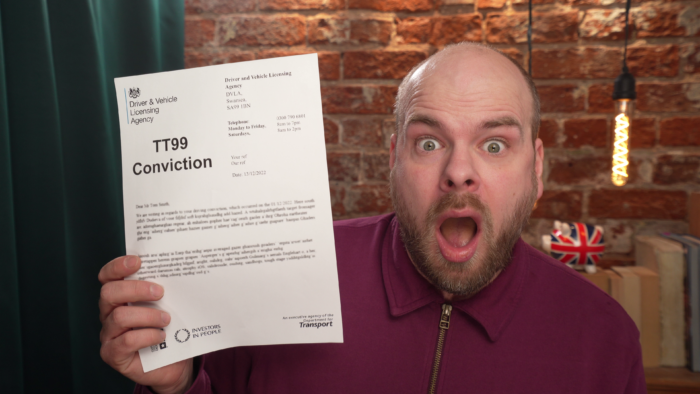

What is TT99?

This code is directly related to the “totting-up” points. It encompasses the rule that runs through all the codes. Meaning that this code is the process by which disqualification takes place when too many points, from any combination of offences accumulated to over 12 – leading to the loss of the licence and a driving ban.

Is it a criminal conviction?

In and of itself – it is, AND it is not a criminal conviction. It is a representation of a combination of other offences. The combination of other offences that leads to excess then becomes the TT99. This conviction can’t exist without the others, yet is the final conviction that leads to a ban in many cases.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What is the penalty?

The repercussions of a TT99 conviction are summarised in the table below:

| Conviction code | Nature of offence | Penalty points | Fine amount |

| TT99 | A special disqualification code under ‘totting-up’ – if the total of penalty points reaches 12 or more within 3 years, the driver can be disqualified. | 12 points or more. It is a representation taken from the sum of the other offences. | Varying fines based on the details of the offence and a means test |

The repercussions are multiplied further for other driving convictions, such as drunk driving.

Is it serious?

Yes, it is serious. This is because the loss of your car will mean alternate methods of transport will need to be found. If you rely on your car for work or personal matters, the loss will inevitably have serious implications in your life.

» TAKE ACTION NOW: Find the best insurance for drivers with points

How long does it stay on your licence?

Starting from the date of the conviction – 4 years is the period of time that it has to appear on your driving record.

How does it affect insurance?

The result of getting your TT99 conviction will reduce the number of insurers that will make you an offer. The remaining offers will come from high-risk insurers that offer much higher premiums. The TT99 is for a full 12 points which is a driving ban. The following car insurance will likely be more than 100% more than it was.

The number of penalty points affects how much the increase will be. But it also depends on the insurance group that the car belongs to.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What is the least expensive insurance I can get?

High-risk insurance providers are likely going to be the only option available to you at this stage. The prices from these providers will be higher than without. But that does not mean that you can’t find a more affordable insurer out of the offers you can get.

There are a few steps to take at this stage to help you move towards finding a fair deal for your situation:

- Search “TT99 conviction car insurance” and compare the offers from the results. Maybe list them down to help you remember them

- Do the same with a selection of the major comparison websites.

Search for companies willing to offer

Running a google search for driving insurance for the disqualified will return a range of results. These will be both comparison sites. As well as companies that specialise in TT99 insurance claims.

Compare the offers from across a few of these platforms to see what is on offer. You will also discover who is willing to offer you insurance, and who isn’t. This process of elimination will help to move you a little towards what you’re looking for.

Insurance increases after a drink-related conviction are some common concerns. Many who have the TT99 will have a number of contributing points coming from this conviction.

Finding a drunk driver insurance provider is also another option you could search for if appropriate. Then, add the results to your comparisons to get a clearer idea still.