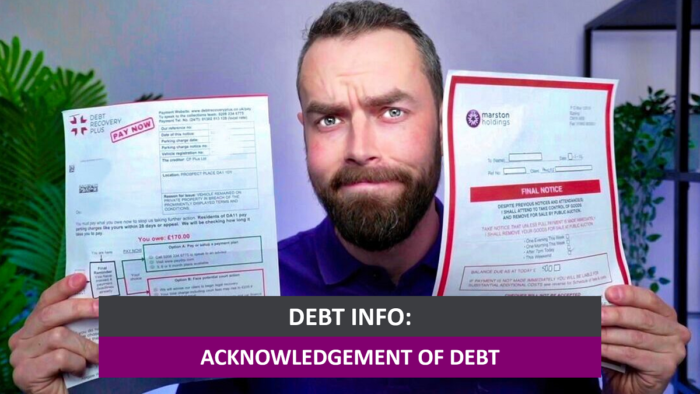

What Is Acknowledgement of Debt? – Complete Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Understanding the term ‘Acknowledgement of Debt’ can be a bit hard, but don’t worry, you’re at the right place to learn. This article will help you know what it means when you’ve accepted your debts. Each month, over 170,000 people come to our website for advice on debt topics, just like you are doing now.

In this guide, we’ll cover:

- What an Acknowledgement of Debt is and its purpose.

- What you should do if you’re worried about it.

- How to write an acknowledgement of debt.

- If some debt can be written off.

- What gets issued in acknowledgement of any indebtedness.

We understand how worrying it can be to have debts, as many people on our team have had debts too. This guide will help you understand your situation better and show you the next steps to take. Let’s start learning together.

What is Its Purpose?

Debt acknowledgement serves the purpose of accepting a liability by a debtor before the expiration period.

It is issued to tell the creditors that I deem myself liable to pay a certain debt, and this is done through a debt acceptance letter or document (AOD).

It is a legal requirement to send a reply to the creditor regarding the acceptance of debt or denial of it.

How Do I Write One?

Writing a debt acceptance letter is not a difficult task. It only requires attention to some technical details and some important points which might be linked to law.

First of all, you need to keep in mind that this is a legal document, and it must be composed without any errors and must include all relevant information so:

- Write it in a professional tone

- List down every detail regarding the dues

- If you have any concerns, mention them

Here is a template you can use to understand the AOD document:

Address: 123 Candyland Lane, Bristol

Date: 15th September 2020

Zip Code: 06011

Subject: Debt Acceptance Letter

To: XYZ LTD.

Dear Sir/Madam,

I am replying towards the letter of debt sent by you to our accountant, we, therefore, accept and deem ourselves as a debtor towards your company. We have a liability for you to pay money amounting to £5000, which is instilled due to a loan taken by our business from you. The payment will be made through a direct bank transfer. I urge a request of two equal instalments for the payment, and I will make sure the payment is made by the 25th of September.

Please send an invoice to our accountant.

Sincerely,

John Smith

ABC LTD

12345678 (Contact Number)

Follow us on Instagram @Abcltd.co (Optional)

*Please note that this is a template and it is not for commercial use*

Notice how some important information regarding the payment amount, payment method, payment date, and details regarding the concerned parties have been displayed?

Make sure to comprehensively express everything while you compose this legal document.

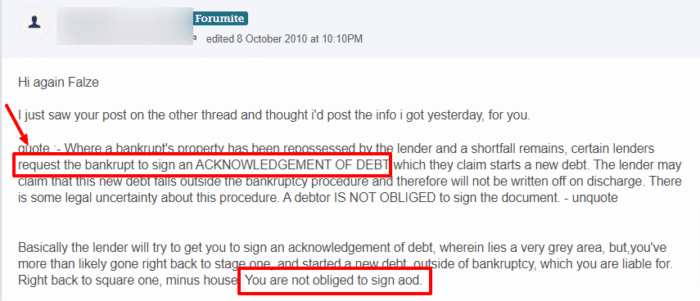

Never sign for an AOD if you don’t feel absolutely certain that you’re not liable for the debt in question.

Consult with a financial advisor or solicitor about the legitimacy of the debt before acknowledging it. You can also get in touch with a debt charity (e.g. StepChange or MoneyHelper) for free impartial advice.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is Issued for Any Indebtedness?

When the acceptance of any kind of debt is made, there has to be a piece of legal evidence as proof for it. The acceptance of a debt letter, at times, does work as evidence. However, a more correct way is to issue a promissory note.

The promissory note is issued by the debtor towards the creditor. It holds all the essential details regarding how and when the payment will be made.

It is similar to the acknowledgement of debt letter. However, it serves a slightly different purpose.

This note has all the terms and conditions represented on it, and these terms are negotiable between the debtor and the creditor. If one of the parties wants to change the terms, they are allowed to do so.

The promissory note is used for a separate independent obligation that will be set upon the concerned people apart from any transaction or situation that gave birth to the promissory note in the first place.

Apart from the promissory note, at times, different documents are also issued, depending on the type of debt/financing one does.

For example, if you lend money to a company, they will hand you debenture certificates.

The debenture certificates are only issued by limited companies. Limited companies are those business entities which have a separate identity from their owners.

Debenture certificates may be offered by Private and Public limited companies, as well as Limited Partnership businesses.

A sole proprietor business owner might issue a bond of indebtedness. Both of these documents provide full details and information about the dues owed.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What is the Limitation Act

The limitation act has several effects on the concerned debtor and creditor. As we mentioned at the start, the acceptance of dues has to be made before the expiration period – which is 6 years – and after that, dues may not be deemed collectable.

Sections 29 (5) and 30 of the Limitation Act of 1980 state that if an AOD has been issued, the time for the recollection of the dues is renewed.