What Is a CCA? – Simple Guide, FAQs & Tips

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debt and are seeking ways to ease your stress? You’ve come to the right place for answers. This article will help you understand what the CCA is and how it can be used to manage your debt problems.

Every month, over 170,000 people approach us to find solutions for their debt issues. So remember, you’re not alone in this.

In this article, we’ll explore:

- What the Consumer Credit Act (CCA) does.

- How to request your CCA agreement.

- What happens if your creditors do not send the CCA agreement.

- Can a debt be enforced without a credit agreement.

We understand your worries about being chased for debt, as some of our team members have faced similar situations. We know how hard it is, but don’t worry; we’re here to help you understand your rights and find the best way to handle your debt.

Let’s understand more about the CCA and how it can help manage your debt.

What do they do?

The Consumer Credit Act (CCA) provides consumers with protection when taking out credit, like loans or credit cards.

Let’s look at the debt and credit regulated by the Consumer Credit Act:

- Credit cards

- Hire purchase agreements

- Payday loans

- Personal loans

- Store cards

- Catalogue credit (e.g. “buy now, pay later” agreements)

If you are borrowing money in the UK, the Act automatically provides you with a high level of credit protection laws, such as the right to a cooling-off period.

It is also used to shape the credit agreement terms and conditions.

What’s a credit agreement?

A CCA agreement is a document relating to the credit you took out from a bank or credit card company.

For example, if you took a loan, you will have signed a CCA agreement that outlines all of the details and terms of the loan under the aforementioned Act.

Remember, you have the right to withdraw from any credit agreement within 14 days of acceptance or when you receive a copy of the agreement. For credit cards, this is 14 days after you’ve been notified of your credit limit.

Also, under the CCA, you have the right to see your credit file and ensure that it is correct and accurate. You can contact the credit referencing agency that produced the report and ask them to update your details.

» TAKE ACTION NOW: Fill out the short debt form

How can I get a copy?

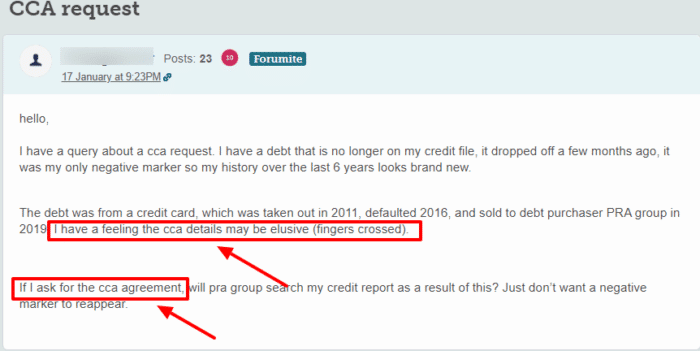

Anyone who has taken out credit covered by the Act can ask for a copy of their CCA agreement. This is known as a CCA request.

You may already have a copy of it, but you can ask the lender at any time to provide the CCA agreement.

You lose an automatic right to access your agreement if you have finished paying back the money you borrowed. However, you can still request a CCA after clearing the debt, although the creditor may not be obliged to provide it.

If you are part-way through your total payments, you are legally allowed to ask for this under Sections 77,78 and 79 of the Act.

How to ask for one

You can phone and ask for your agreement, but the best way to ask your creditor for a copy of your CCA agreement is to put it in writing. Send your creditor a letter requesting your CCA agreement, and they will provide it to you.

If you are unsure of how to work the letter, you could always use our free pre-written letter template to ask for your credit agreement.

Download the template, add your account info, name and address and send it off in the post. It will save you time and lots of headaches.

Be aware that to ask for your agreement, you will need to enclose a £1 (in the form of a coin, cheque, or pot order) inside the letter. This is the fee for requesting a credit agreement.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if they don’t send it?

Creditors have 12 business days to respond to your CCA request letter. You may need to wait this long for them to respond. During this time, they cannot take further legal action against any debt you may have with them.

If they do not respond soon enough, you could make a complaint to the Financial Conduct Authority (FCA).

Keep in mind that if your creditor can’t produce the CCA agreement, the debt is unenforceable until they find it. Also, your credit score won’t drop simply because you requested a CCA. What actually hurts your credit rating is the unenforceable debt being recorded on your credit file.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What if they do send a copy?

The credit card company or loan provider should reply to your letter with a true copy of the original which is clear to read. It must include all of the original terms and conditions relating to the credit agreement.

However, the true copy does not have to include a date or your signature.

You may be disheartened to learn after receiving the CCA agreement that they still have a copy, meaning the debt can still be enforced.

But you may choose to go down another avenue and ask for the business to freeze interest for a couple of months so you can get back on track.

They do not have to accept your proposal, but some bodies encourage them to do so. They are more likely to accept if you can prove financial difficulty, such as losing your job.

Can a debt be enforced without one?

Now here’s the good news!

If creditors cannot provide you with a copy of the agreement, presumably because they no longer have it, any debt relating to that agreement can no longer be legally enforced.

The debt will still exist on your account, and your credit report, but the creditor is not able to ask the court to make you pay – and subsequently cannot enforce your debts with bailiffs.